Creating a Loan

Last updated April 17, 2025

This guide will walk you through the high-level steps of creating a loan in Hypercore. For more in-depth knowledge, refer to our other guides.

Step 1: Accessing the Loan Creation Page

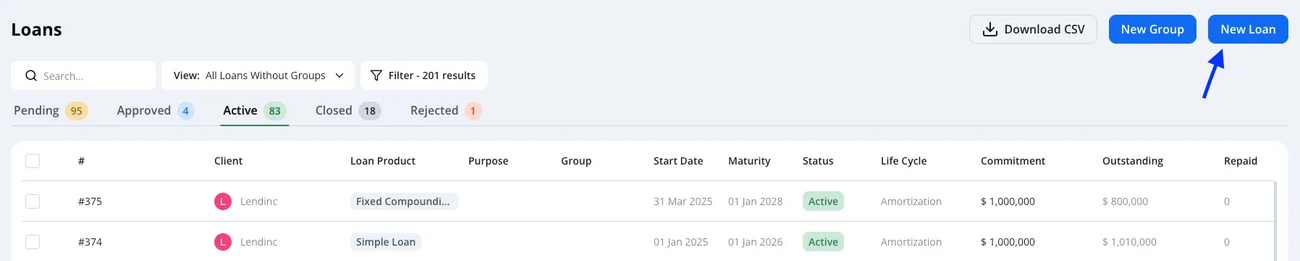

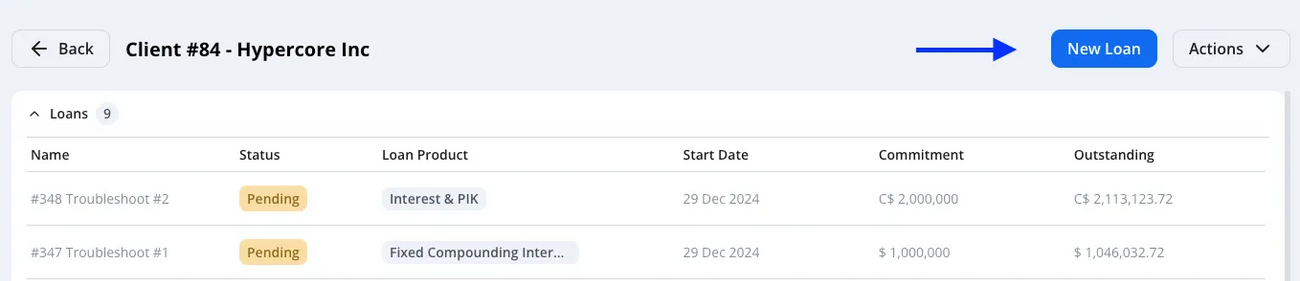

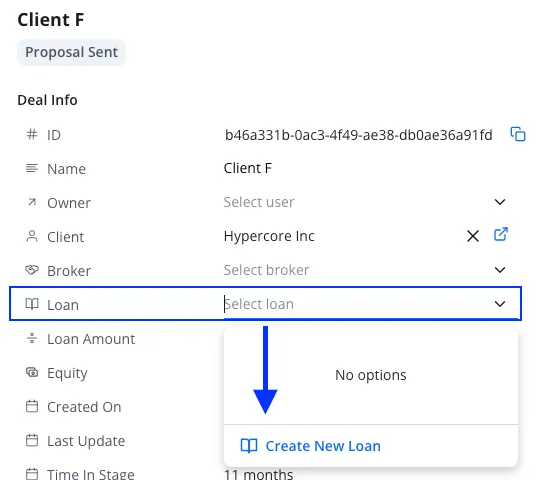

You can create a new loan from various locations within Hypercore:

Loan Portfolio Page: The most common way to create a new loan.

Client Page: Add a loan directly to a specific client.

Workflows: Create loans as part of a workflow - already connected to a specific client.

