Loan Fees

Last updated November 23, 2025

This guide covers how to create, configure, and update fees within loans, including explanations of all available options and best practices.

Where Can You Add Fees in Hypercore?

You can add fees to loans via three main methods:

- During Loan Creation Use the Fees section in the Loan Creation Wizard to set up fees as you create a new loan.

- After Loan Creation Add fees anytime by navigating to an existing loan and opening the Fees tab at the bottom of the loan details page.

- Bulk Import For mass updates, fees can also be imported in bulk using the Bulk Actions > Imports section.

Note: The process for configuring a fee is the same across methods 1 and 2. For bulk imports, the component are the same, however with a different process.

Step-by-Step: Adding a Fee to a Loan

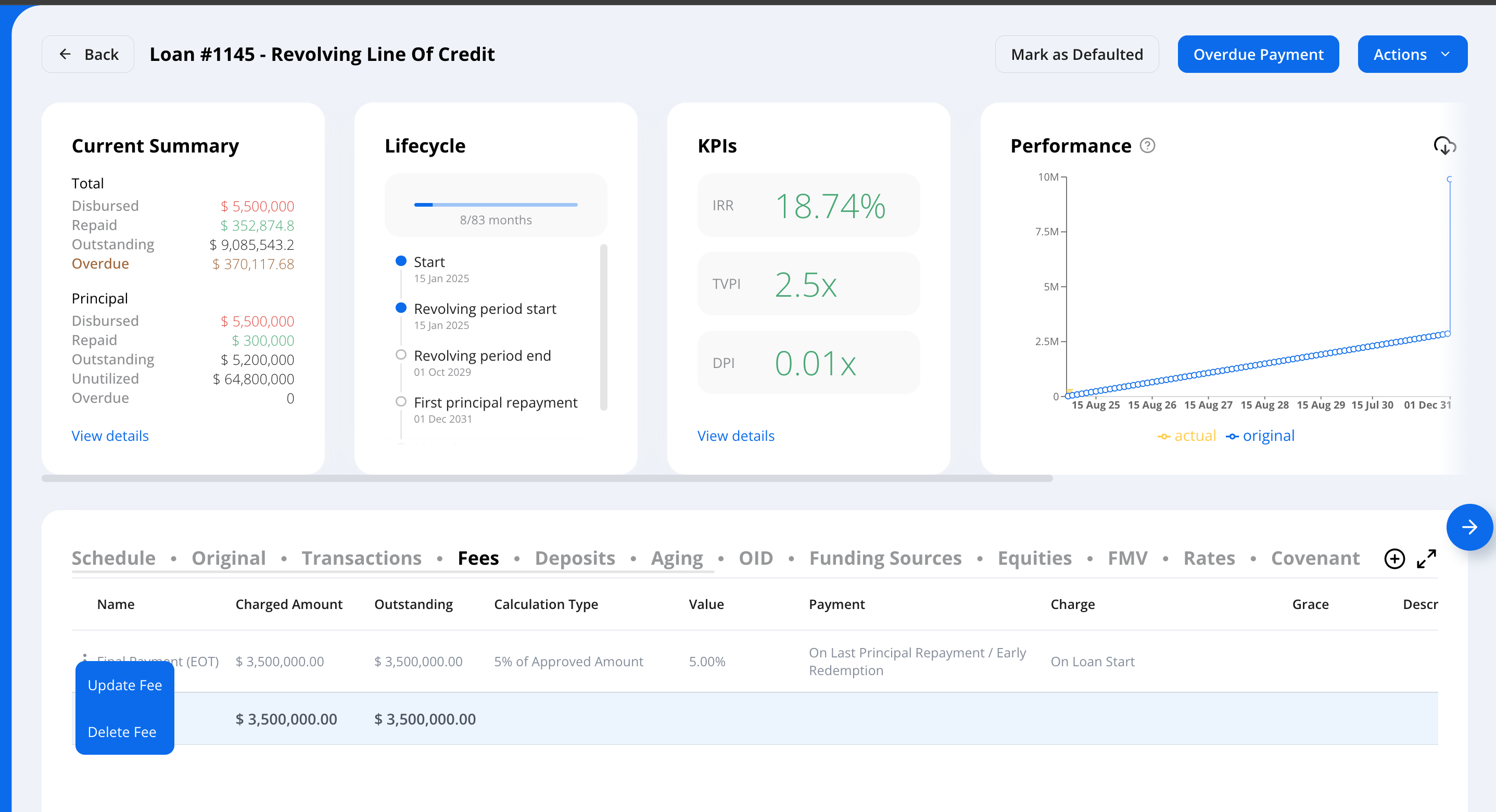

1. Open the Fees Tab

- Go to the relevant loan.

- Click on the Fees tab in the lower section of the screen (next to the schedule)

- Click the "+" (Add Fee) button.

2. Select a Fee Option (Template)

- The first field is Fee Options: This dropdown contains predefined templates, set up for your organization by your team and Hypercore Support.

- Fee options can vary by loan type.

- Need a new fee type? Contact Hypercore Support to have it added.

- Selecting a template will pre-fill many fields (e.g., calculation, charge/payment settings), but you can customize as needed.

3. Name the Fee

- Enter a clear, descriptive Fee Name (e.g., “Annual Management Fee 2024”).

- Tip: Use consistent naming conventions to make fees easily searchable and auditable.

4. Define if the Fee is a Penalty

- Penalty Fee Toggle: Switch on if the fee is a penalty (as opposed to a standard fee).

- Why this matters:

- Penalties and fees behave the same, but are visually distinguished for tracking and reporting.

- Payment priority: Penalties are typically paid before other fee types in repayment allocation.

5. Allocate Fee to Funding Sources (if applicable)

- If your account uses Funding Sources, you can assign the fee to one or more sources linked to the loan.

