Understanding Hypercore's Loan Schedule

Last updated May 15, 2025

Overview of the Loan Schedule

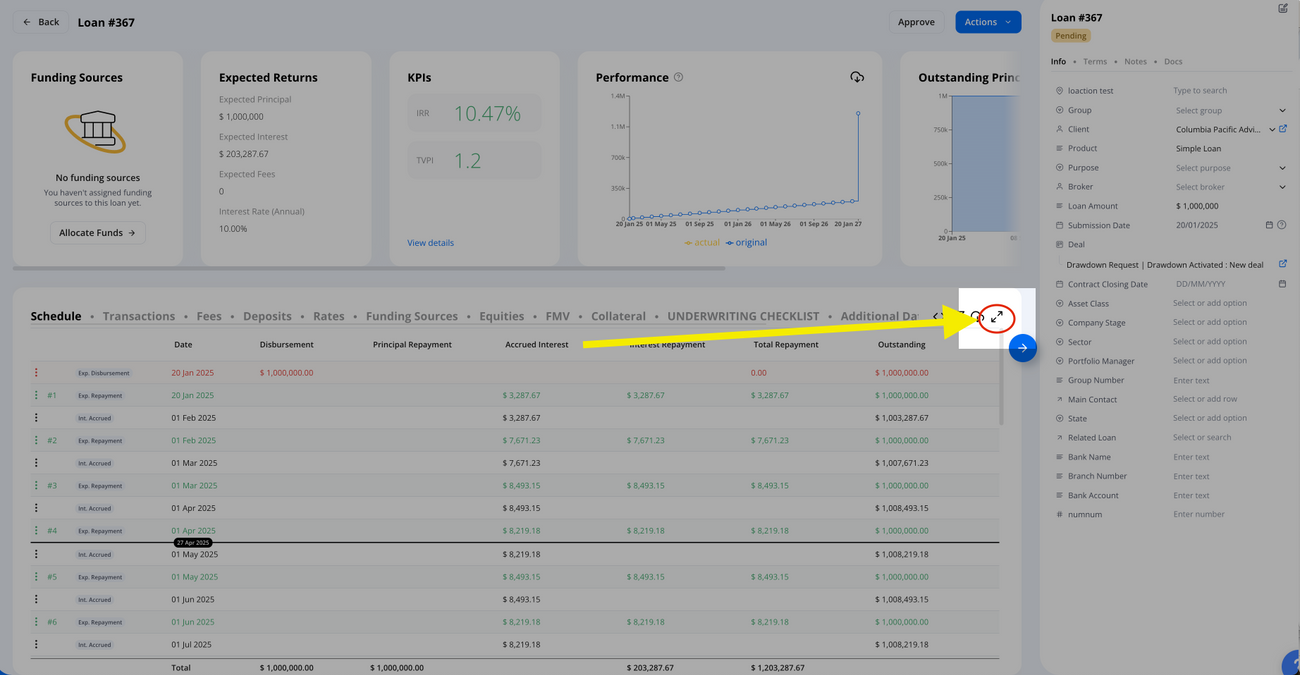

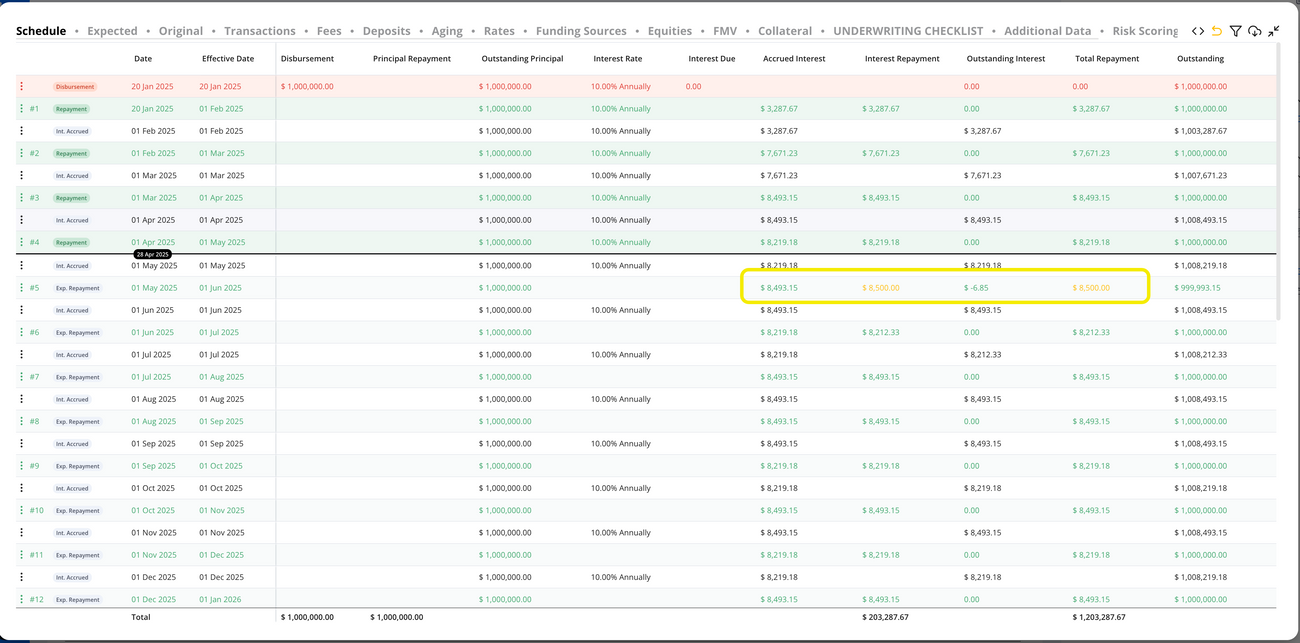

Hypercore’s Loan Schedule is presented in the preview when the user sets the loan terms and after the terms have been submitted. It provides a view of loan