Loan Troubleshooting Guide

Last updated June 23, 2025

1. Introduction

Welcome to the Hypercore Loan Troubleshooting Guide. This comprehensive resource is designed to help lenders identify, diagnose, and resolve common issues that may arise when using the Hypercore platform for loan management.

Common Troubleshooting Approach

For most Hypercore issues, follow these steps:

- Identify the specific error or unexpected behavior.

- Check the relevant section in this guide.

- Verify your loan settings and data inputs.

- Apply the recommended solution.

- Test to ensure the issue is resolved.

2. Creating Loans - Common Issues

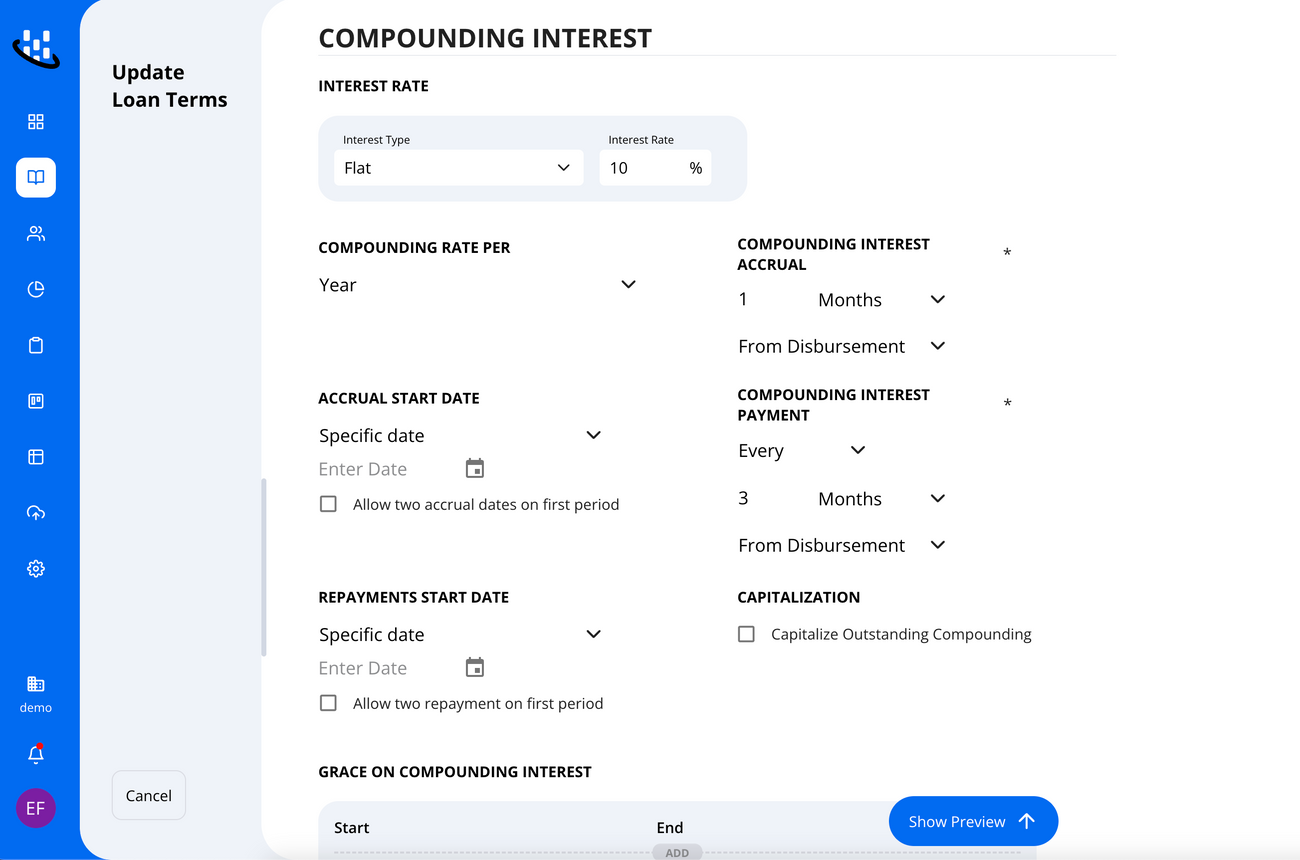

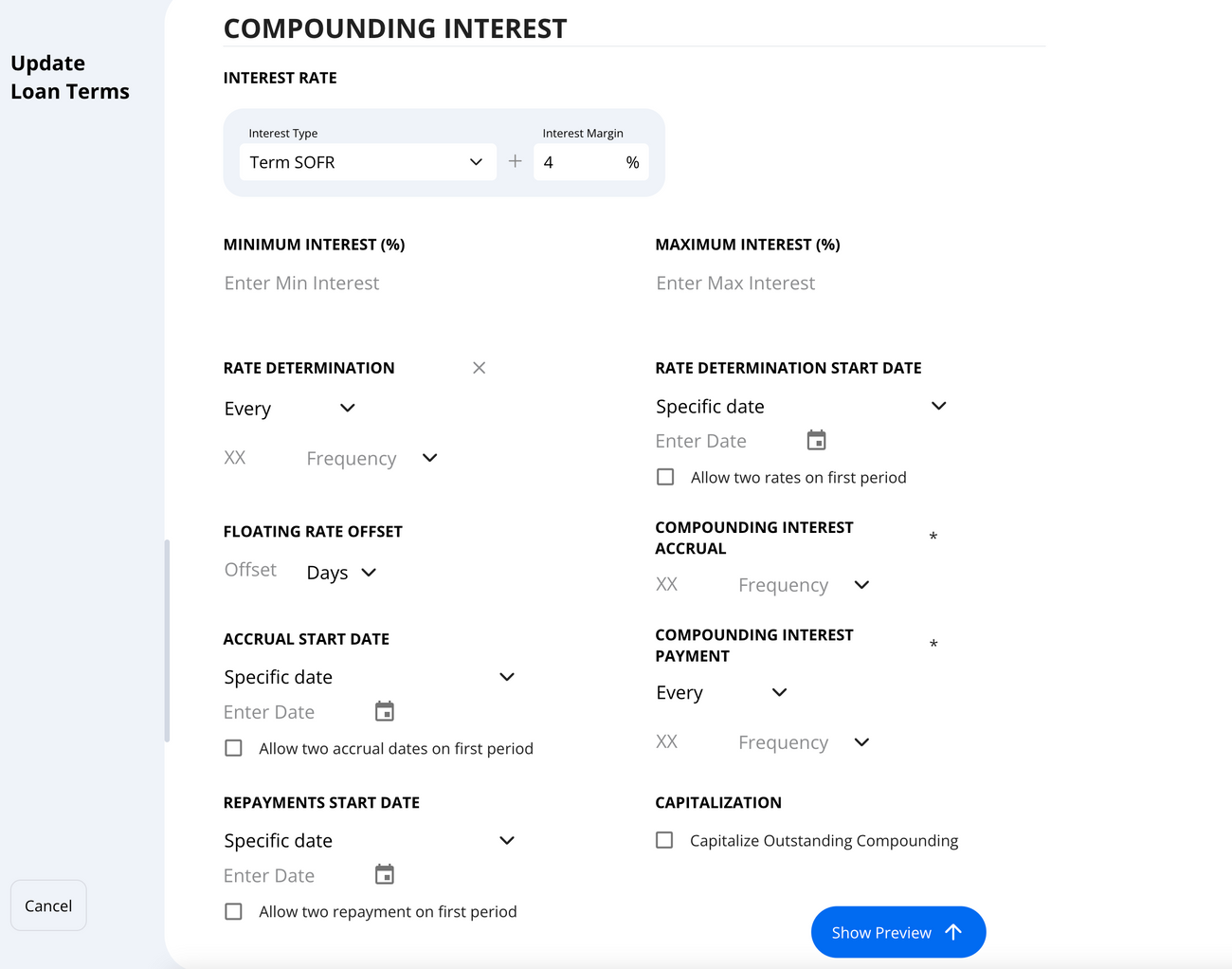

Interest Frequency Issues

Problem: Interest calculations differ from expected amounts.