6. Add a Description (optional)

- Use the open text field to add details or internal notes about the fee.

7. Set Amount & Calculation Method

a. Amount to Charge

- Enter the value for the fee.

- Calculation field: Choose how the fee amount is determined.

- Examples include:

- Flat Fee: Fixed dollar amount.

- % of Approved Amount: Percentage of the loan commitment.

- % of Unutilized Amount: Based on undrawn commitment.

- % of Disbursement: Based on amounts disbursed.

- % of Outstanding Principal/Interest/Repayment: Dynamic calculation based on loan activity.

- For all methods and explanations, see here

Example: $5,000 flat 1% of disbursement 0.25% of unutilized approved amount

8. Set Charge & Payment Timing

a. Charge Timing

- Defines when the fee is considered due and added to the loan’s amortization schedule.

- Options include:

- As Interest: Accrues daily/monthly like interest.

- On Date(s): One-time or multiple specific dates.

- On Frequency: Recurring (e.g., monthly, quarterly, annually).

- On Disbursement: With each or first disbursement.

- On Repayment: Tied to repayment events.

- On Early Redemption: Charged when loan is paid off early.

For all Charging methods, see here

- Note: This affects when the fee is shown as due/outstanding.

b. Payment Timing

- When you expect the borrower to pay the fee.

- The options are very similar to the charge options. For all methods, see here

- Charge Same as Payment:

- Toggle to make payment due immediately upon charging (hides separate charge settings).

- Capitalize Fee:

- Instead of paying the fee in cash, add it to the loan’s principal (fee will accrue interest as part of the balance).

Example: For recurring fees, set both charge and payment frequency (e.g., charge and pay $5,000 on the 1st of each month).

9. Compounding Fees

- For fees that aren’t paid immediately, enable Compounding Fee.

- Choose compounding frequency (e.g., monthly, quarterly).

- Use case: Accrued, unpaid fees that should themselves accrue interest over time.

10. Save the Fee

- Click Add Fee to save.