transactions, repayments, and accruals. The schedule is designed to mirror familiar spreadsheet layout. It dynamically updates based on user inputs.

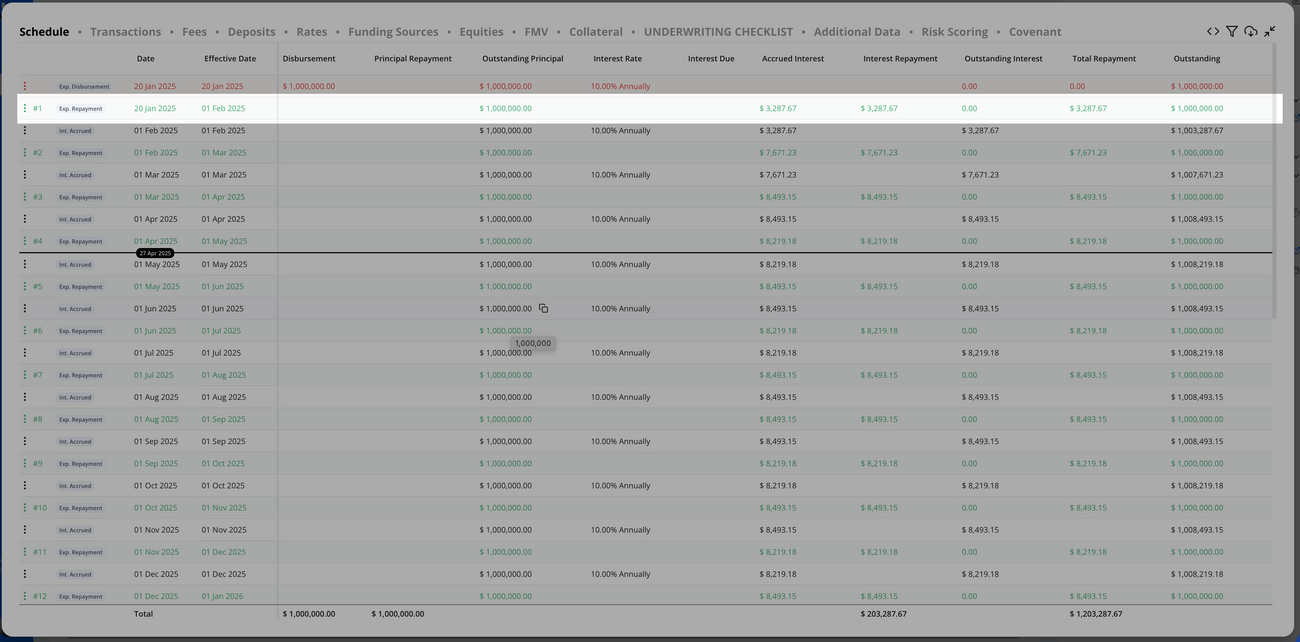

The schedule consists of multiple columns:

- Date – Transaction or accrual date.

- Effective Date – Calculation-effective date (may differ from Date).

