Product Updates: Nov 19, 2025

Last updated November 20, 2025

Funding Entity Page Reimagined

The Funding page has been fully redesigned to give you clearer visibility into portfolio performance and capital deployment.

Summary cards

We’ve introduced new Summary Cards on the Funding Source page, giving you immediate visibility into key metrics, including:

- Allocated Loans Overview

- Total Commitment

- Capital Deployed

- Undeployed Capital

- Expected Return to Date

- Expected Return

- KPIs

- Realized and Expected IRR-

- Realized and Expected TVPI

- DPI

- Average Interest Rate

- Utilization Rate

- Actual Cashflow Metrics

- Total Contributed

- Total Dsitributed

This redesign makes it easier to track performance, understand where capital is allocated, and evaluate fund-level returns- all from a single view.

Hover to see tooltips for broader explanation on each metric

Loans Tab

The redesigned Loans section gives you a clearer, faster way to review all allocated loans tied to the funding source. Key improvements include:

- Search by Loan Name or Loan ID

- Filter by loan status for quicker segmentation

- More informative columns - including Committed, Outstanding, Expected Return and IRR figures

- Column breakdowns on hover - hover over fields like Outstanding to see a detailed breakdown

This update makes it easier to navigate large portfolios and access the information you need with fewer clicks.

Loans reflect only this funding source’s share of the loan.

Funding Sources Templates

Funding source setup is now faster, more consistent, and less error-prone.

With Funding Source Templates, you can predefine standard configurations for your funding sources - so every time a funding entity is added to a loan, the system automatically applies the correct rules, flags, and settings.

Why it matters:

- Ensures consistency across all loans

- Reduces manual setup errors

- Saves time for both onboarding and ongoing operations

- Makes scaling to multiple entities easier and more controlled

New Schedule Columns:

Capitalized Balance

A new optional schedule column is now available: Capitalized Balance. Once enabled (via the filter icon in the schedule), it will appear by default on all loan schedules moving forward.

What it shows: The balance on which interest is currently accruing, including:

- Outstanding principal

- Capitalized fees

- Outstanding compounding (capitalized)

- Any other capitalized components

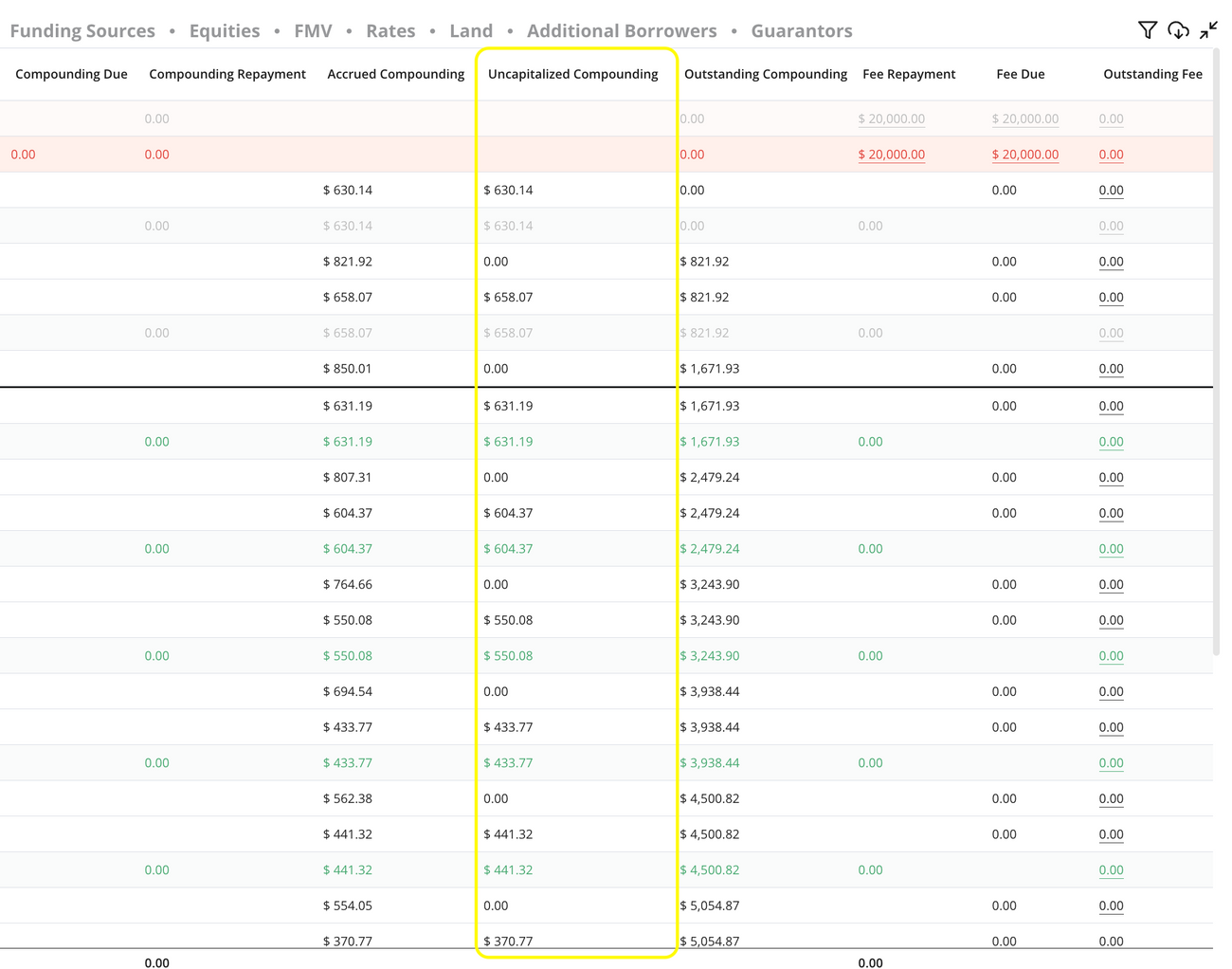

Uncapitalized Compounding

For loans with compounding interest, we’ve added another column: Uncapitalized Compounding.

What it shows: All compounding interest that has accrued but has not yet been capitalized into the balance.

This helps distinguish between:

- Capitalized amounts (the "Outstanding Compounding" column), and

- Accrued-but-not-capitalized interest

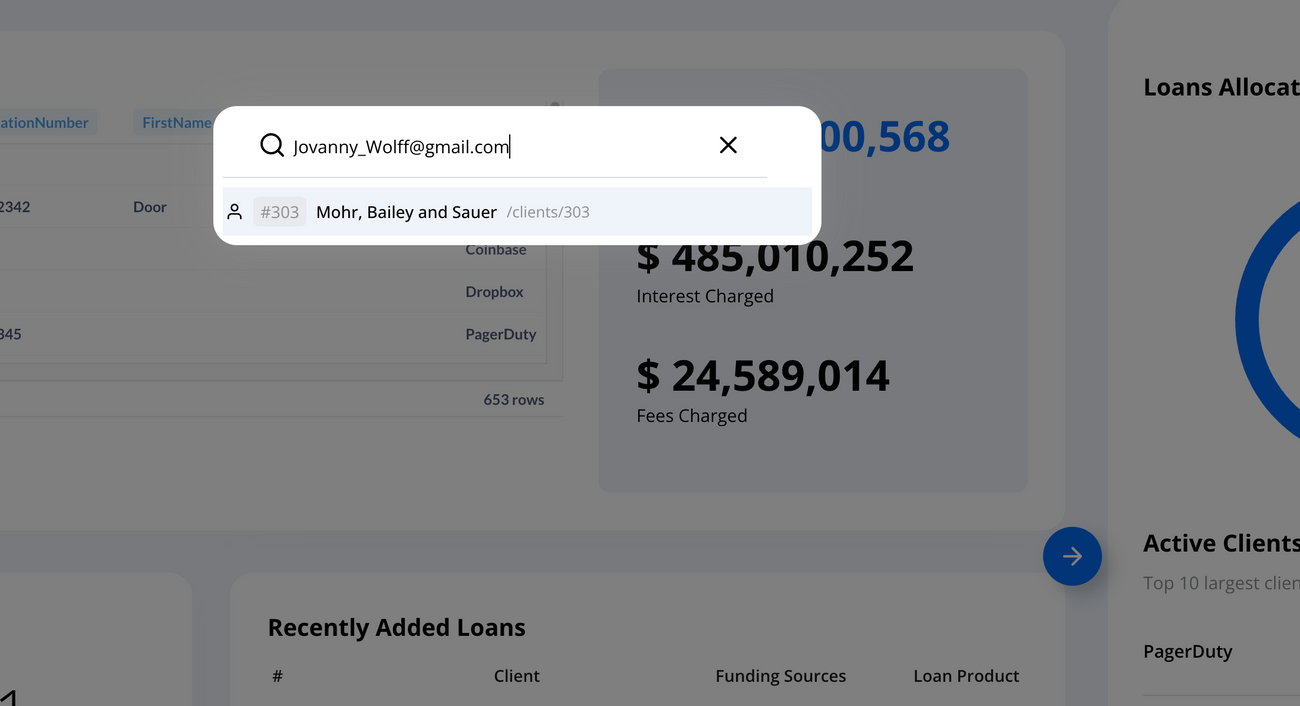

Search functionality

We’ve expanded search optionality to include emails

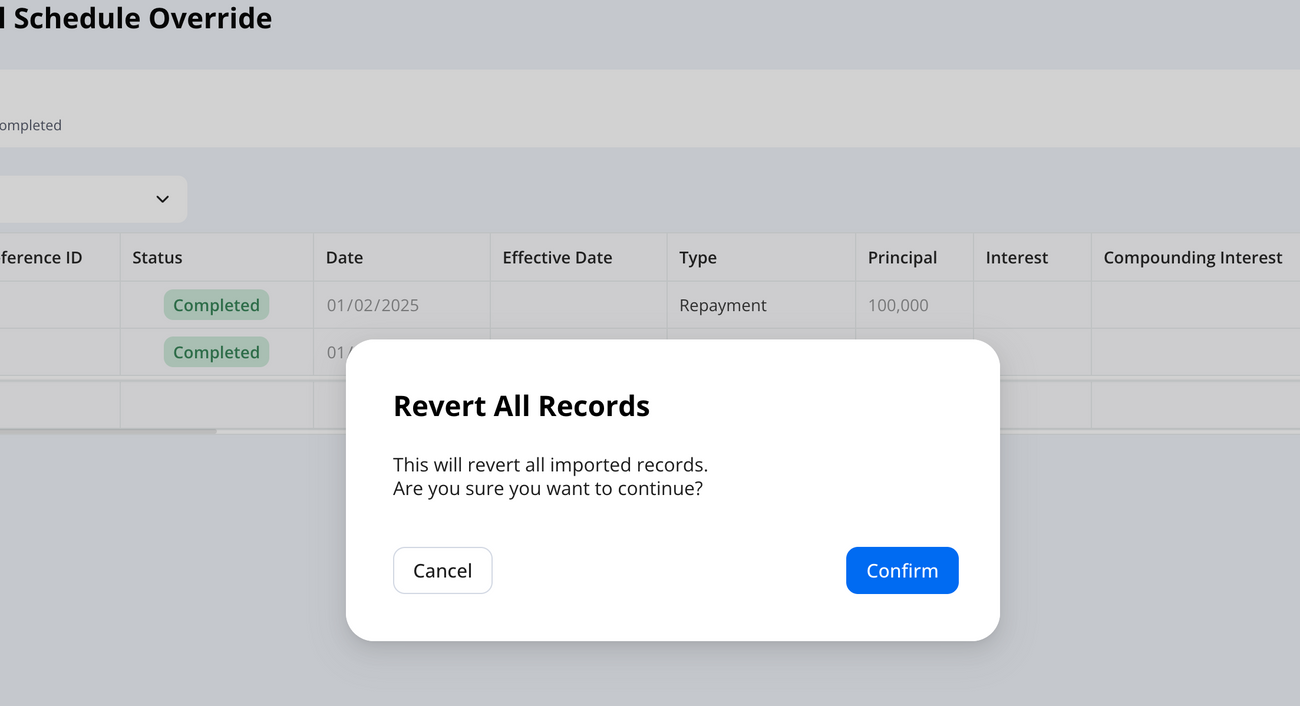

Bulk Actions

When reverting records the system will prompt you to confirm this action to ensure optimal compliance and record keeping

Questions or thoughts? Let us know.