Imports: A different process entirely. For more details, contact your Customer Success Manager. A future guide on this process will be added later.

Step 2: Inputting Basic Loan Details

- Choose the Loan Type from the available options

- Loan Types are templates pre-configured to match the needed fields to your various loan products.

- For any changes or additions to the loan types, feel free to reach out to your Customer Success Manager.

- Fill out the Loan Name and Submission Date

- The submission date will automatically be used as the first disbursement date unless changed manually (see utilization assumptions below)

- Other optional fields:

- Purpose - This field is used for segmenting your loans (whether from the portfolio, reports, statements), however does not affect the loan in any way

- Maturity Date - The end date as specified in the legal agreement. Used as validation on certain triggering events, however does not affect the loan schedule directly.

- Contract Closing Date - The date in which the legal agreement was signed. Does not affect the loan schedule.

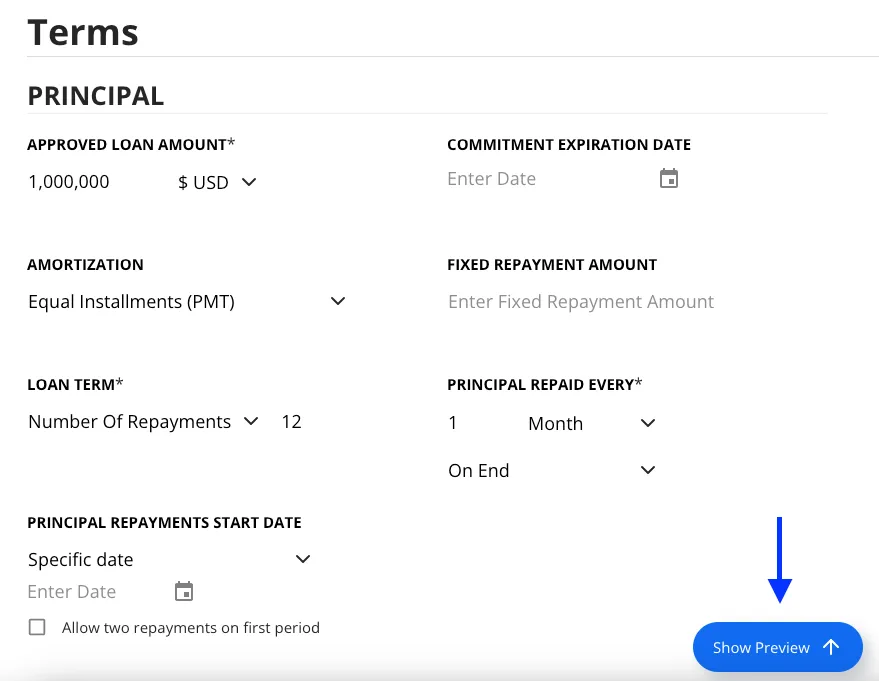

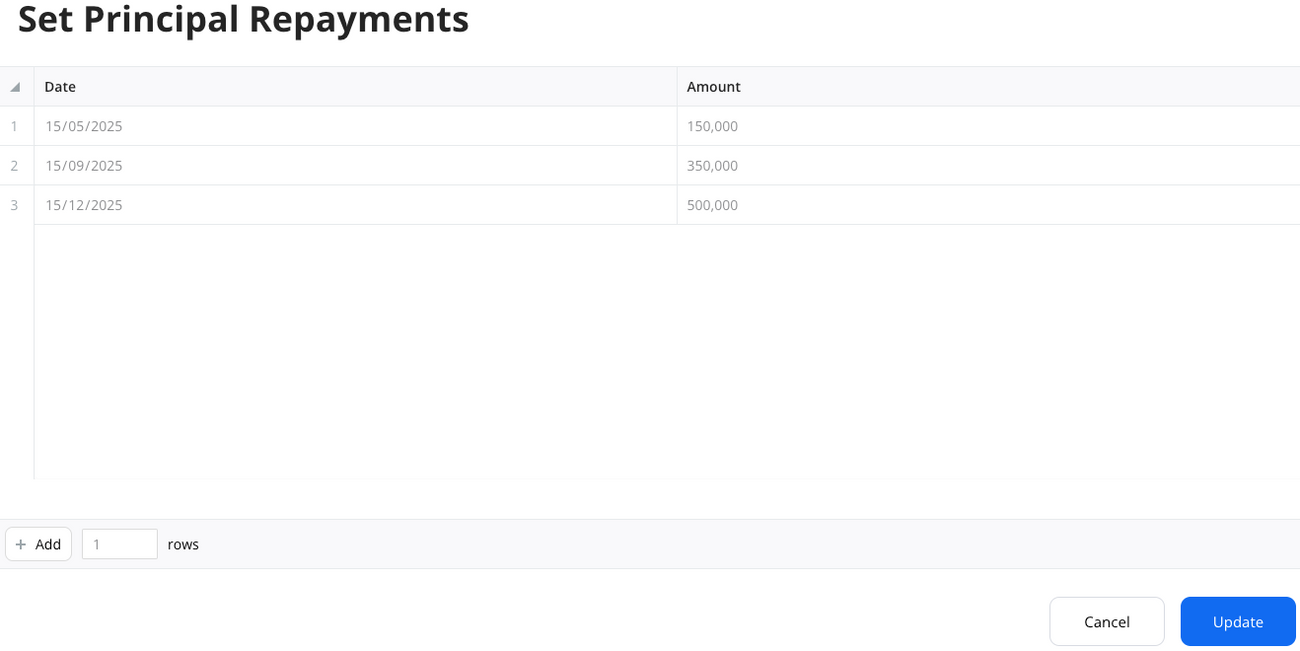

Step 3: Configuring Principal Terms

- Choose the Approved Loan Amount (Commitment)

- Select the Amortization Method (Equal Installments, Equal Principal, Custom). *See below for a quick guide on Custom amortization.

- Set the Loan Term by either # of repayments or End Date

- Set up the Principal Repayment Frequency

- If the first repayment is not in-line with the frequency, you can manually set via the Principal Repayments Start Date

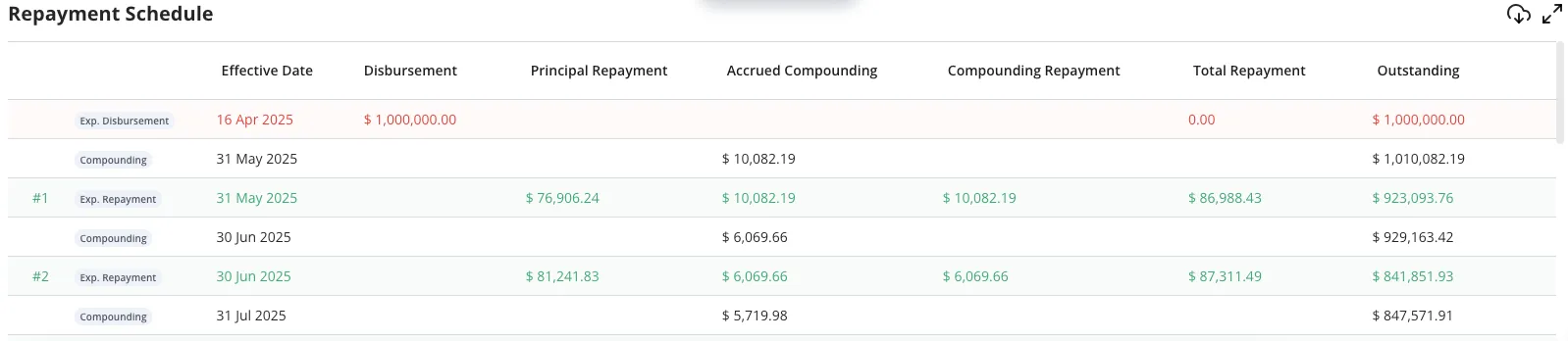

- Review the Repayment Schedule Preview to ensure accuracy.