- Transaction Type – Describes the event (e.g., Disbursement, Repayment, Accrual).

- Principal

- Disbursement – Principal amount funded to the borrower.

- Principal Repayment – Principal paid on the transaction date.

- Outstanding Principal – Remaining unpaid principal after the transaction.

- Interest

- Interest Rate – Annual interest rate applied to the principal.

- Interest Due – Interest calculated for the current day.

- Accrued Interest – Interest accumulated but unpaid.

- Interest Repayment – Interest paid on the transaction date.

- Outstanding Interest – Unpaid accrued interest.

- Compounding (if applicable)

- Compounding Rate – Annual rate applied to outstanding interest or balances.

- Compounding Due – Compounded amount calculated for the current day.

- Accrued Compounding – Total compounded value accumulated.

- Compounding Repayment – Compounded amount repaid.

- Outstanding Compounding – Remaining unpaid compounded amount.

- Fees

- Fee Due – Fees charge for the current day.

- Fee Repayment – Fees repaid on the transaction date.

- Outstanding Fee – Total unpaid fee balance.

- Total Position

- Total Repayment – Sum of principal, interest, compounding, and fee repayments.

- Outstanding – Total amount due (principal + interest + compounding + fees).

- Original Issue Discount (OID) (if applicable)

- OID Rate – Discount rate applied to the face value of the loan.

- OID Cost – Nominal value of OID recognized in the current period.

- OID Interest – Interest impact from OID amortization.

- OID Remaining Cost – Unamortized portion of the original discount.

Base Value - Daily Interest Calculation

Hypercore’s schedule functionality incorporates daily interest calculations to deliver the most precise interest repayment outcomes. Users can define the basis for these calculations, choosing between 360 days per year, 365 days, 364 days, actual days in the year, and 30/actual days per month. This approach ensures:

- Accurate accruals tracking on a day-to-day basis

- Precise calculation of interest for partial periods

- Better handling of irregular payment schedules

To view the detailed daily calculations, expand the loan schedule view and click on a 'big row'. This action will reveal all the underlying daily charged rows and transactions.

Example calculation based on the provided image:

For a loan balance of $1,000,000 with an annual interest rate of 10%, the daily interest for February 1 is calculated as follows:

(10% ÷ 365) × $1,000,000 = $273.97

This matches the structure shown in the schedule image, where each day's interest is computed individually.