Possible Causes:

- Incorrect compounding frequency setting (daily, monthly, quarterly).

- A mismatch between interest frequency and payment frequency.

Resolution:

- Navigate to the Loan Terms page.

- Verify the compounding frequency matches your loan agreement.

- Check that payment frequency aligns with compounding expectations.

- Save changes and review the recalculated schedule.

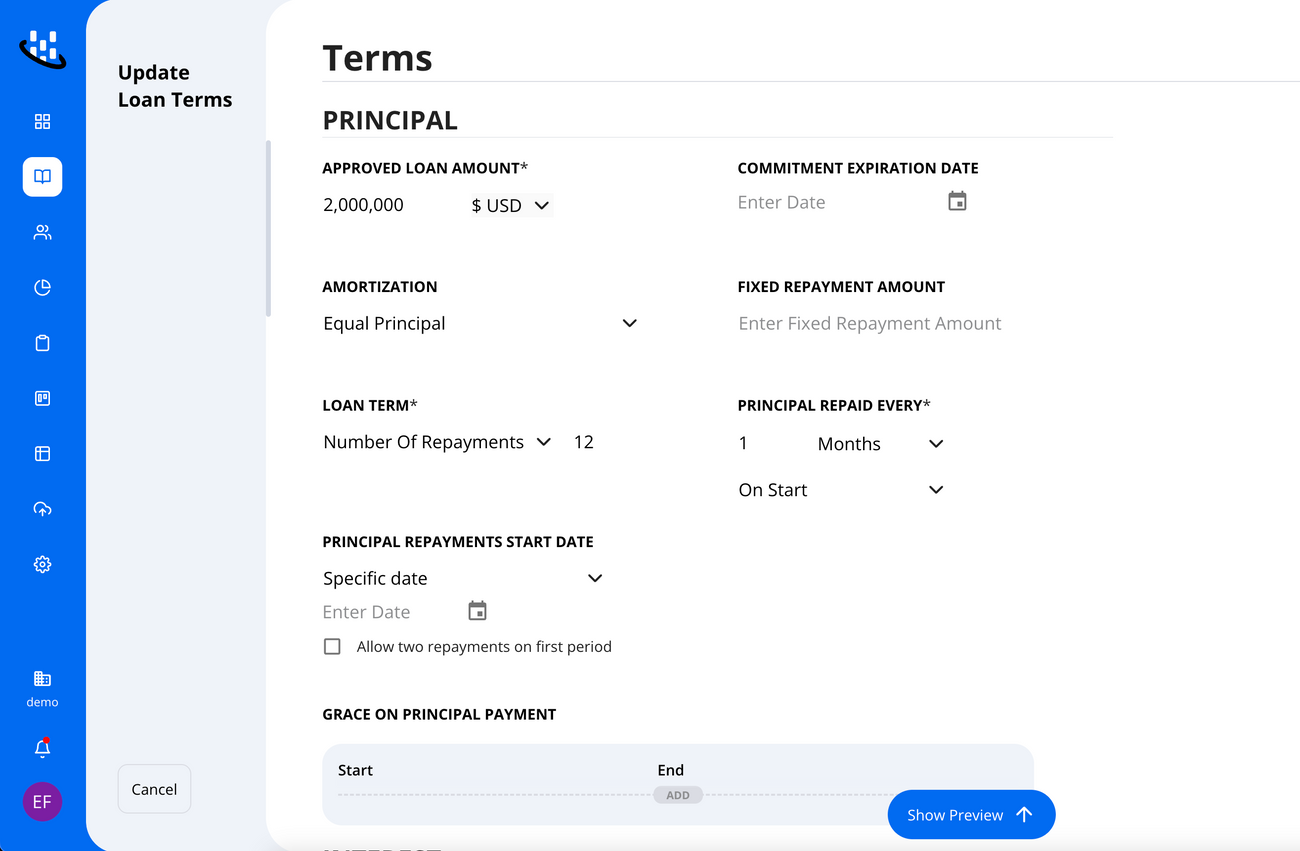

Principal Repayment Issues

Problem: The principal is not fully repaid in the schedule or repayment allocations are incorrect.

