Loan Actions: Approvals, Repayments, and Transcations

Last updated December 28, 2025

1. Approving and Activating a Loan

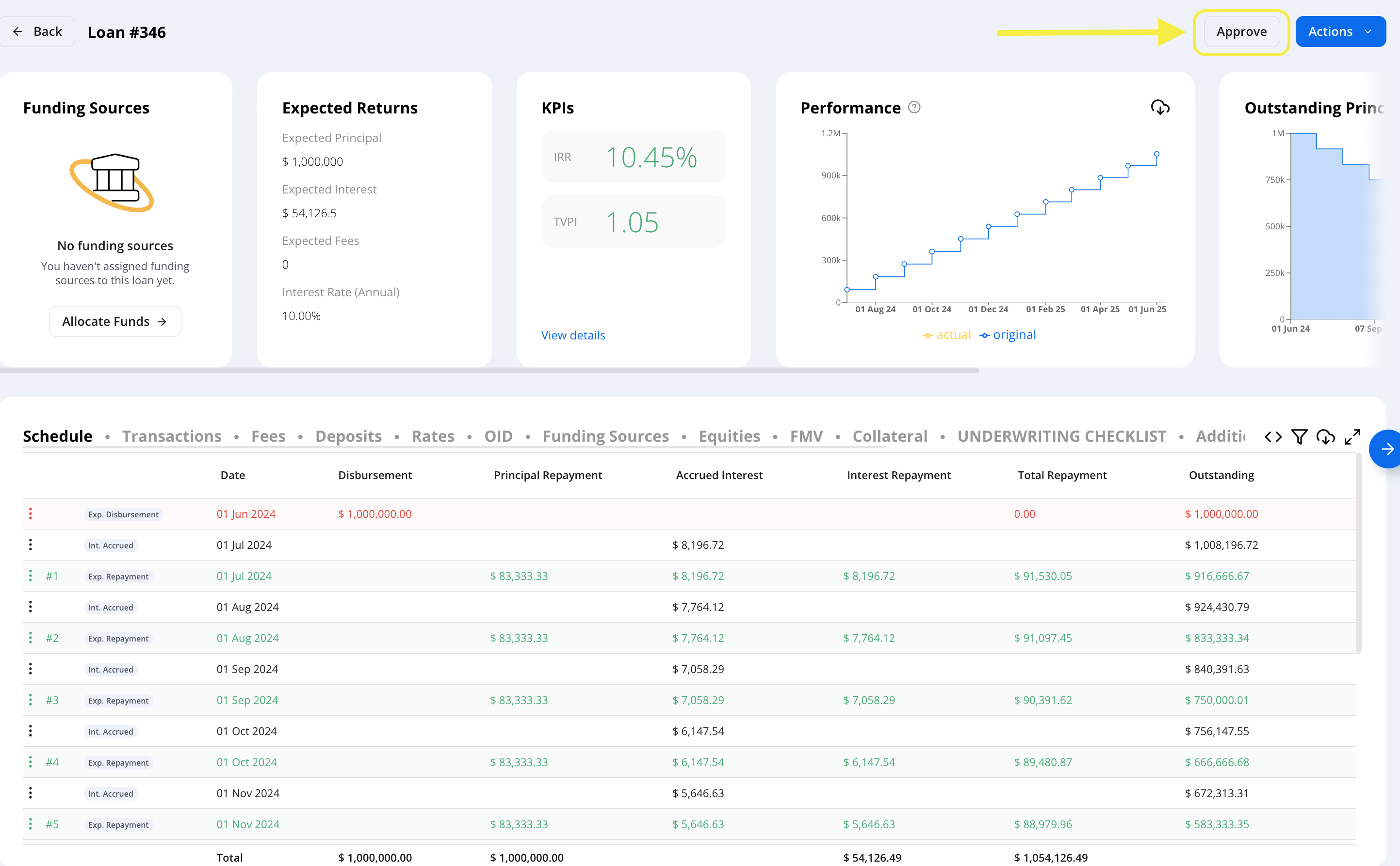

Step 1: After the initial loan terms were submitted, click "Approve"

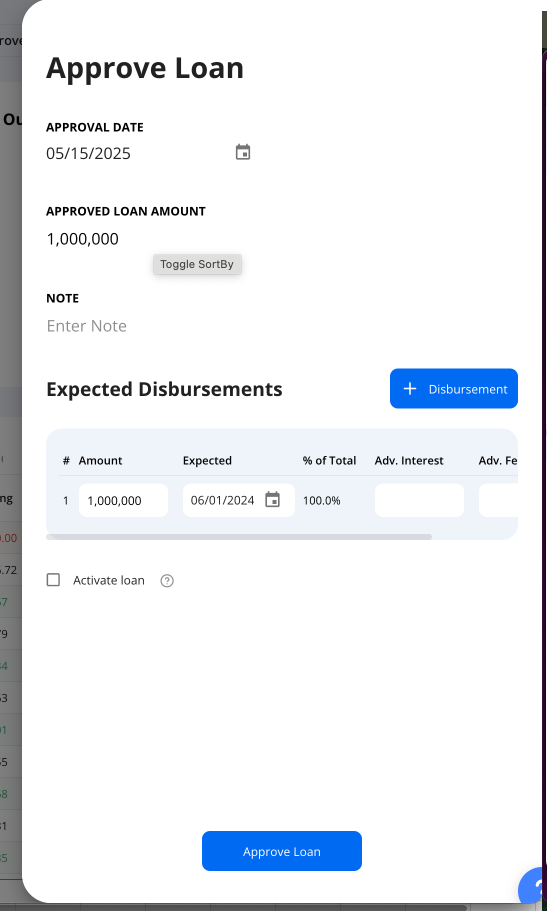

Step 2: Enter the Approval Date and Approved Loan Amount. Verify all Expected Disbursement details are correct, then click Approve Loan. You can either activate the loan immediately by checking the checkbox or activate it separately later.

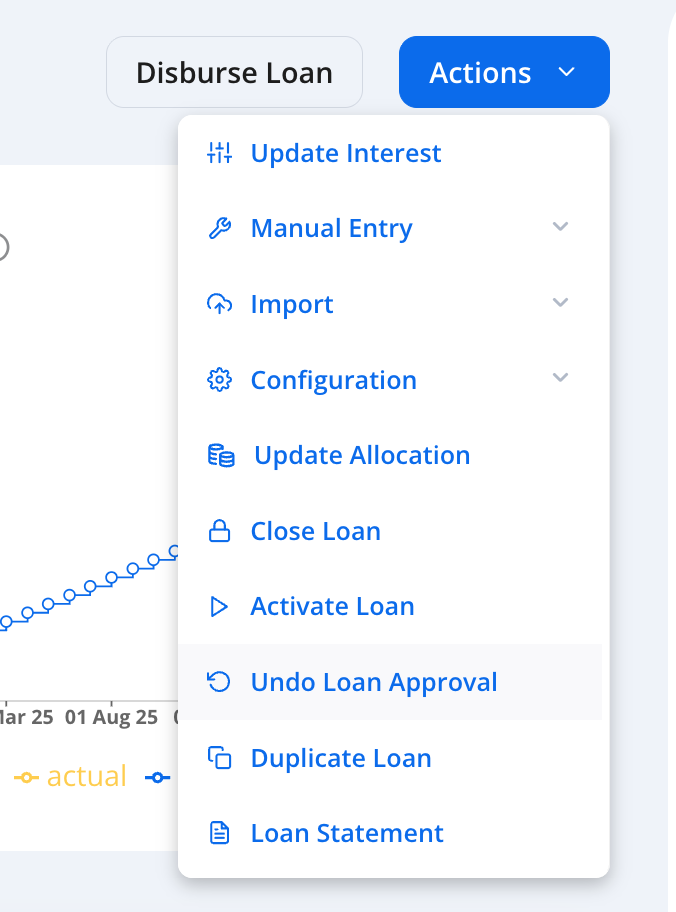

Reverting a Loan from Approved to Pending

If a loan was approved by mistake or needs edits before disbursement, you can revert it to Pending.

- Open the approved loan.

- Click Actions → Undo Loan Approval.

- (Optional) Add a note explaining the reason and confirm the action.

The loan status will change to Pending, and the Approve button will reappear.

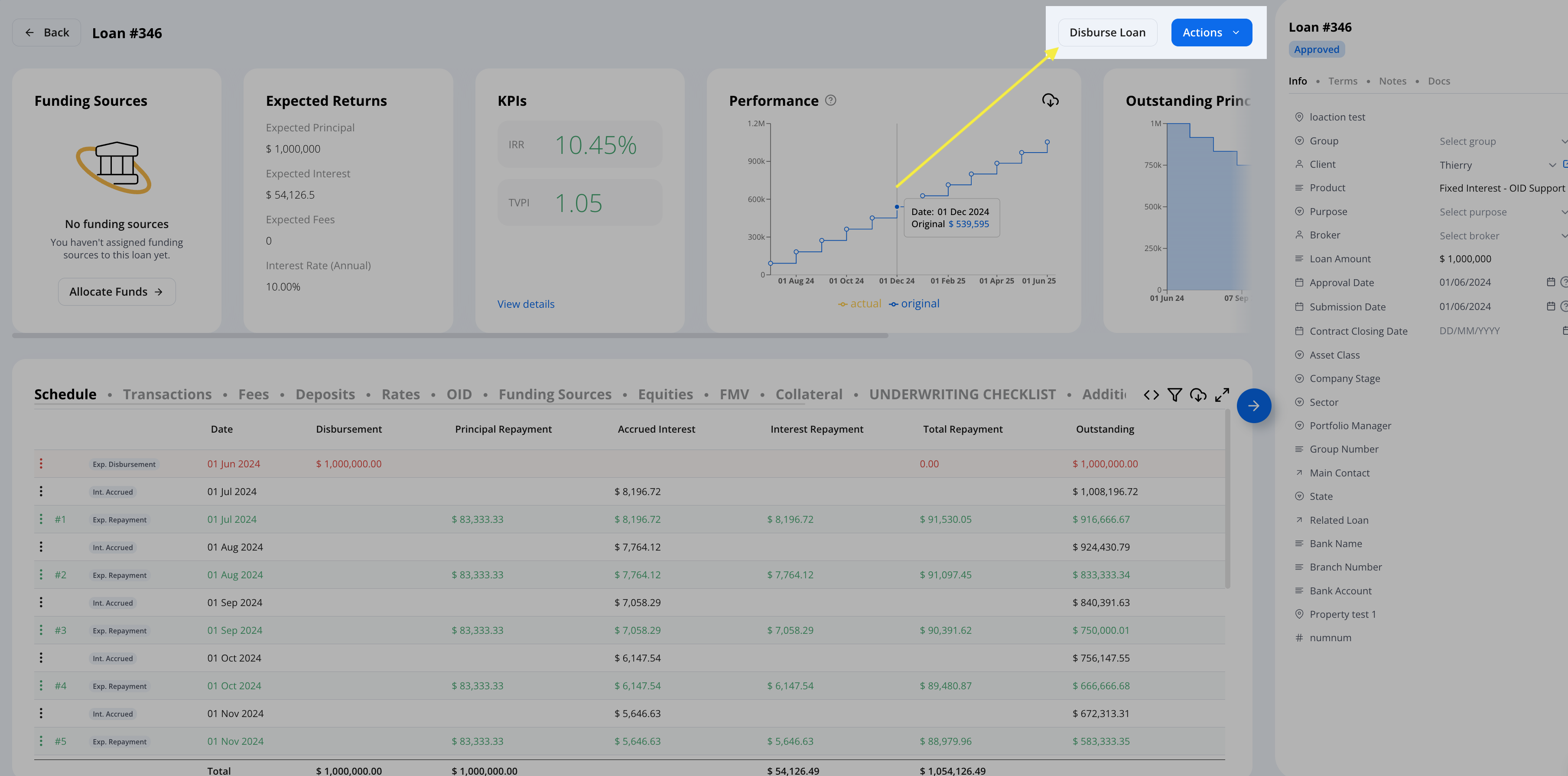

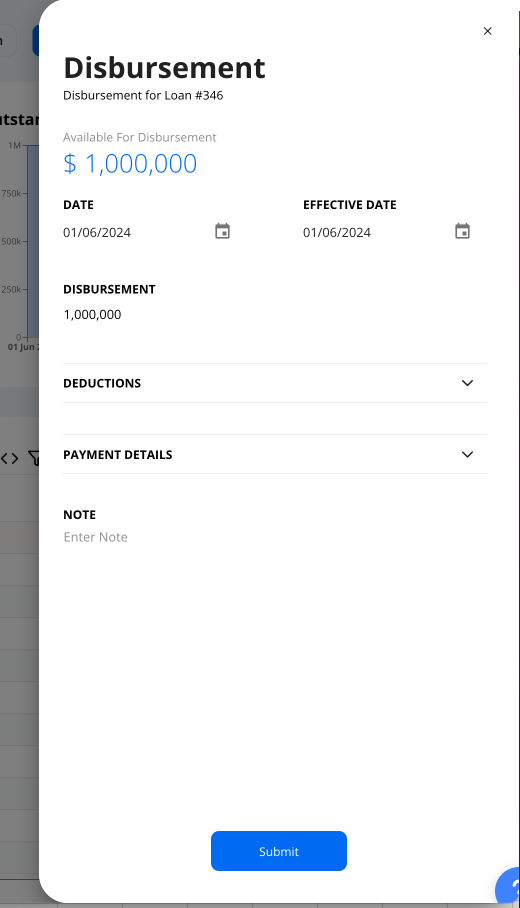

Step 3: Create a Disbursement transaction (This will activate the loan):

- Enter disbursement details.

- Submit the transaction.

Tip: Approve and activate as separate actions for better control.

Cancelling a Disbursement

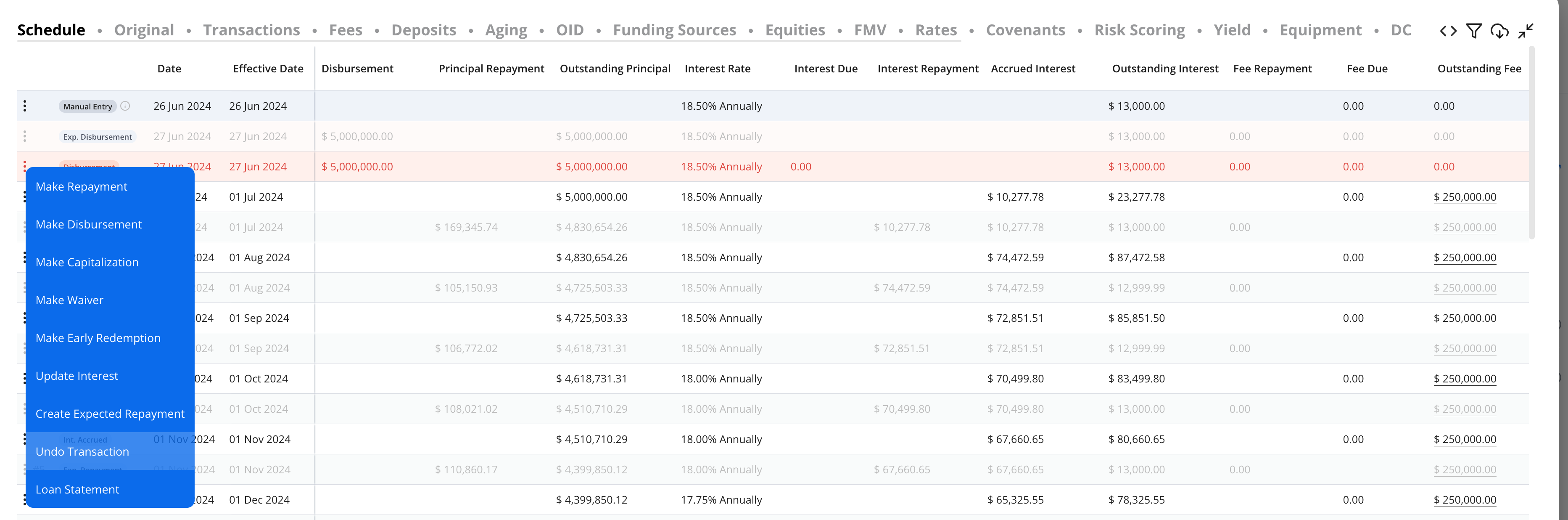

From the Amortization Schedule:

- Find the row that includes the disbursement transaction.

- Click the ellipsis menu (⋮) to the left of the row.

- Select Undo Transaction, then click Confirm.

Note: this action can be done from the Transactions tab within the Amortization Schedule.

2. Adding a Repayment

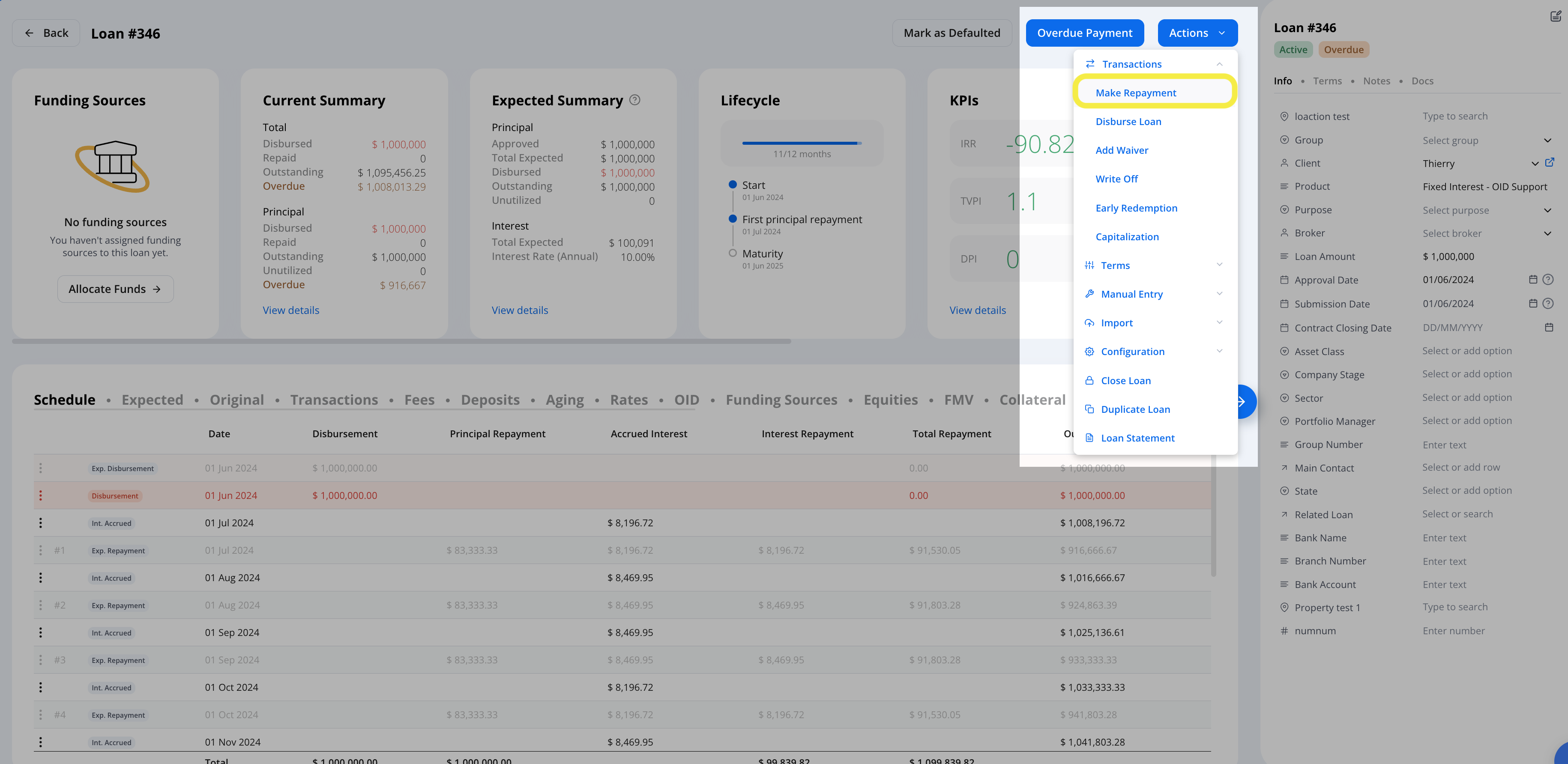

Step 1: Open the loan → Click Transactions and Make Repayment.

You can also make repayments directly from the schedule by clicking the ellipsis (…) in the expected repayment row.

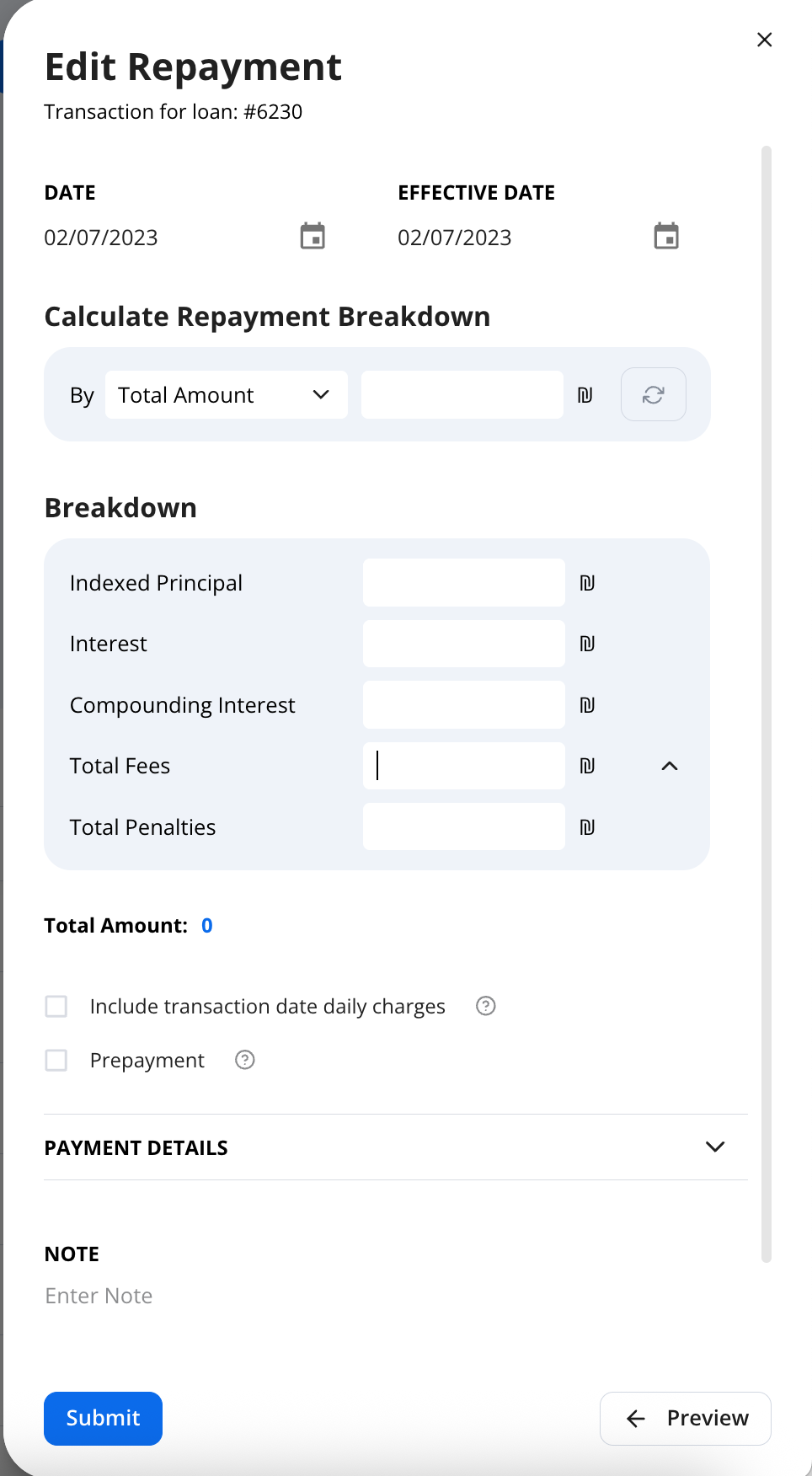

Step 2: Enter the repayment Date and Effective Date

Calculate Repayment Breakdown: If you don’t specify the breakdown, Hypercore will auto-allocate according to repayment strategy. Manual allocation ensures the repayment is distributed as intended

Step 3: Break down the repayment into:

- Principal

- Interest

- Compounding interest

- Total Fees (with breakdown option using the right arrow)

- Other components (if applicable)

Include Transaction Date Daily Charges Enable this option if you want the transaction to accrue charges on the transaction date itself. This is commonly used for early redemptions or partial redemptions where same-day accruals are charged.

Prepayment Mark the transaction as a prepayment to indicate that the repayment is made ahead of the scheduled due date.

Breaking down repayments is crucial as it lets you control how payments are applied to different components.

Step 4: Preview and submit the repayment.

3. Other Loan Transaction Actions

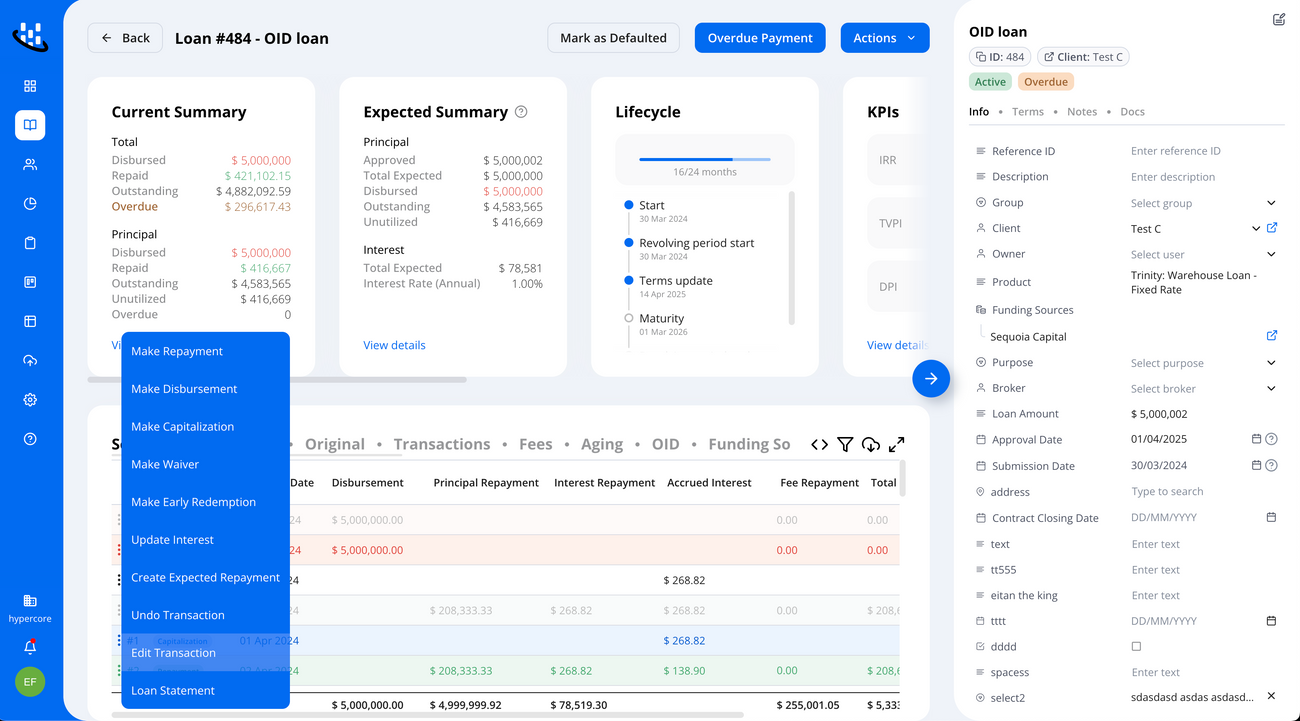

You can apply the following manual transactions to manage loan changes: Accessed from: Loan page -> Actions -> Click Transactions

| Action | Purpose |

| Waiver | Forgive part of any loan component (principal, interest, fees, etc.). This reduces the borrower’s obligations without requiring a payment. Typically used when a borrower cannot pay or as part of a negotiated adjustment. |

| Write Off | Record a permanent loss for all or part of the loan (principal, interest, or fees). - When a write-off is entered, the system stops the amortization schedule. |

| Capitalization | Add unpaid interest or fees to the principal balance. This increases the loan’s principal but avoids requiring immediate payment. It is commonly used when payments are deferred or during loan restructurings. |

| Early Redemption | Record when a borrower fully repays the loan before the scheduled maturity date. - After recording an Early Redemption, the amortization schedule will stop calculating further. - The system will prompt you to close the loan, but you must manually confirm closure. |

For early repayments that do not fully redeem the loan (or if you do not want to stop the amortization schedule), simply use Make Repayment with the desired date.

4. Undoing a Transaction

If a transaction was entered by mistake:

- Go to the loan’s Transactions tab.

- Find the transaction.

- Click Undo to reverse it.

Tip: You can also undo transactions directly from the schedule

5. Editing a Transaction

If a transaction needs to be modified:

- Go to the loan’s Transactions or Schedule tab.

- Find the transaction.

- Right Click Edit to update its details (e.g., date, amount, type).

When you edit a transaction, Hypercore will automatically undo the original transaction and create a new one with your updated details.

Need help with complex adjustments? Contact us support@hypercore.ai