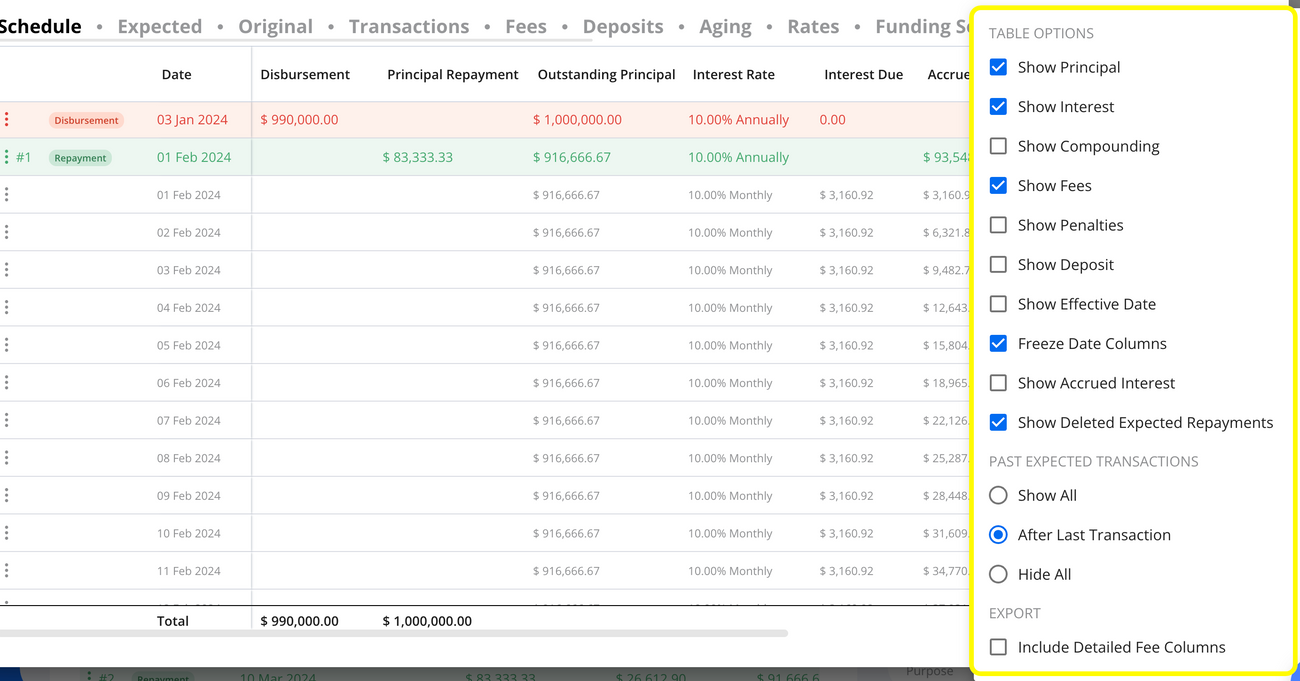

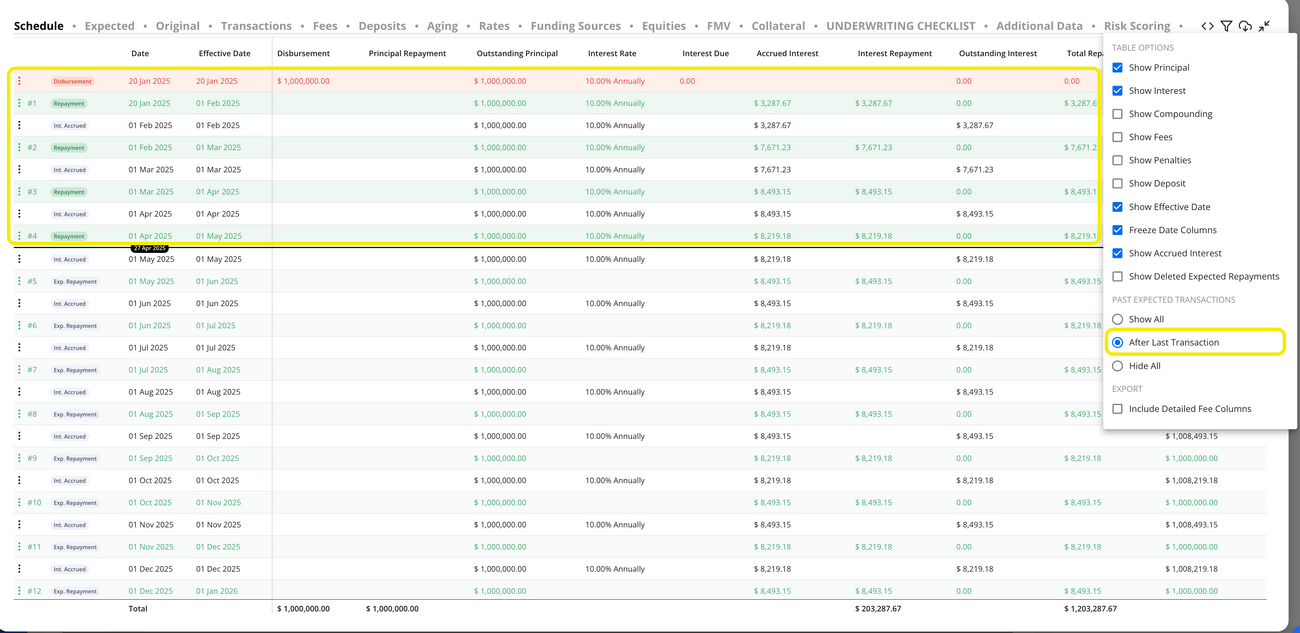

Schedule Filters

The schedule includes filtering options to display specific column types:

- Show Principal - Show or hide detailed principal columns

- Show Interest - Show or hide detailed interest columns

- Show Compounding - Show or hide detailed compounding interest columns

- Show Fees - Show or hide detailed fee columns

- Show Penalties - Show or hide detailed penalties columns

- Deposits - Show or hide deposit columns

- Show Effective Date - Show or hide effective date column

- Show Accrued Interest - Show or hide accrued (compounding) rows

- Show Deleted Expected Repayments - Show previously deleted expected repayments

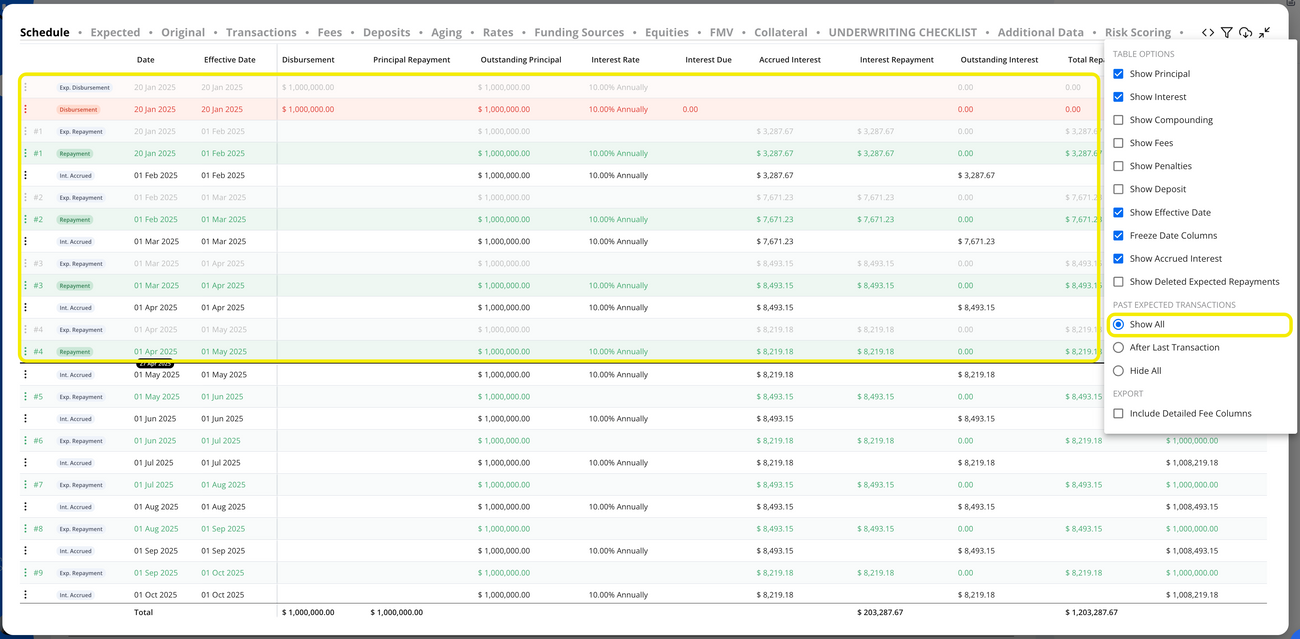

Past Expected Transactions Settings

By default, expected repayments are shown only after the last recorded transaction. Expected transactions dated in the past do not affect the schedule unless settings are adjusted to display them.

Show Accrual Setting

Enabling "Show Accrual" displays daily accrual rows, representing the interest accumulated each day.

Show Deleted Setting

The "Show Deleted Expected Repayments" setting allows users to display rows that were previously deleted from the schedule.

Other Columns Settings

Users can control which columns to display or hide to tailor the schedule view to their specific needs.

Past Expected Transactions

By default, Hypercore’s schedule displays expected repayments after the last recorded transaction. Expected transactions dated in the past will not affect the schedule or reduce outstanding amounts unless settings are adjusted. Users can modify these settings to view all expected transactions, including those with past-dated entries.