- The fee will now appear in the loan’s schedule, showing due dates, outstanding amounts, and payment status.

Editing & Updating Fees

- To amend an existing fee (e.g., after a loan amendment), open the fee from the Fees tab and click Edit/Update Fee.

- You can:

- Update amount or calculation method.

- Add an Update to change the fee amount from a certain date forward (e.g., reduce fee after 1 year).

- The schedule and outstanding balance will update automatically based on the changes.

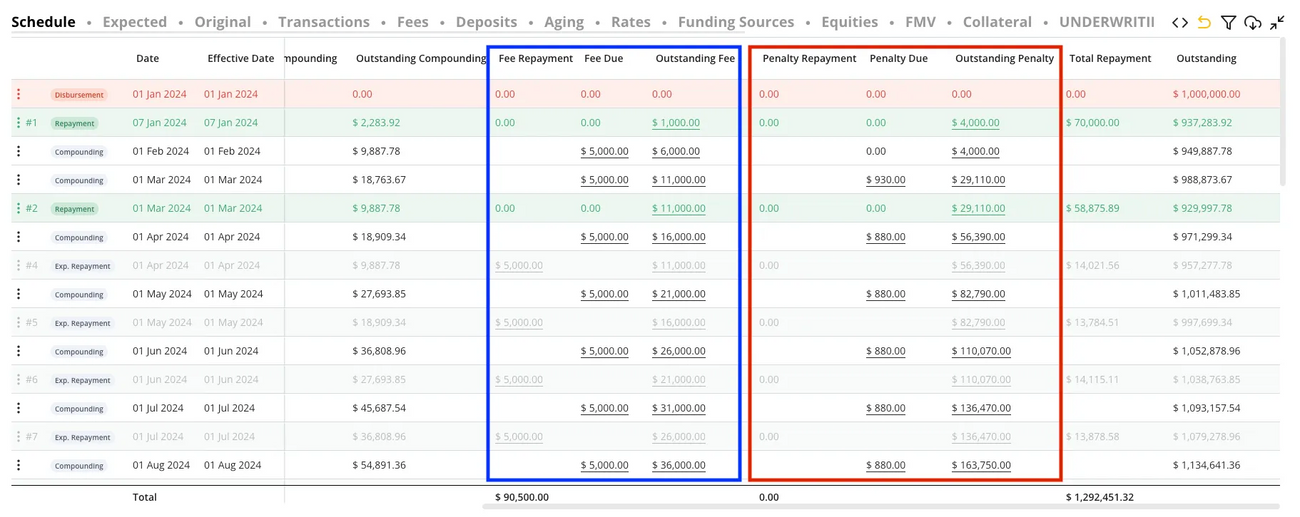

Tracking Fees in the Loan Schedule

- All fees, due and paid, appear in the Loan Schedule and Fees tab.

- You can see:

- Upcoming charges and due dates

- Payment history

- Outstanding (unpaid) fee balances

- Fees also show in OID (Original Issue Discount) reporting if configured.

Bulk Importing Fees

- For multiple loans or fees, use the Bulk Actions > Imports feature.

- The components will be identical to the fee set up (name, calculation method+value, charge timing, payment timing, etc.)

Best Practices & Tips

- Use clear, descriptive names and descriptions for all fees.

- Leverage fee templates to ensure consistency and speed up loan setup.

- Differentiate penalties from standard fees using the toggle for reporting and repayment priority.

- If you have bespoke fee calculation logic, work with Hypercore Support to set up custom fee options.

- Regularly review and update fee structures as needed - especially after loan amendments or changes in client agreements.

Fee Calculation Methods

Flat

A fixed amount charged, regardless of the loan amount, utilization, or repayment.

Example: $500

% of Approved Amount

Calculated as a percentage of the total facility/loan amount approved, regardless of how much is drawn.

Example: 1% fee on a $1,000,000 approved facility = $10,000 fee.