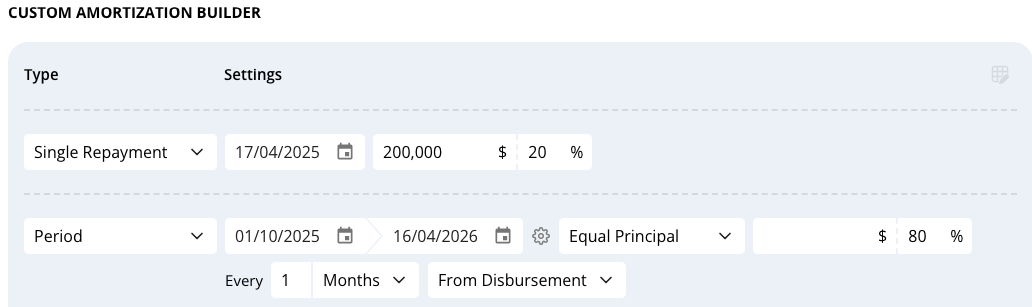

Custom Amortization

Custom amortization allows you to enter the principal repayments in a variety of methods:

- By single repayment: date + amount

- Periodic repayment: frequency + amount

- By set repayments: date + amount

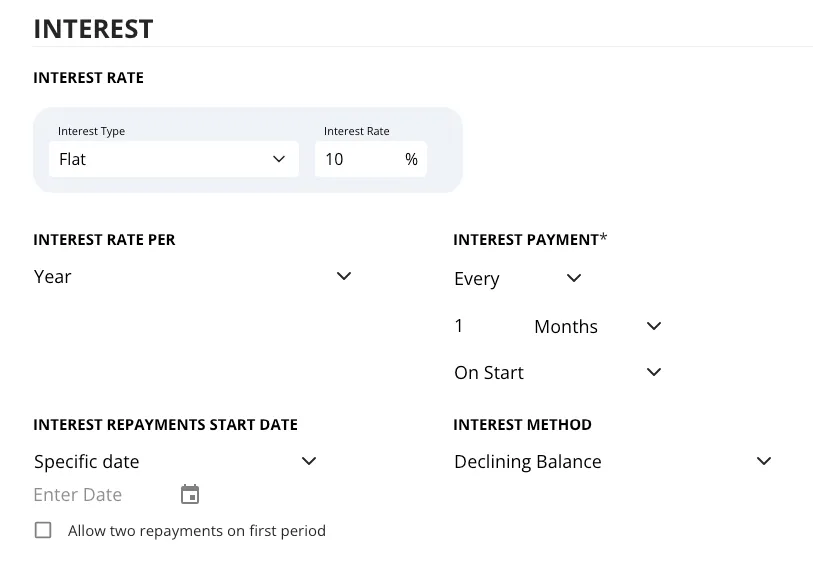

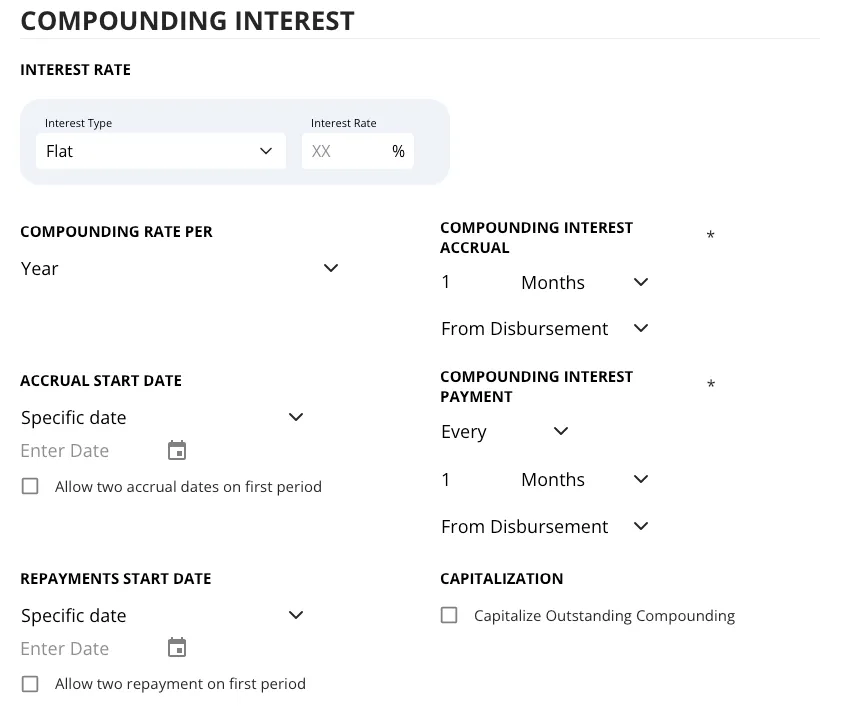

Step 4: Configuring Interest and Compounding Terms

When configuring interest in Hypercore, you’ll define how interest accrues, the repayment frequency, and whether it compounds over time.

- Interest Type: Simple vs Compounding (PIK)

- In Hypercore simple interest (cash interest) and compounding interest (PIK/capitalized) are separate components both on the loan terms creation and on the loan schedule.

- Compound interest accrues on itself after every accrual period and is capitalized into the outstanding balance.

- If you have a loan with both compounding and simple interest, you can decide if the simple interest should be calculated based on the principal or principal+accrued compounding.

- Interest Rate: Fixed vs Floating

- Fixed Interest: A static rate

- Floating Interest: Consists of a base reference rate (like SOFR) plus a margin. You can also configure:

- A Minimum and Maximum cap on the total interest rate

- A Rate Determination Frequency that defines how often the floating rate updates (e.g., monthly, quarterly)

- Interest Accrual Frequency

- This determines how often interest is accrued (e.g., Monthly, Quarterly). It defines the cadence of interest buildup.

- Interest Repayment Frequency

- Determines the frequency of interest repayment

- Each expected repayment will include the accrued interest on the respective period

- Any unpaid compounding interest will accrue on itself

Here are the differences between Simple and Compounding Interest accrual/repayment frequencies

- Cash Interest -Repayment Frequency only -This defines how often interest is paid by the borrower (e.g., monthly, quarterly). -Interest does not accrue to the loan balance—it’s simply paid on a schedule.

- Compounding Interest -Has both an Accrual Frequency and a Repayment Frequency -Accrual Frequency determines how often unpaid interest is added to the loan balance (i.e. compounded). - Repayment Frequency defines how often payments are expected. -If no payments are made, interest continues to accrue and compound based on the set accrual schedule.