Possible Causes:

- Incorrect amortization method (equal installments vs. equal principal).

- Rounding issues affecting long-term calculations.

- Final balloon repayment is not configured correctly.

Resolution:

- Review the Principal Settings tab.

- Confirm the amortization method matches your loan agreement.

- Verify balloon payment settings if applicable.

- Check for any rounding discrepancies in your spreadsheet.

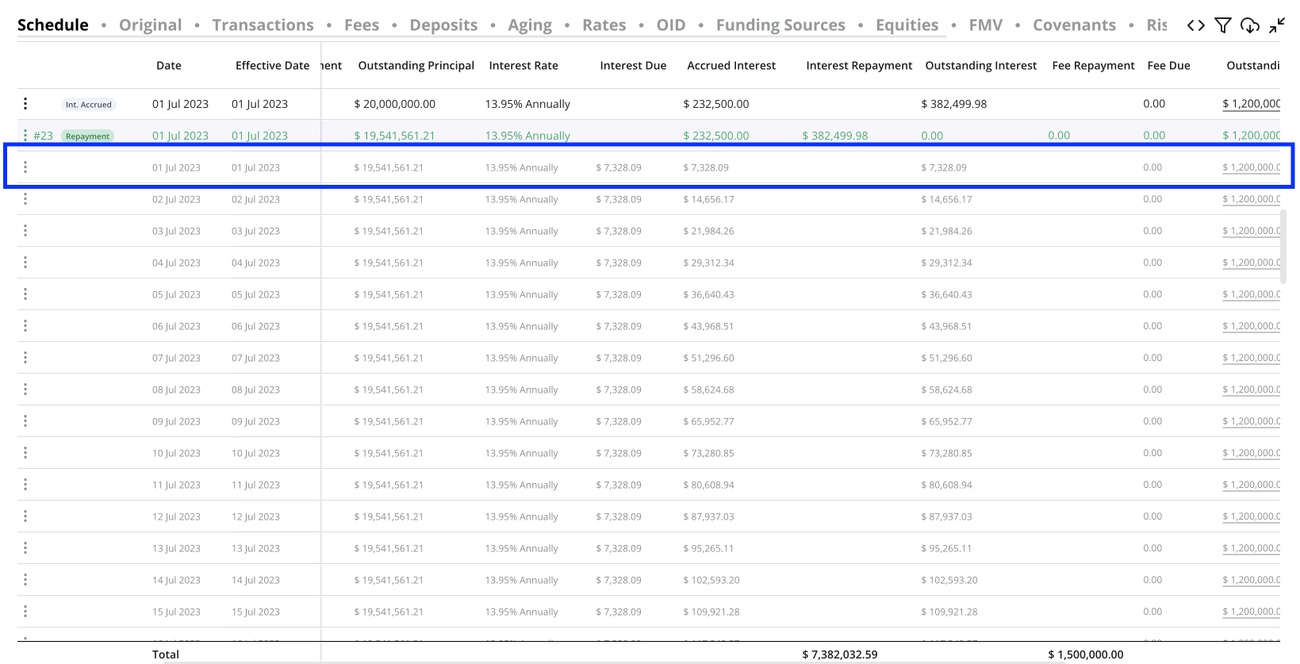

3. Loan Schedule Troubleshooting

Understanding the Loan Schedule

Understanding how to read and interpret the Hypercore loan schedule is crucial for effective troubleshooting - Schedule Guide

Common Schedule Reading Issues:

- Identifying the correct schedule type (actual vs. expected).

- Understanding accrued vs. outstanding compounding interest.

- Interpreting multiple fee types in the schedule.