% of Approved Amount Minus Disbursements

Calculated as a percentage of the difference between the approved amount and the disbursed amount. Essentially a commitment fee on undrawn funds.

Example: Approved $1,000,000, disbursed $400,000, fee is 1% on $600,000 = $6,000.

% of Unutilized Approved Amount

Similar to above, charged on unused facility amount.

Also known as: Commitment Fee, Undrawn Commitment Fee, Unused Commitment Fee, Non-Utilization Fee, Non-Usage Fee, Availability Fee, Standby Fee.

% of Unutilized Facility

Calculated as a percentage of the unused portion of the approved facility amount. The fee is charged on the difference between the total facility approved (across all tranches) and the total amount that has been disbursed to date.

Also known as: Facility Availability Fee, Undrawn Line Fee, Unused Line Fee, Commitment Commission, Non-Utilisation Fee, Line Fee.

Example:

If a facility has an approved amount of $5,000,000, and the borrower has so far received disbursements totaling $3,500,000, the unutilized portion is $1,500,000.

If the fee rate is 1%, the fee charged would be: 1% On $1,500,000 = $15,000

% of Unutilized Disbursements From First Disbursement

Calculated as a percentage of undisbursed amounts after the first disbursement has occurred.

Example: After first disbursement, remaining undrawn facility is $700,000 → fee applies on that.

% of Unutilized Disbursements By Utilization Period

Charges a fee on unutilized amounts per defined utilization period (e.g. monthly or quarterly).

Example: At each month-end, fee applies to undrawn portion for that month.

% of Unutilized Expected Disbursements

Calculated as a percentage of planned or scheduled disbursements that were not utilized. Often used in construction or drawdown facilities.

Example: If $200,000 expected to be disbursed in June wasn’t, fee applies on $200,000.

% of Non-Amortized Approved Amount

Charged on the portion of the approved facility that is not amortized, meaning principal still outstanding or undrawn. This is equal to Approved Amount minus Total Principal Paid

Example: The loan was approved for $2,000,000. So far, $1,500,000 has been disbursed, leaving $500,000 undrawn. Of the disbursed amount, $750,000 has been repaid, so the outstanding principal is $750,000.

The fee is calculated on the sum of the undrawn amount ($500,000) and the outstanding principal ($750,000), totaling $1,250,000

% of Future Interest Charges Until Maturity

Calculates a fee as a percentage of future scheduled interest charges remaining until loan maturity.

Example: Future interest charges total $50,000; fee is 2% = $1,000.

% of Disbursement

Charged as a percentage each time a disbursement is made. Please note: Charges must be configured in this section. Once configured, they will be applied on the same day as the disbursement. Charge options are 'On First' or 'On Every' Disbursement

Example: 1% fee on each disbursement.

% of Outstanding Principal

Calculates fee as a percentage of the current principal outstanding balance.

Example: Principal balance is $500,000, fee is 1% = $5,000.

% of Outstanding Principal & Compounding Interest

Fee calculated as a percentage of principal plus accrued compounding interest at the time of calculation.

% of Outstanding Principal & Interest

Calculated as a percentage of principal plus simple interest accrued.

% of Outstanding Principal & All interests

Fee on principal plus all types of accrued interest, including simple and compounding

% of Principal Repayment

Calculated as a percentage of any principal repayment made. Often used for exit or early repayment fees.

Example: 2% of a $100,000 repayment = $2,000 fee.

% of Interest Repayment

Fee charged as a percentage of interest payments made.

CPI Average

Fee calculation linked to the average Consumer Price Index (inflation index) over a period. Used to adjust fees with inflation.

Example: CPI average of 3% may adjust the fee amount accordingly.

Flat Minimum Interest

A minimum interest amount charged regardless of actual calculated interest.

Example: If accrued interest is $20,000 but minimum is set to $50,000, the charged interest is the difference, $30,000.

Months for Minimum Interest

Defines how many months the minimum interest applies for.

Example: Minimum interest applies for first 3 months. If the loan redeems after 2 months, the remaining month of interest will be applied as a fee.