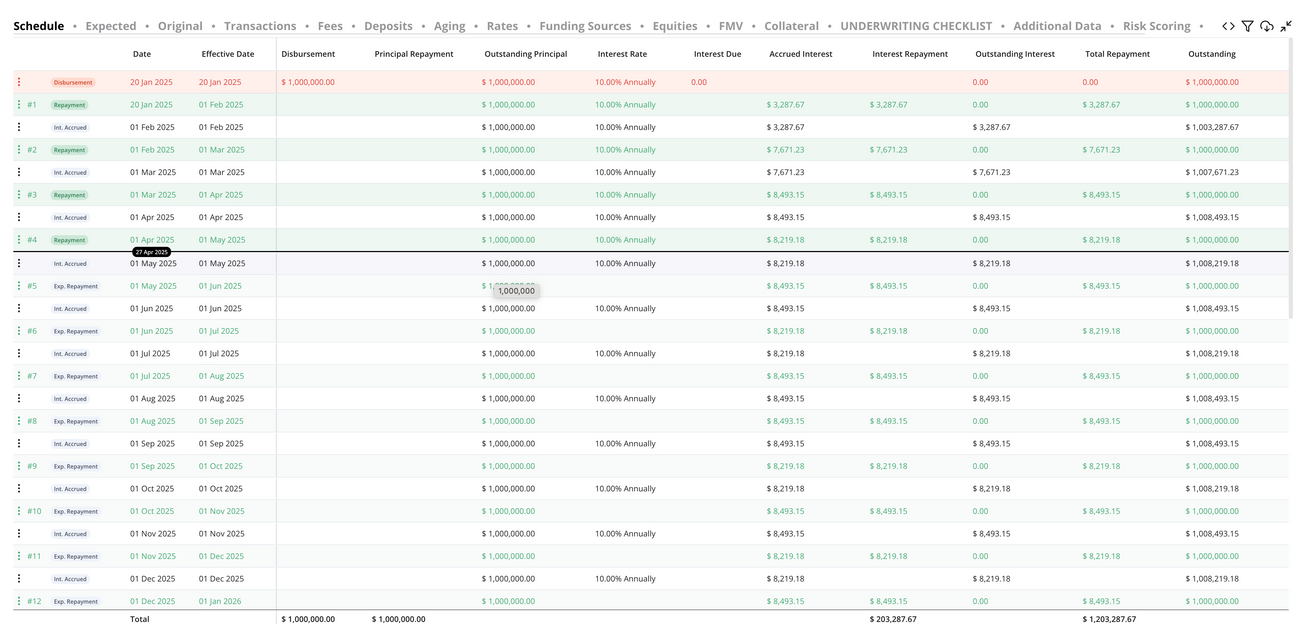

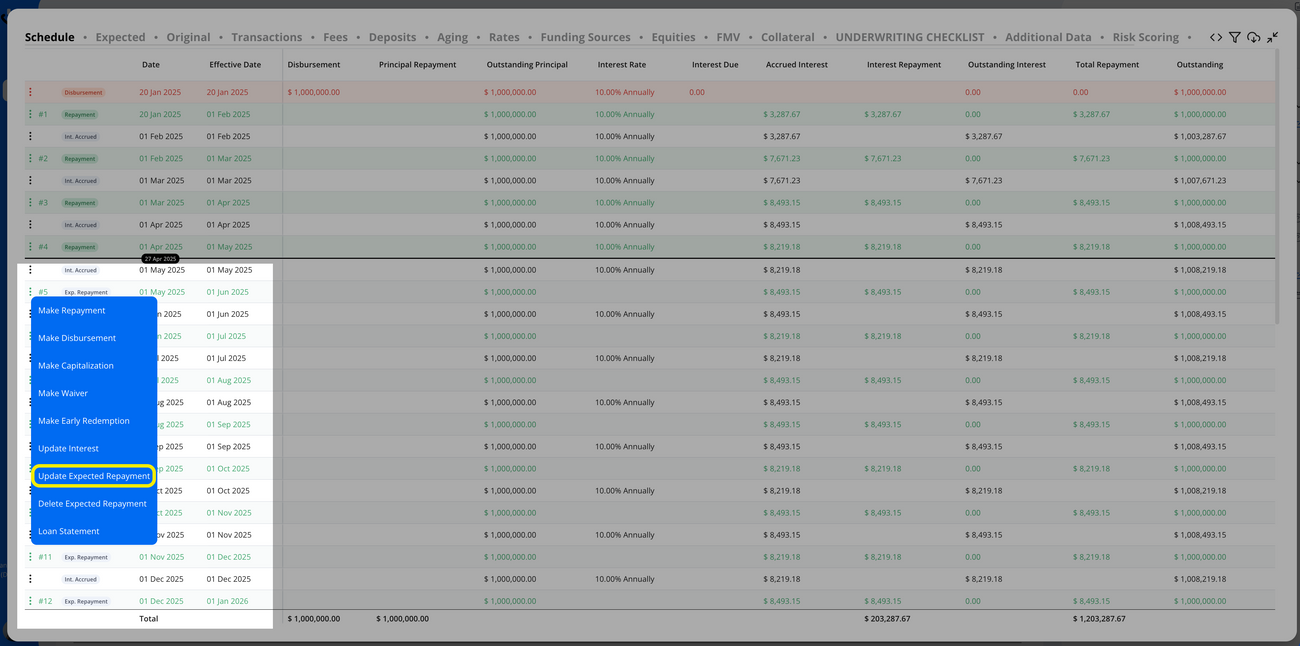

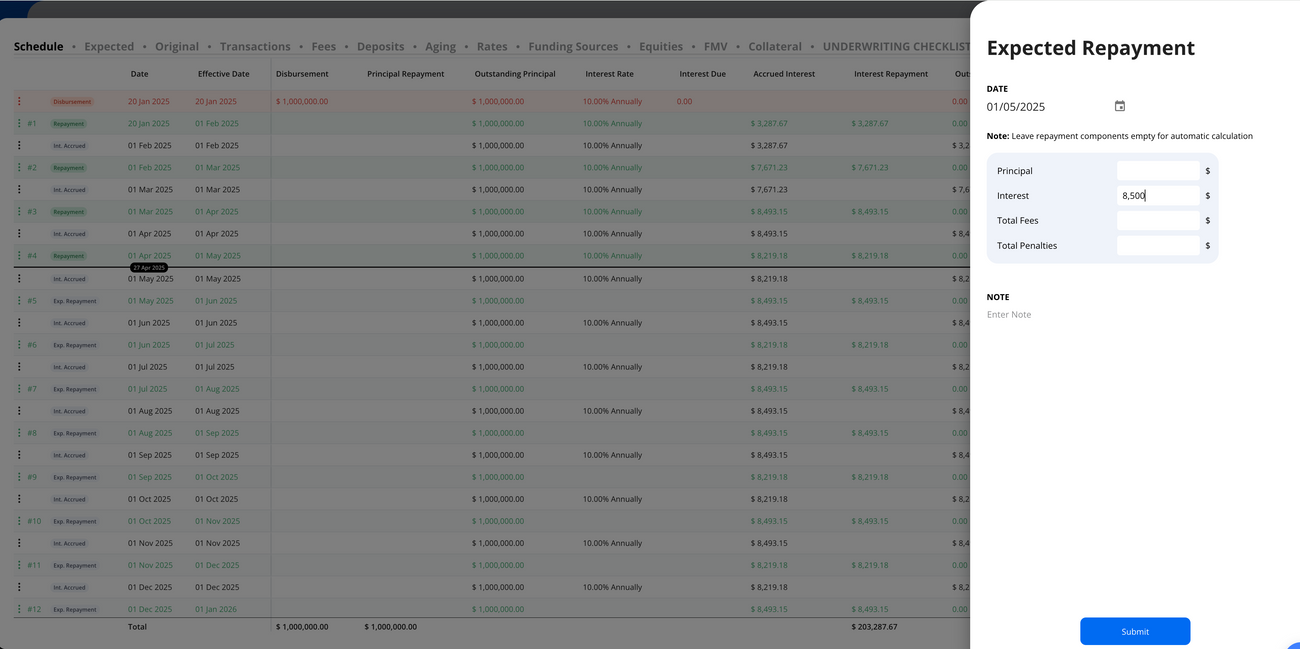

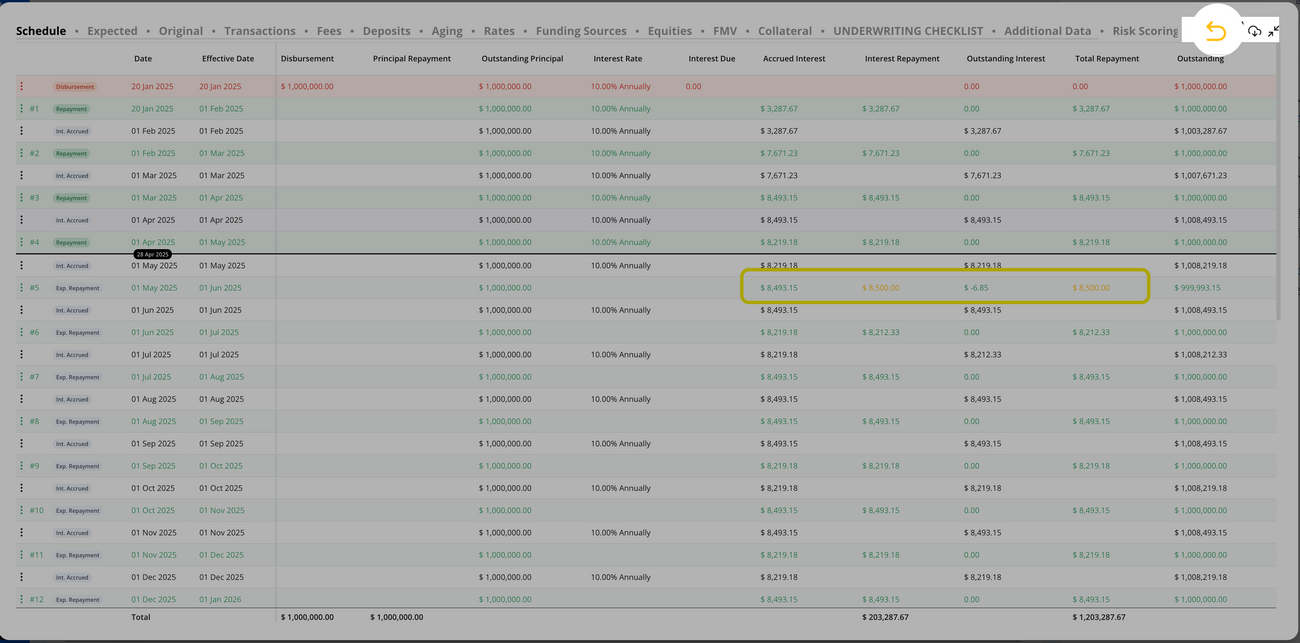

Manual Expected Repayment Override

Users can manually set expected repayments by entering values in the designated yellow-highlighted manual amount fields, as shown in the image. This provides full control over how repayments are allocated, allowing precise adjustments when needed.

When to Use This vs. Update Terms

While many repayment adjustments should be handled using the "Update Terms" function, manual repayment overrides should be used for edge cases where updating loan terms is not feasible. Examples include:

- Making a one-time adjustment without affecting future scheduled payments

- Temporarily overriding a repayment amount due to an exceptional case

- Managing a unique fee or penalty without altering the loan's structure

By using manual overrides selectively, users can maintain accurate repayment records while preserving loan terms for standard adjustments.