Customizing Schedule View - helpful when troubleshooting

- Click on the "Expand" icon at the top of the schedule.

- Click on the "Filter" icon and select relevant columns.

- Focus on specific date ranges or transaction types.

- If needed Export the schedule to CSV if needed.

Daily Interest Calculation Understanding

Hypercore calculates interest on a daily basis, which can sometimes lead to unexpected results if not properly understood:

Daily Interest = (Outstanding Principal * Annual Interest Rate) / 365 or 360 (depending on day count setting)Common issues with daily interest calculations:

- Incorrect day count convention (Actual vs. manual 365/360 days) causing small discrepancies

- Leap year calculations affecting long-term loans

- Compounding (Accrual) start and end dates do not align with expectations

Resolution:

- Verify the day setting in the loan terms and ensure it matches your loan agreement.

- Click on a schedule row to expand it and view the daily charge row calculations in expanded schedule mode.

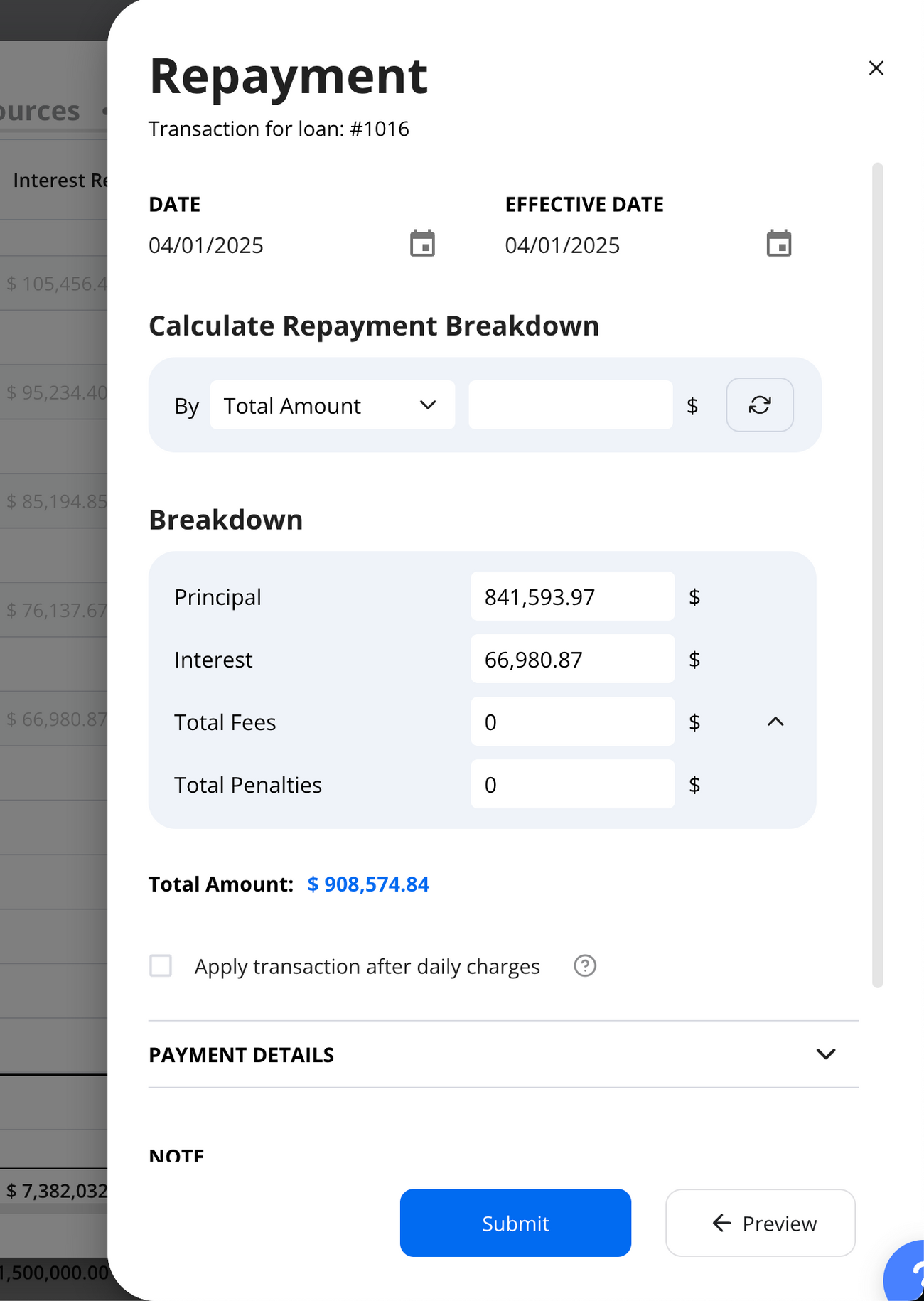

4. Transaction Troubleshooting

Repayment Issues

Problem: Repayment is incorrectly distributed across principal, interest, and fees.

Possible Causes:

- Incorrect repayment strategy configured in loan settings.

- Manual components allocations overriding default behavior.

- Incorrect effective date for repayment.

Resolution:

- Check the Repayment Strategy settings.

- Verify the repayment date and effective date.

- Adjust manual component allocation amounts if necessary.

- If needed, undo the transaction and re-enter it correctly.

