Loan Aging Guide

Last updated July 3, 2025

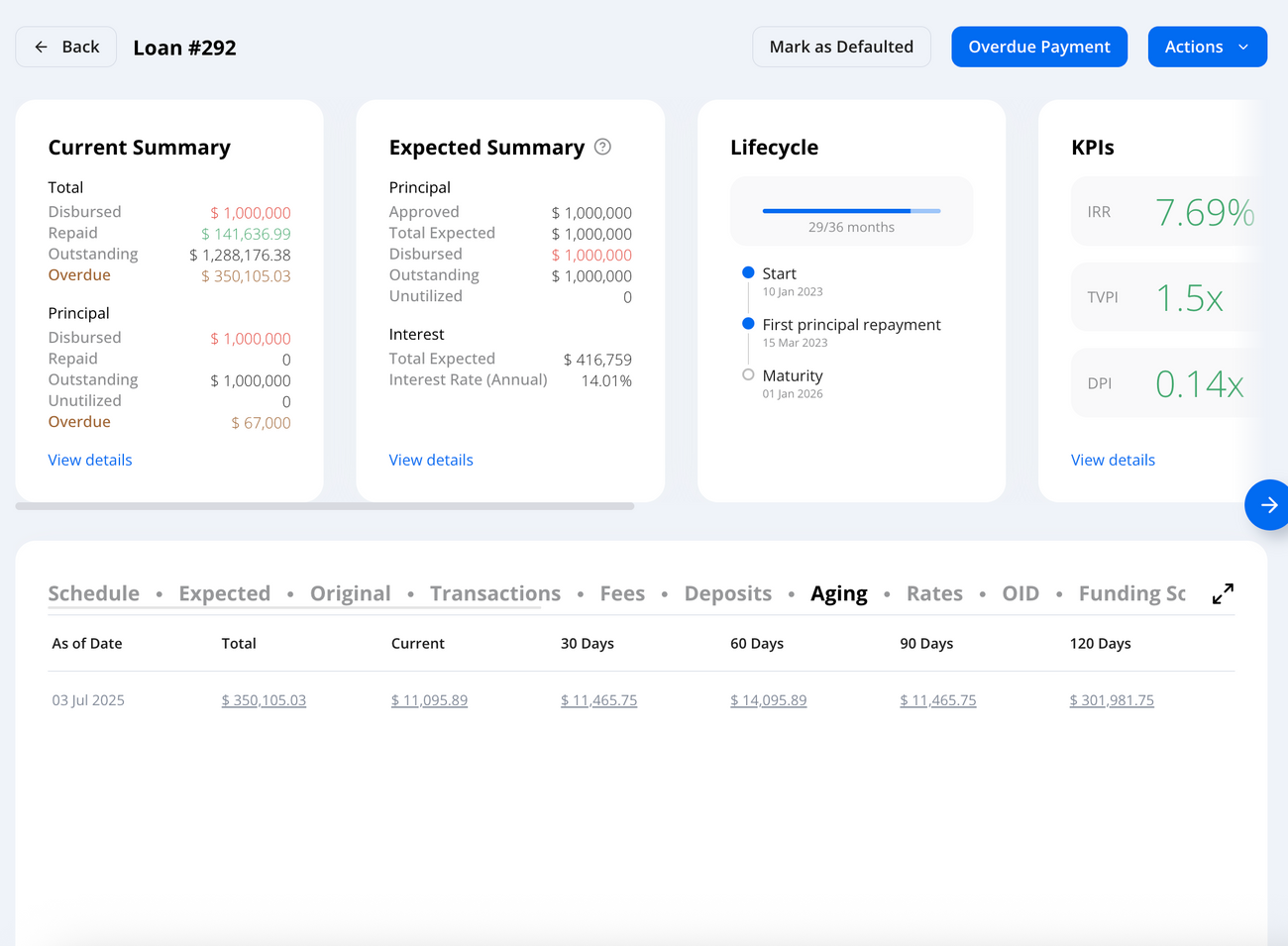

What is Aging?

Aging refers to the process of categorizing overdue loan amounts based on the length of time they have been outstanding. By aging overdue repayments, lenders can monitor borrower performance, assess the associated risk, and prioritize their collection efforts accordingly.

How Aging is Calculated

Hypercore automatically calculates the aging of overdue repayments based on the loan schedule’s expected repayment dates and the actual payment activity. As repayments are missed or delayed, the system categorizes the overdue amounts into different aging buckets.

The aging categories (buckets) are defined as follows:

- 0–30 days past due

- 31–60 days past due

- 61–90 days past due

- 91–120 days past due

- 120+ days past due

Each bucket displays the outstanding principal, interest, and fees that fall into the respective overdue period. This breakdown enables clear tracking of overdue amounts and their respective duration, helping you manage collections effectively.

Example of Aging Calculation:

Expected Repayments:

- Apr 1: $50

- May 1: $100

- Jun 1: $150

- Jul 1: $200

Actual Payments:

- May 5: $50 → late for Apr

- Jun 1: $50 → partial for May

- Jul 1: $200 → on time for JulResulting Aging Buckets (as of July 3, 2025):

| Current | 30 days | 60 Days | 90 Days | 120 days |

| $0 | $150 | $100 | $0 | $50 |

| Amount due in the first 30 days | Amount overdue 31–60 days | Amount overdue 61–90 days | Amount overdue 91–120 days | Amount overdue 120+ days |

| Missed Jun 1 | Partial May 1 | Late Apr 1 |

Where You’ll See Aging

The aging breakdown is accessible via the Aging tab, located next to the loan schedule. You can view the overdue amounts, categorized by the aging buckets.

Configuration Options

Can I customize the aging buckets?

Yes, Hypercore allows for customizable aging buckets. For example, you can define custom aging ranges such as:

- 0–15 days

- 16–60 days

- 60+ days

Can I use monthly buckets instead of daily?

Yes, Hypercore supports monthly aging buckets (e.g., 1M, 2M, 3M+), which can be configured per portfolio to better suit your reporting needs.

Can I choose between FIFO and LIFO?

Yes, the repayment allocation method can be set globally for your portfolio, enabling you to choose either FIFO (First In, First Out) or LIFO (Last In, First Out) to prioritize the reduction of overdue amounts.

Charging Methods: FIFO vs LIFO

There are two main methods for charging overdue repayments when a payment is made: FIFO (First In, First Out) and LIFO (Last In, First Out). These methods define how repayments are allocated to reduce the overdue amounts.

1. FIFO (First In, First Out)

- How it Works: In FIFO, the oldest overdue amounts (those with the longest time outstanding) are cleared first. This means that the system will prioritize paying off the oldest overdue repayment before moving to more recent overdue amounts.

- Example:

- Loan with three overdue periods:

- $100 overdue for 30 days

- $50 overdue for 60 days

- $75 overdue for 120 days

- A repayment of $120 is made.

- FIFO will first reduce the $75 from the 120-day overdue period (because it's the oldest overdue) and then reduce the remaining $45 from the 60-day overdue period.

2. LIFO (Last In, First Out)

- How it Works: In LIFO, the most recent overdue amounts (those with the shortest time outstanding) are cleared first. This means that the system will prioritize paying off the most recent overdue repayment before addressing the older ones.

- Example:

- Loan with three overdue periods:

- $100 overdue for 30 days

- $50 overdue for 60 days

- $75 overdue for 120 days

- A repayment of $120 is made.

- LIFO will first reduce the $100 from the 30-day overdue period (because it's the most recent overdue) and then reduce the remaining $20 from the 60-day overdue period.

Troubleshooting Aging Discrepancies

In the event of discrepancies in aging or the total overdue amount, the following troubleshooting steps can help resolve the issue:

Aging Total Seems Incorrect

- Possible Cause: Payments have not been applied correctly, or the loan status or schedule may be outdated.

- Action: Ensure that all payments are properly applied to the loan, and verify that the loan schedule is up to date.

Buckets Appear Incorrect

- Possible Cause: The FIFO/LIFO setting may not be aligned with the expected behavior for repayment allocation.

- Action: Review the FIFO/LIFO setting in the system to ensure it matches your intended repayment allocation method.

Manual Check in Excel

If discrepancies in aging persist and further investigation is required, you can perform a manual check by following these steps:

- Go to the loan page and export the full repayment schedule.

- Export the transaction history to ensure all relevant payment data is captured.

- In Excel:

- Match due dates and amounts with actual payment dates.

- Calculate the number of days overdue manually.

- Assign amounts to their respective aging buckets based on the overdue days.

- If inconsistencies still remain, contact Hypercore Support for assistance.

Statement Generation for Aging Details

If you would like to generate a statement that includes detailed aging breakdowns of overdue repayments, please reach out to the Customer Support Team at support@hypercore.ai . Our team will assist you in generating the necessary statement that includes aging details for your loan.