Step 5: Utilization Assumptions

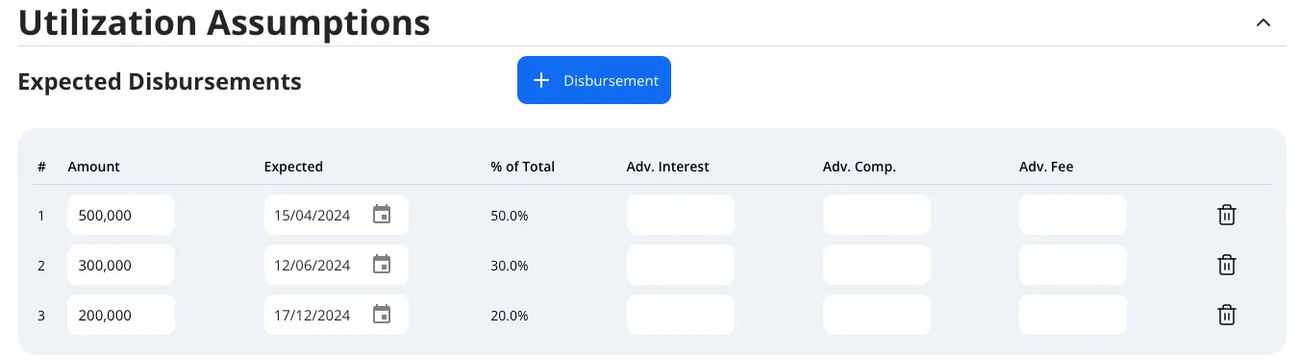

Utilization Assumptions is Hypercore's way of setting up your Expected Disbursements.

To set up expected disbursements you will need to provide an amount and date.

- When adding expected disbursements, the % of approved amount will automatically be calculated.

Step 6: Adding Fees

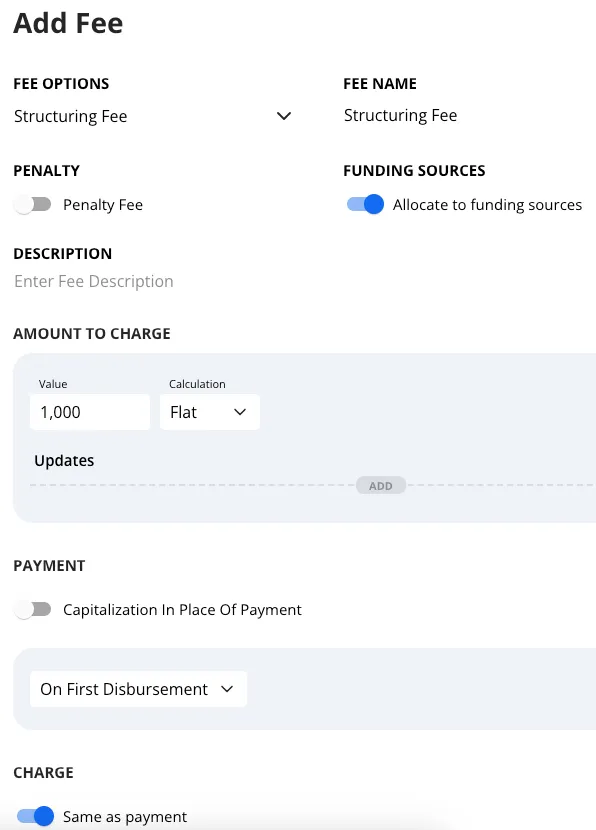

- Select a Fee Option

- Fee options are pre-defined templates that auto-fill all relevant settings for a fee. You can contact your Hypercore Customer Success Manager to configure these.

- After selecting an option, you can freely edit any detail, or choose not to use a template and build the fee from scratch.

- Fee Name

- Auto-filled when using a Fee Option, but you can edit it at any time.

- Penalty Fee Toggle

- Enabling this classifies the fee as a penalty. This does not affect its calculation but will change how it's displayed (e.g., separate columns on the schedule and summary) and its priority in adhoc repayments based on your configured repayment strategy.

- Define Amount to Charge

- Payment Settings

- Capitalization In Place of Payment: When enabled, the fee will be added to the loan’s balance rather than paid immediately. This amount will accrue interest like any other part of the balance.

- Payment Timing: Select when the fee should be paid. Options include:

- On a specified date/s

- On a frequency (e.g., monthly, quarterly)

- On a triggering event (e.g., disbursement, repayment, early redemption)

- Charge Timing

- Same as Payment Toggle: Fees will be paid when they are charged (added to the schedule). Disabling this allows you to select the charge timing of the fee to be different than that of the repayment.

- Example: A fee may be charged at default but paid only upon loan resolution.

Note: Fees can also be compounded using a dedicated toggle that opens additional settings like accrual frequency.

Step 7: Adding Deposits

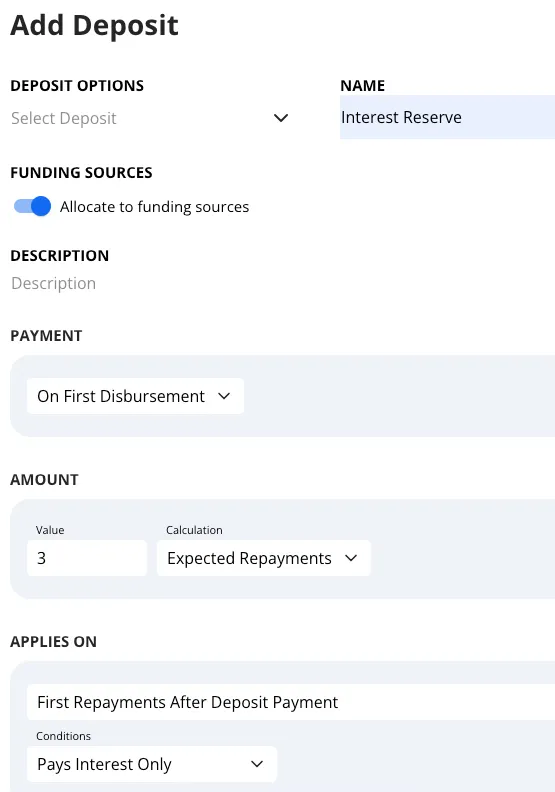

Deposits in Hypercore are a form of reserve within the loan. The borrower pays a predefined amount upfront, which is later used to cover future repayments. Here's how to configure a deposit:

- Select a Deposit Option (Optional)

- Deposit options are pre-set templates that auto-fill common settings. Contact your Hypercore Customer Success Manager to configure these for your loan types.

- You can select an option to pre-fill values or create the deposit manually from scratch.

- Set the Payment Timing

- Choose when the deposit should be paid. Common options include:

- On a Specified Date

- On Loan Start

- On First Disbursement

- Define the Deposit Amount

- You can define the amount as:

- A Flat Amount

- A Percentage such as Commitment, Outstanding, Disbursement, etc.

- X Number of Expected Repayments – one of the most common configurations. Hypercore will calculate the repayment amount (e.g., interest only) at the time of disbursement and multiply it accordingly. For example, 3 expected repayments of $10k in monthly interest = a $30k deposit.

- Set the Application Timing

- Determine when the deposit will be used to repay the loan. Options include:

- First Repayments After Deposit Payment – repays the first installments immediately following the deposit

- Last Repayments – the deposit is held and used at the end of the schedule

- Apply Conditions (Optional)

- Define how the deposit will be applied by setting repayment conditions:

- None – applied across all repayment components

- Exclude Fees – deposit will not cover fee amounts

- Interest Only – deposit will be applied only to interest components

Example: A deposit is set to be paid on the first disbursement and is equal to 3 expected repayments. If the interest accrued is $10k/month and the condition is 'interest only', the borrower will pay $30k up front. Hypercore will then automatically use this to repay the first three monthly interest payments.

- Click Add Deposit to apply the configuration.

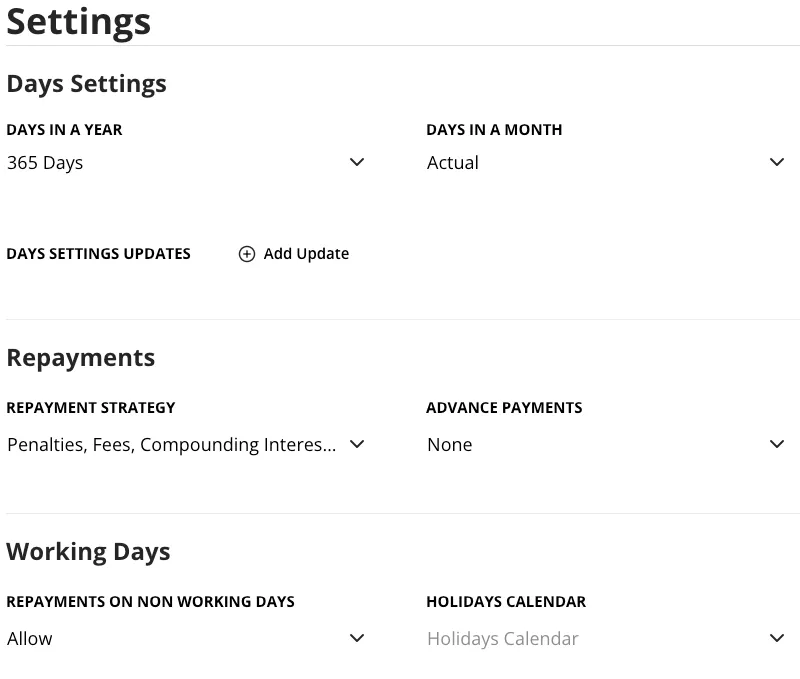

Step 8: General Settings

The General Settings section defines core assumptions used throughout the loan, including day count conventions, repayment rules, and working day logic.

Days Settings

- Days in a Year / Days in a Month

- These control how daily interest and other charges such as fees/penalties are calculated.

- You can configure them independently, allowing for combinations like 360/30, 365/Actual, etc., depending on your loan agreement.

- Days Settings Updates

- Use the Add Update button to change the day count settings mid-loan.

- This is useful for amendments or contract changes. Updates will recalculate future interest based on the new settings.

Repayments

- Repayment Strategy

- This defines how incoming repayments are allocated when no detailed breakdown is provided.

- For example, if a borrower pays $100k without specifying whether it's for interest or fees, Hypercore will apply the repayment based on your strategy’s priority (e.g., penalties > fees > interest > principal).

- This is especially useful for ad hoc or partial repayments.

- Advance Payments

- This setting controls whether repayments (especially interest) are made in advance rather than in arrears.

- Each repayment will include two dates:

- Date: When the payment is made

- Effective Date: When it impacts the loan schedule

For example if a loan pays interest in advance every month you can have a repayment on April 1 that is effective for May 1 (i.e. on April 1 the borrower will repay interest that is accrued between April 1 and May 1).

- Available options:

- None – All repayments are in arrears

- Cash and Compounding Interest – All interest is paid in advance

- Cash Interest Only – Only simple interest is paid in advance

- Interest and Principal – Full scheduled amounts are paid in advance (excluding fees/penalties)

Working Days

- Repayments on Non-Working Days

- Determines how Hypercore handles repayments scheduled for non-working days:

- Allow – The repayment can fall on a non-working day

- Move to Previous Working Day

- Move to Next Working Day

- Holidays Calendar

- If configured, this defines specific dates considered as non-working (e.g., national holidays).

- These dates will be factored into repayment scheduling alongside the working day settings.

- Working Days

- You can customize which days of the week are considered working days.

- Any unchecked day (e.g., Sunday or Friday) will be skipped when generating repayment schedules, unless "Allow on non-working days" is selected.

Step 9: Finalizing the Loan Setup

- It is highly recommended to preview the loan schedule

- Make any necessary adjustments to the loan details if needed.

- Click Submit and Continue to finalize the loan creation.

- Once submitted the loan will be created and in the Pending status

Important: A loan is only created once the application is submitted. If the page is exited before submission - whether by clicking outside the application, closing the tab, or due to server/internet issues - all progress will be lost.

Tip: To avoid losing work, consider quickly outlining the key fields and submitting the loan. You can always return later to edit and complete the details.

Troubleshooting Tips

- If you encounter errors when saving, check that all required fields are filled out and formatted correctly.

- For support, contact Hypercore Support through the Help Center or via email.

- link to our Loan Troubleshooting Guide