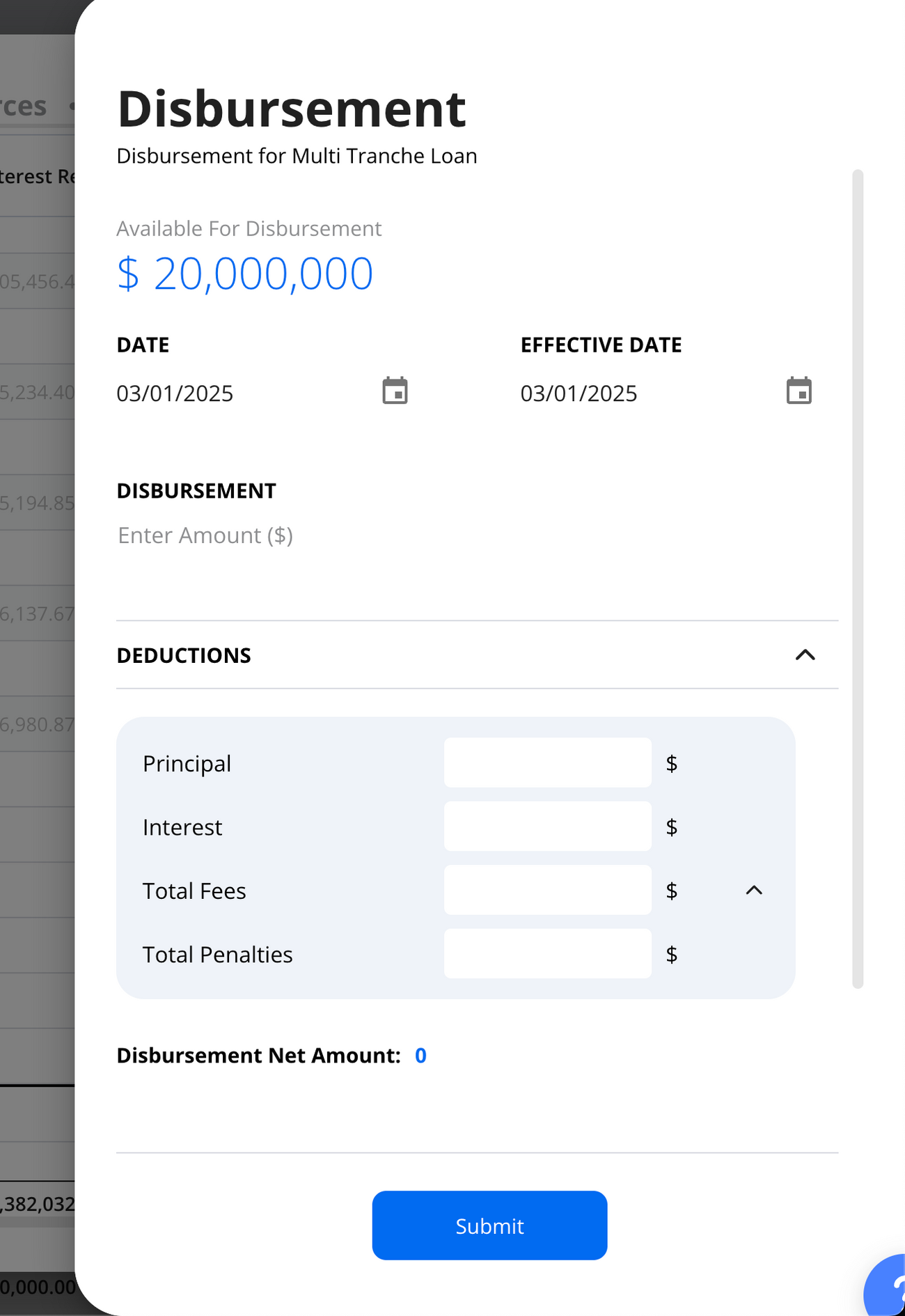

Disbursement Problems

Problem: The amount disbursed doesn't match the entered amount.

Possible Causes:

- Fees automatically deducted.

- Interest reserve retained (deducted).

- Multiple disbursements were allocated incorrectly.

Resolution:

- Verify if interest is deducted in the deductions section

- Review fee settings affecting disbursements.

Effective Date vs. Transaction Date

- Effective Date: When a financial event impacts the schedule calculations.

- Transaction Date: When the transaction actually occurred.

Common Issues:

- Interest accrues unexpectedly after a repayment.

- Transactions appear in unexpected reporting periods.

Resolution: Verify both the Transaction Date and Effective Date when entering transactions.

Early Redemption Amount Discrepancies

Problem: The calculated redemption amount differs from expectations.

Possible Causes:

- Repayment penalties or fees not considered

- The interest accrual cutoff date misunderstood

- Outstanding fees or penalties not included

- Compounding interest is not accruing or capitalizing as expected.

Resolution:

- Use the Early Redemption calculator tool in Hypercore - Confirm all outstanding balances are included in the calculation.

- Make sure the terms and fees are aligned to your loan.

5. Interest and Fee Issues

Interest Calculation Troubleshooting

Problem: Interest calculations differ from expectations.

Possible Causes:

- Different day count convention (365 vs. 360 days).

- Floating rate index values are not updated.

- Misapplication of floor/ceiling rates.

- Wrong Repayment frequency setting.

- Error in your spreadsheet.

- Interest is compounded (For example a missed compounding repayment)

Resolution:

- Verify interest calculation method in loan settings.

- For floating rates,

- Expand the schedule and verify that the correct interest rate is displayed in the 'Interest Rate' column.

- Make sure the values are up to date in the Settings page under the Floating Rates tab.

- Check floor/ceiling settings.

- Verify the interest repayment frequency settings on the loan terms page.

Standard Fees and Deposits

Hypercore supports the ability to include standard fees or deposits when a new loan is created. This can include common items such as interest reserves, origination fees, and underwriting fees, which are usually common on all or majority of your loans. These can be pre-configured to populate as part of the loan terms.

If you’d like to enable or update your standard fees/deposits, please reach out to your Hypercore Customer Success Manager and we’ll be happy to assist with the configuration.

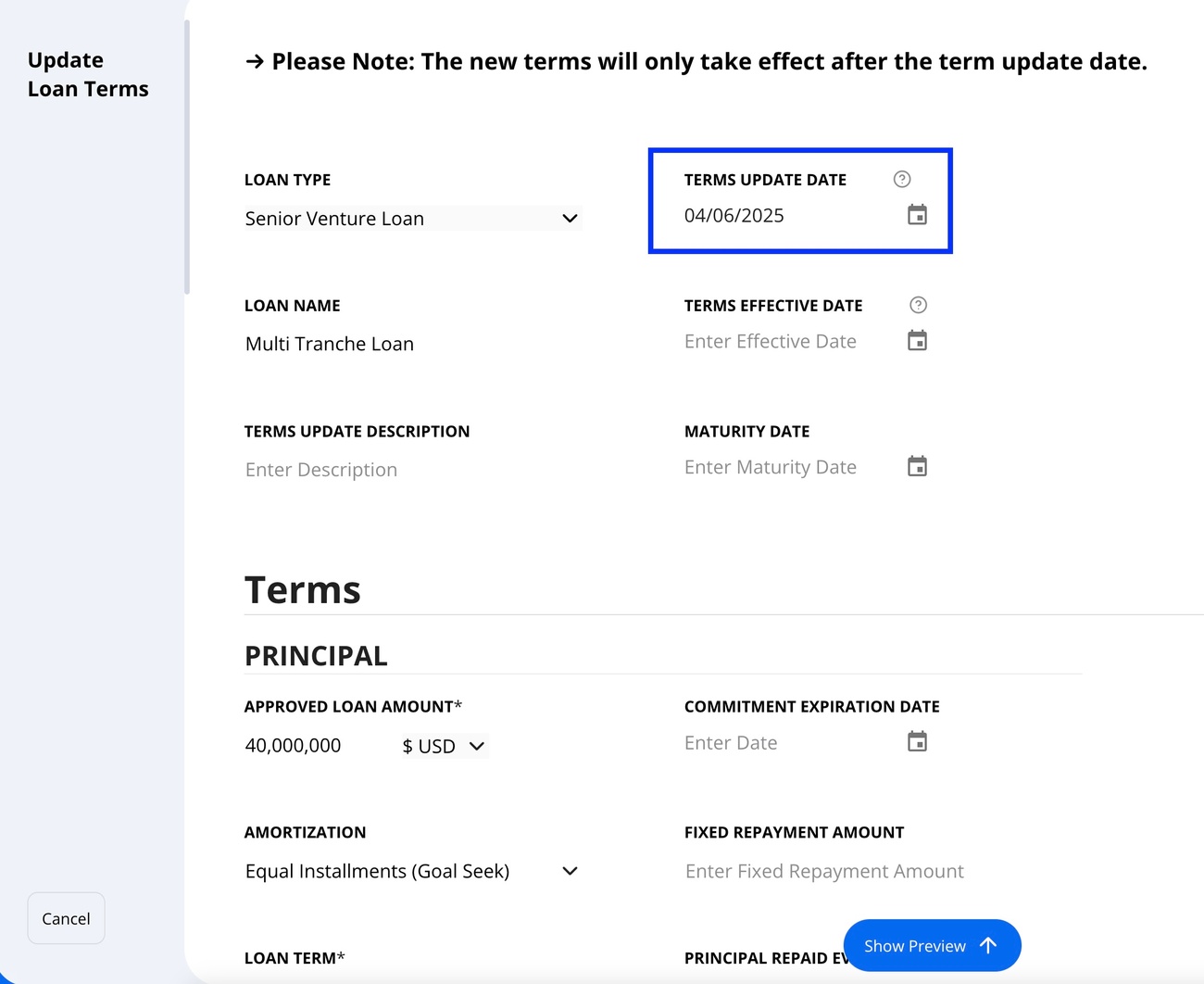

7. Terms Troubleshooting

Loan Amendments and Term Changes

Problem: After modifying loan terms, the schedule doesn’t update as expected.

Possible Causes:

- The incorrect effective date of the new terms.

- Wrong terms settings were amended.

- Conflicts between term amendments.

Resolution:

- Check the effective date of the amendment.

- Ensure all relevant terms were updated.

- Compare the original vs. amended terms.

8. Support Escalation

If the issue persists after following the guide:

- Contact your Customer Success Manager.

- Submit a support ticket through Hypercore.

- Provide loan details, error messages, and steps taken.