Step 1: Click the ellipsis menu next to the repayment and select "Update Expected Repayment"

Step 2: Enter the adjusted expected repayment breakdown.

Step 3: Click "Submit" to view the adjusted schedule. The yellow highlight showing $8.5K indicates the user-modified repayment amount. After applying an override, the system automatically recalculates interest and updates the schedule.

Users can also revert an override if needed, which restores the original expected repayment values. The following image shows how to revert an override in the schedule.

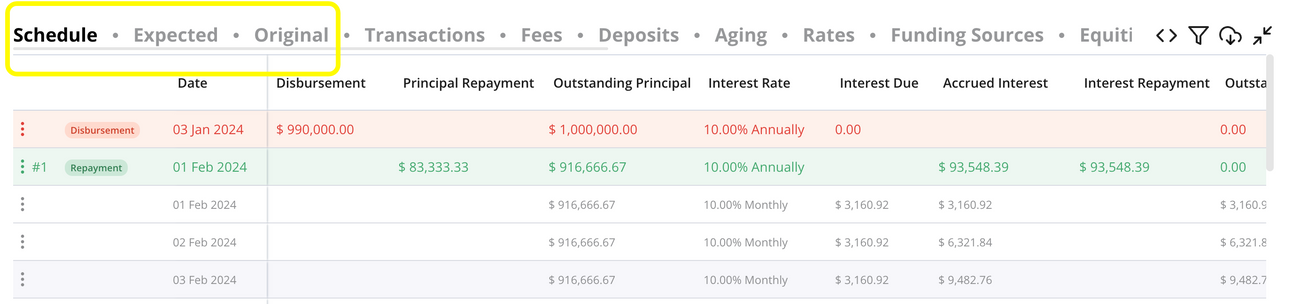

Multiple Schedule Views

Hypercore provides three distinct schedule views:

- Current Schedule (Schedule): Displays all live transactions and updates, reflecting both past and present activities of the loan, showing the actual current loan position. Future outstanding principal and interest calculations exclude any planned future disbursements

- Expected Schedule: Displays projected future transactions based on current loan terms, including expected repayments. Future outstanding principal and interest calculations incorporate planned future disbursements. This view helps users anticipate upcoming cash flows and assess future loan activity.

- Original Schedule: Preserves the loan's initial schedule before any modifications, providing a reference for comparison against expected and current schedules. This view does not reflect any term updates, repayments, or disbursements made after the loan's inception.

Multi-Tranche Facility Schedule

The platform supports multi-tranche loan management:

- The schedule combines transactions and expected repayments from all tranches, providing a comprehensive view of loan activity.

- Each daily charge row shows the total interest charges across all tranches. For instance, if Tranche A accrues $500 in daily interest and Tranche B accrues $700, the schedule shows a consolidated daily charge of $1,200.

- Example image: