Deposits

Last updated January 5, 2026

What are Deposits?

Deposits are cash amounts retained upfront and actually paid into the loan, designed to pre-fund future repayments. They act as advance payments that Hypercore automatically applies against upcoming or final loan repayments.

Important: Deposits must be paid before they can be applied to repayments.

Typical examples:

- Prepaid interest: Borrower pays 3 months of interest upfront, covering early repayments.

- Retained reserve for maturity: Deposit held to cover the last few payments at loan end.

- Security or reserve fund: Deposit retained by lender as a buffer for servicing costs or potential shortfall.

- Capitalized or structured loans: Deposit used to offset borrower repayment obligations during grace periods or promotional phases.

Creating Deposits

- Upon Loan Creation:

- Navigate to the Deposits tab available during the loan setup process.

- On Existing Loans:

- Access the Deposits tab located near the Fees tab in the loan interface.

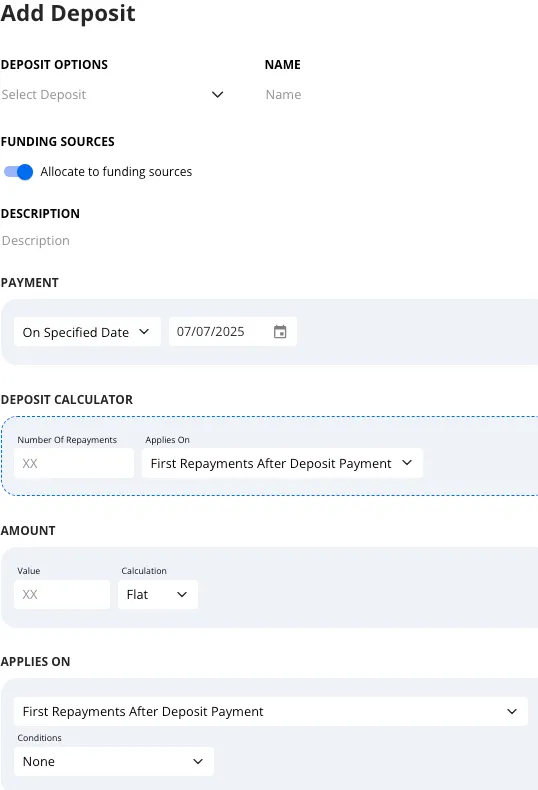

Required Fields When Creating a Deposit

- Deposit Option - This it an optional template to prefill deposit setup *Speak with your Customer Success Manager if you would like to define options

- Deposit Name - A clear name identifying the deposit.

- Payment Timing - Determines when the deposit is paid.

- Options: Specific Date On Loan Start On First Disbursement

- Calculator (optional) - Calculates deposit amount based on repayment schedules. You can set it to cover repayments

- Immediately after the deposit is made

- Final repayments at the end of the loan

- Amount - The deposit amount. Often calculated via the calculator (e.g. total of X repayments) but can be entered manually (flat amount) or use any calculation type available in Hypercore (see In-Depth Fee Guide).

- Applies On - Defines whether the deposit covers the first repayments after the deposit or the last repayments at loan maturity.

- Conditions - Adjust how the deposit is applied.

- Options include: – Excludes Fees: Only pays off principal and interest. – Excludes Fees on Deposit Payment Date: Pays principal, interest, and fees, but excludes fees charged on the deposit payment date (ideal when deposit is paid alongside disbursement fees). – Pays Interest Only: Deposit will only pay off interest repayments (most common use case).

Examples

Example 1: First Repayments Covered

- Setup: Deposit on first disbursement with a calculator for 3 repayments after deposit.

- Scenario: Loan starts on January 1. Monthly interest repayment is $10k. Conditions set to Interest only.

- Result: Deposit calculated at $30k pays:

- $10k on Feb 1

- $10k on Mar 1

- $10k on Apr 1 Borrower will not need to make repayments during these months as they are covered by the deposit.

Example 2: Final Repayments Covered

- Setup: Deposit covers 6 repayments at end of loan.

- Scenario: Loan starts on January 1. Monthly interest repayment is $10k. Conditions set to Interest only.

- Result: From Aug 1 onward, each month’s $10k repayment is paid from the $60k deposit until depleted.

Example 3: Calculated

- Setup: Deposit on first disbursement

- Scenario: Loan starts on January 1. Deposit set to Flat $50,000. Conditions set to none.

- Result: The deposit will pay out the first $50,000 of expected repayments, regardless of component (interest, principal, fees)

- $10k interest on Feb 1

- $10k interest on Mar 1

- $30k on Apr 1 - $10k interest + $20k deferred Title and Broker Fees Borrower will not need to make repayments until the $50k deposit balance is utilized.

How to Pay Deposits

Deposits must be funded before they can apply to repayments. There are two ways deposits can be paid, depending on how they are configured:

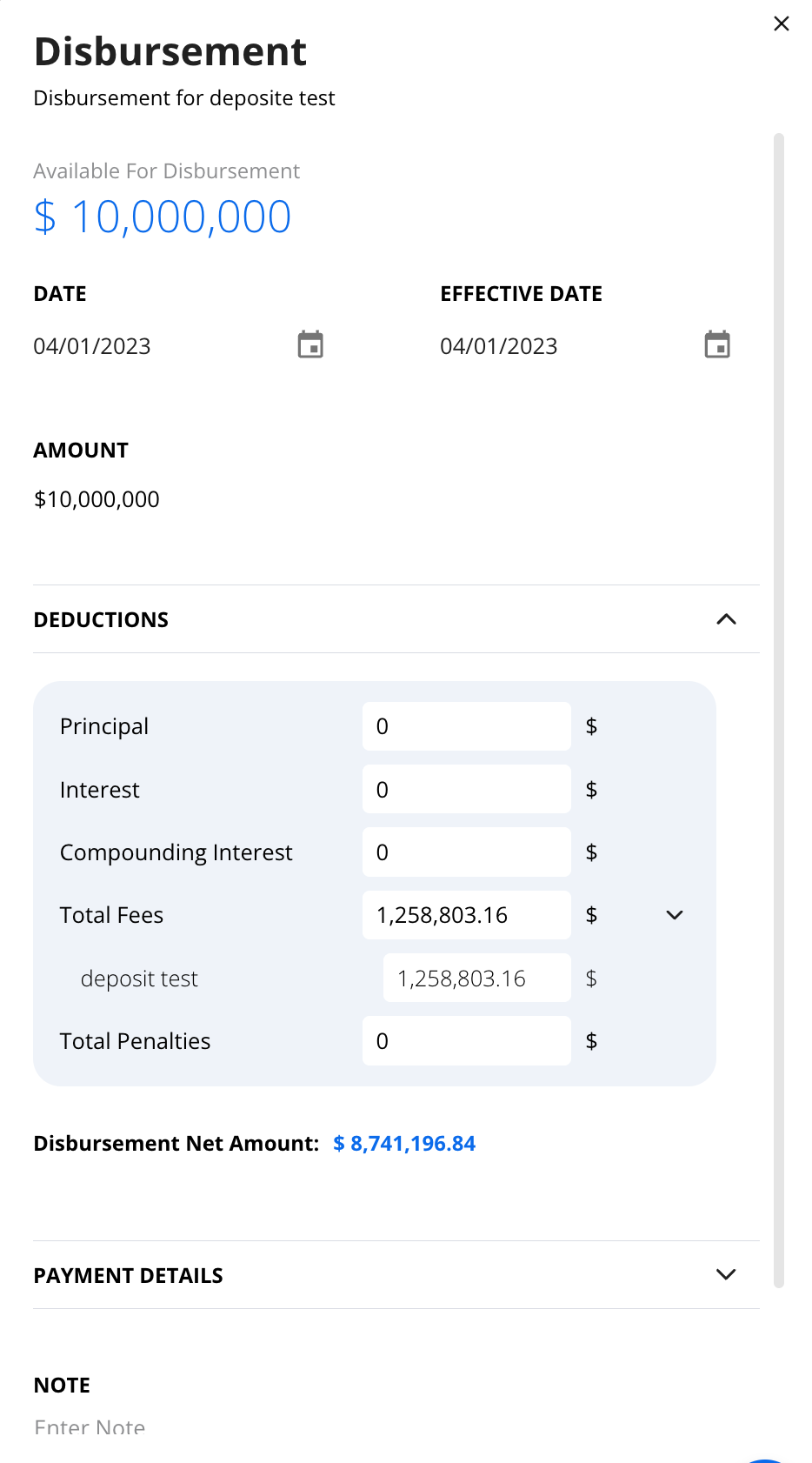

1. Automatic deduction on first disbursement

If the deposit is scheduled for “On First Disbursement” or on "loan start" and the disbursement has not yet been made, Hypercore will:

- Automatically deduct the deposit amount from the first disbursement.

- Records the deposit payment internally - no separate transaction required.

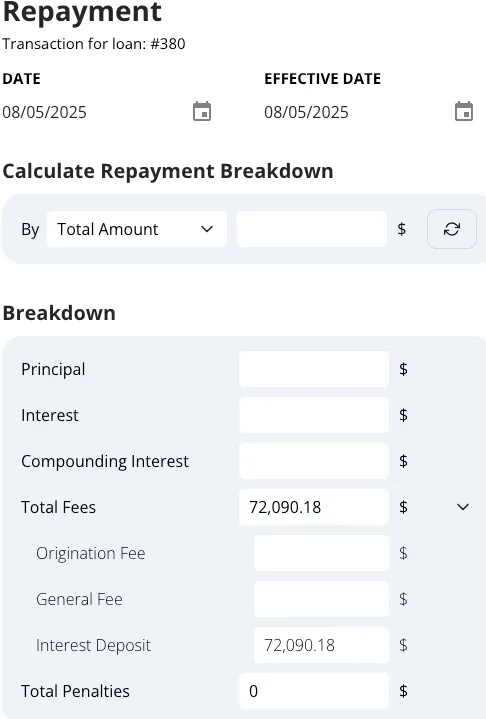

2. Manual repayment transaction

For all other deposit configurations, payment is done via a repayment transaction:

- An expected repayment entry for the deposit will appear on the loan schedule.

- When making the repayment transaction in Hypercore, the deposit amount will be included in the fee breakdown components of the transaction screen.

- This ensures the deposit is paid and recorded against the deposit balance.

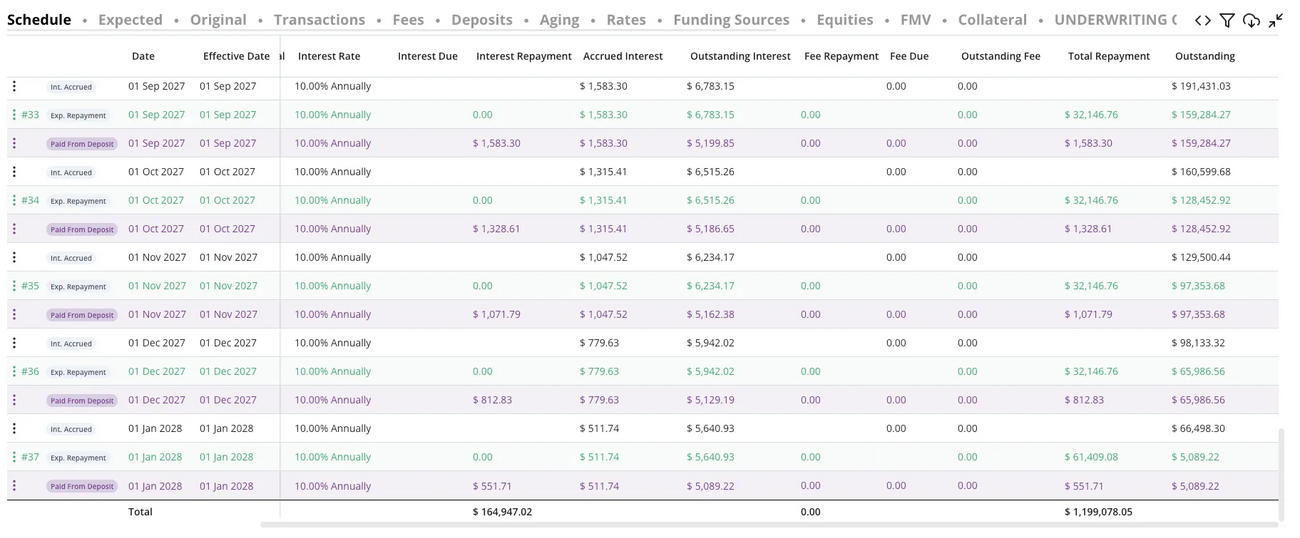

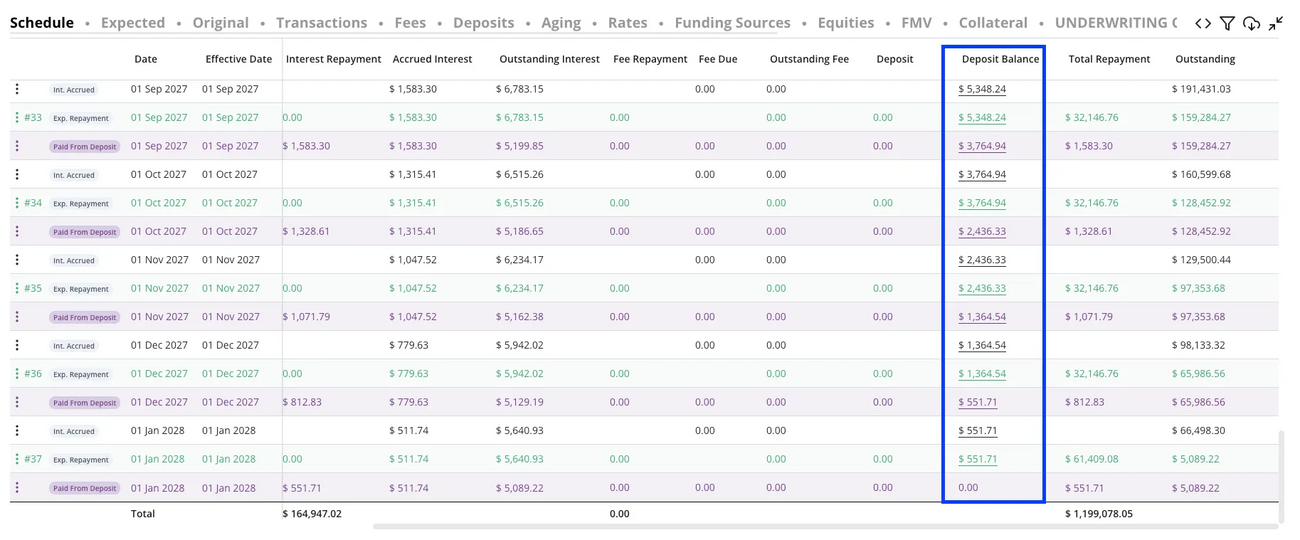

How Deposits Display in the Loan Schedule

“Paid from deposit” rows

Appear in purple on the schedule, showing repayments that were covered by the deposit.

Deposit Balance Column

View the remaining deposit balance by enabling “Show deposit” in schedule filter options

Troubleshooting Deposits

The deposit was repaid and expected to support 3 months of interest repayments. I see that the deposit balance finished after 2 months.

This usually happens when the deposit was paid in advance for a set amount based on the original repayment amounts, but something in the loan changed after setup. For example, an increase in the interest rate or a new disbursement raised the repayment amounts, causing the deposit to run out faster than planned.

My deposit was supposed to only account for interest, however I see it is being used for a fee repayment.

Make sure to set up the deposit conditions as “Pays Interest Only.” Without this condition, the deposit can be used for any repayment, including fees.

I set up a deposit, yet don’t see the repayments being paid by deposit.

Confirm that the deposit was repaid. Deposits must have a funded balance before they can start applying to repayments.

I set up a deposit for 6 months, however the loan was redeemed after 4 months. What will happen?

Hypercore will credit any outstanding deposit balance back to the principal amount and refund the remaining deposit to the borrower upon loan redemption.

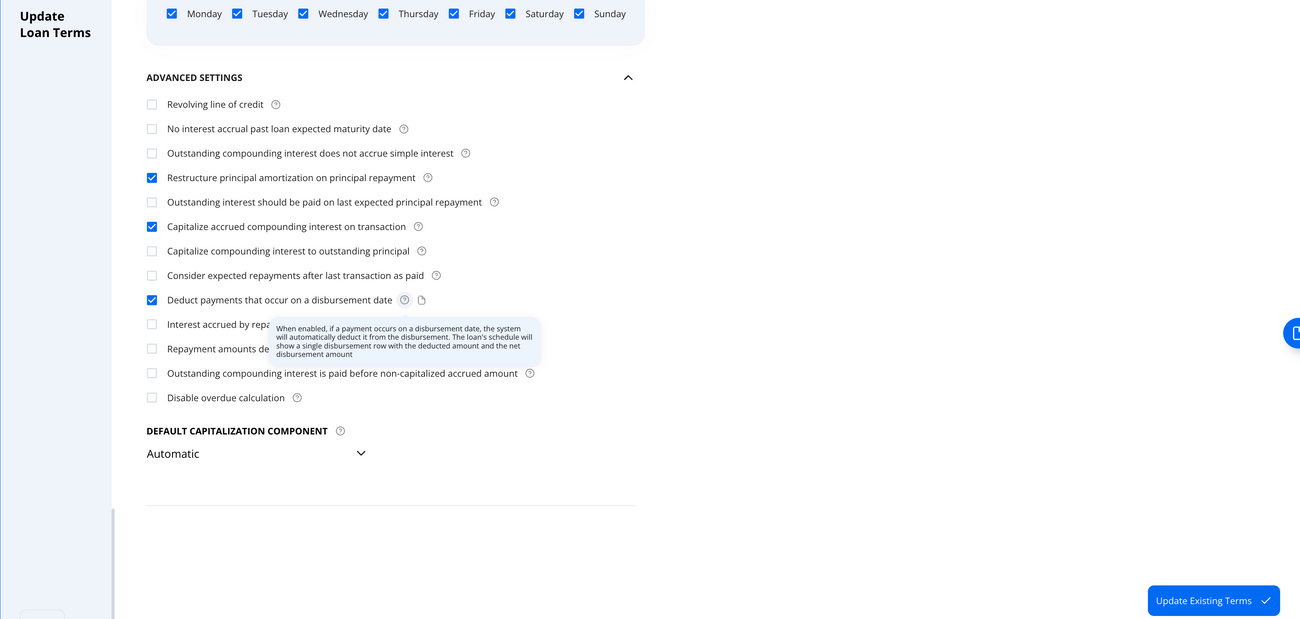

I configured the deposit to be calculated off the disbursement but the deposit is not showing up in the disbursement transaction?

Confirm the 'Deduct payments that occur on a disbursement date' flag is configured.

Need Help?

Contact Hypercore support at support@hypercore.ai