Months Minimum Interest On First Disbursement

Minimum interest charged for a specified number of months, applied to the principal from the first disbursement.

% Minimum Interest On Total Disbursed

Sets a minimum interest amount calculated as a percentage of total disbursed funds, ensuring lenders receive at least that much in interest.

Example: 5% minimum interest on $200,000 disbursed = minimum $10,000 interest.

Months Minimum Interest On Paid Principal

This sets a minimum interest charge based on the principal being repaid. If the principal is repaid before the minimum period, the borrower still pays interest for the full minimum period.

Example: If $50,000 of principal is repaid after 1 month, but the minimum is 2 months, the borrower pays the remaining 1 month of interest on $50,000, even though it was only outstanding for 1 month.

Payment Timing Methods

On Specified Date

The fee is paid on a single, pre-defined date.

Example: A $5,000 arrangement fee charged on August 1st, 2025.

On Frequency

The fee is paid recurrently based on a set frequency, such as monthly, quarterly, or annually.

Example: A 1% facility fee charged monthly throughout the loan term.

On Dates

The fee is paid on multiple specific dates.

Example: Charging fees on June 1, September 1, and December 1.

On Loan Start

The fee is paid when the loan begins (not necessarily on first disbursement, for example a revolving credit line).

Example: An origination fee charged immediately upon loan start.

On First Disbursement

The fee is paid when the first disbursement of funds is made.

Example: A commitment fee triggered when the first drawdown occurs.

On Every Disbursement

The fee is paid each time a disbursement is made.

Example: A 0.5% disbursement fee charged every time funds are drawn.

On Repayment

The fee is paid whenever any repayment is made, regardless of component.

Example: A processing fee applied on each repayment transaction.

On Principal Repayment

The fee is paid specifically when a principal repayment is made.

Example: A prepayment penalty fee calculated and charged when principal is repaid.

On Interest Repayment

The fee is paid when an interest payment is made.

Example: A servicing fee applied each time interest is paid.

On Early Redemption

The fee is paid when the loan is paid off early (redeemed before maturity).

Example: An early termination fee charged upon early payoff of the remaining balance.

On Principal Repayment / Early Redemption

The fee is paid when there is a principal repayment or an early redemption event.

Example: Applies whether the borrower is making a scheduled/unscheduled principal repayment or fully paying off the loan early.

On Last Principal Repayment / Early Redemption

The fee is paid when the final principal repayment is made or the loan is redeemed early.

Example: An exit fee charged only upon the final principal payment or early loan closure.

Proportional To Prepaid Principal

The fee is paid when the final principal repayment is made or the loan is redeemed early. When doing a repayment that is marked as a prepayment, if the user is calculating the distribution based on the nominal principal, the fee will be added to the distribution according to this calculation:

[nominal principal] / [outstanding principal] * [outstanding fee]

Example: An exit fee is paid on maturity or on prepayment.

Charging Timing Methods

As Interest

The fee is charged daily, functioning like interest, and can be set up to have frequent accrual periods.

Example: A management fee charged daily and accrued monthly like interest.

On Specified Date

The fee is charged on a single, pre-defined date.

Example: A $5,000 arrangement fee charged on August 1st, 2025.

On Frequency

The fee is charged recurrently based on a set frequency, such as monthly, quarterly, or annually.

Example: A 1% facility fee charged monthly throughout the loan term.

On Dates

The fee is charged on multiple specific dates.

Example: Charging fees on June 1, September 1, and December 1.

On Loan Start

The fee is charged when the loan begins (not necessarily on first disbursement, for example a revolving credit line).

Example: An origination fee charged immediately upon loan start.

On First Disbursement

The fee is charged when the first disbursement of funds is made.

Example: A commitment fee triggered when the first drawdown occurs.

On Every Disbursement

The fee is charged each time a disbursement is made.

Example: A 0.5% disbursement fee charged every time funds are drawn.

On Repayment

The fee is charged whenever any repayment is made, regardless of component.

Example: A processing fee charged on each repayment transaction.

On Principal Repayment

The fee is charged specifically when a principal repayment is made.

Example: A prepayment penalty fee calculated and charged when principal is repaid.

On Interest Repayment

The fee is charged when an interest payment is made.

Example: A servicing fee charged each time interest is paid.

On Early Redemption

The fee is charged when the loan is paid off early (redeemed before maturity).

Example: An early termination fee charged upon early payoff of the remaining balance.

On Principal Repayment / Early Redemption

The fee is charged when there is a principal repayment or an early redemption event.

Example: Applies whether the borrower is making a scheduled/unscheduled principal repayment or fully paying off the loan early.

On Last Principal Repayment / Early Redemption

The fee is charged when the final principal repayment is made or the loan is redeemed early.

Example: An exit fee charged only upon the final principal payment or early loan closure.

On Arrears

The fee is charged when a repayment is late, applying as a penalty or late fee.

Example: A late payment fee charged when a scheduled repayment is overdue.

Default Interest:

Set up Default Interest as a Penalty Fee so it accrues like interest but is displayed and prioritized as a penalty in schedules, statements, and allocations.

- Add a new fee

- Go to the loan Fees tab and click + Add Fee.

- Name the fee

- Fee Name:

Default Interest(or your preferred naming convention).

- Mark it as a Penalty

- Turn Penalty Fee ON.

- Why: Penalty fees are shown separately and typically have higher payment priority in allocations.

- (Optional) Add a description

- Enter a short explanation, e.g., “Default interest at 24% p.a. on outstanding principal and compounding interest.”

- Define the Amount to Charge

- Value:

X(set the lender’s rate; typically an annual percentage). - Calculation: Select % of Outstanding Principal & Compounding Interest.

- Meaning: The fee is calculated on the current outstanding principal plus any compounding interest balance.

- Minimum Amount (optional): Enter a floor amount if your policy requires one.

- Updates (optional): Click Add to create dated rate changes if the default rate changes mid‑term.

- Set Payment behavior

- Capitalization in Place of Payment: OFF (leave off unless you intend to capitalize unpaid amounts at each payment date).

- Timing: Choose On Last Principal Repayment / Early Redemption.

- Meaning: Although the fee accrues over time, it will be collected when the final principal is repaid or if the loan redeems early.

- Set Charge (accrual) timing

- Same as payment: OFF (so accrual dates can differ from collection date).

- Timing: Select As Interest.

- Meaning: The fee accrues on the same cadence as interest (e.g., monthly/quarterly), starting from the date you specify below.

- From: Set the Default Start Date (e.g., the date the loan went into default).

- Until: Leave blank to continue accruing until cure/redemption, or set an end date if the default period is defined.

- Enable compounding (if required)

- Turn Compounding Fee ON.

- Meaning*the : Any unpaid default interest will compound according to the loan’s compounding rules.

- Save

- Review the setup and click Save. The fee will appear as a Penalty line item in schedules and statements.

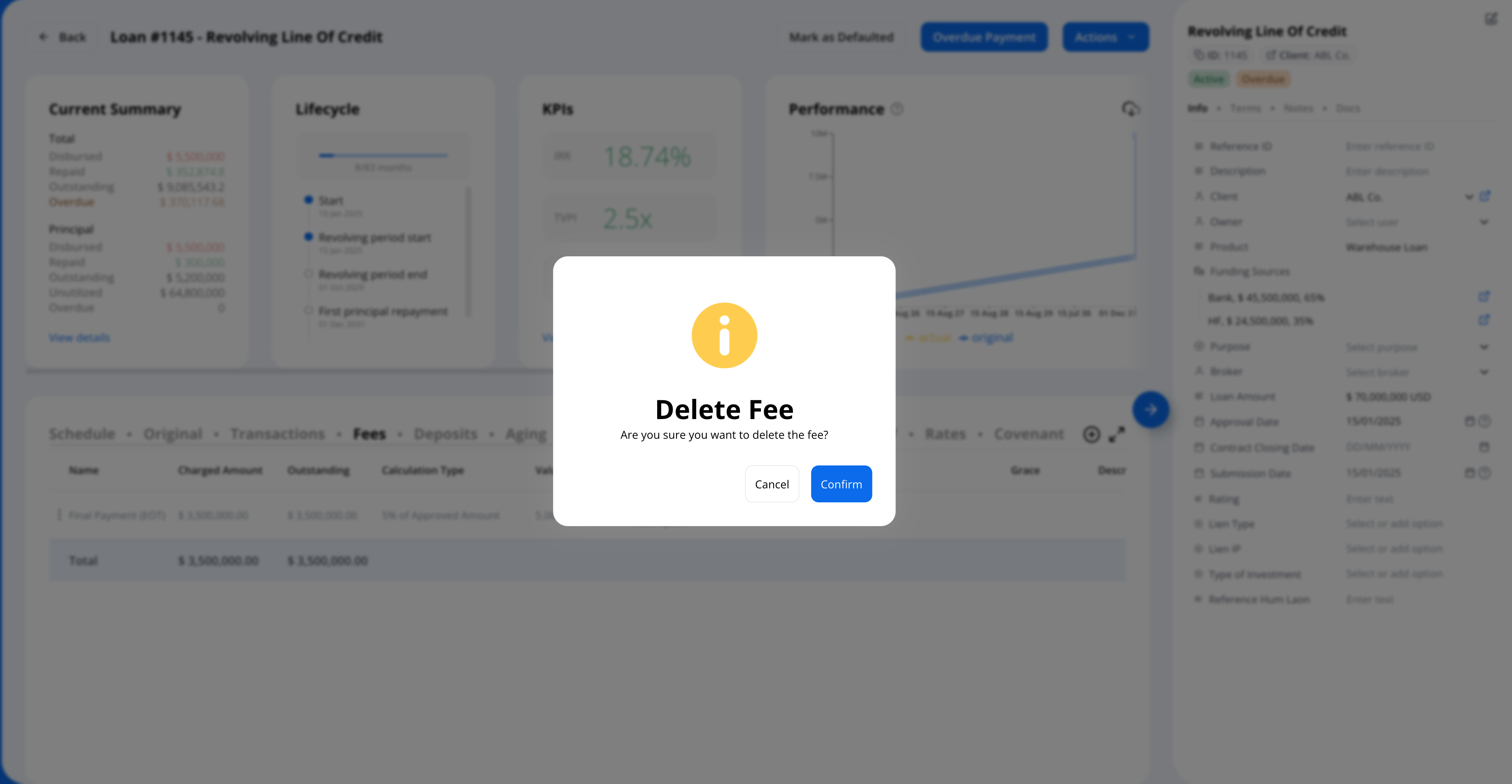

Deleting a Fee

You can delete any existing fee directly from a loan’s amortization schedule. How to Delete a Fee:

- Open the Loan – Go to the relevant loan.

- Go to the Fees Tab – Open the Fees table in the bottom tabs.

- Find the Fee – Locate the row of the fee you want to delete.

- Delete – Click the ellipsis (⋯) next to the row and select Delete Fee.

- Confirm – In the prompt, click Confirm to permanently remove it.

FAQ

Q: Can I edit a fee after it’s been created?

A: Yes! Use the Update function in the Fees tab to change amounts, calculation, timing, etc.

Q: Can a fee be capitalized (added to principal)?

A: Yes, use the “Capitalize Fee” toggle in the Payment section when creating or editing the fee.

Q: How do I add a fee for multiple loans at once?

A: Use the Bulk Actions > Imports feature and follow the fee import template.

Q: What if I need a new type of fee or calculation?

A: Contact Hypercore Support to have new fee options/templates added to your account.