Loan Amendments & Update Terms

Last updated September 4, 2025

Overview

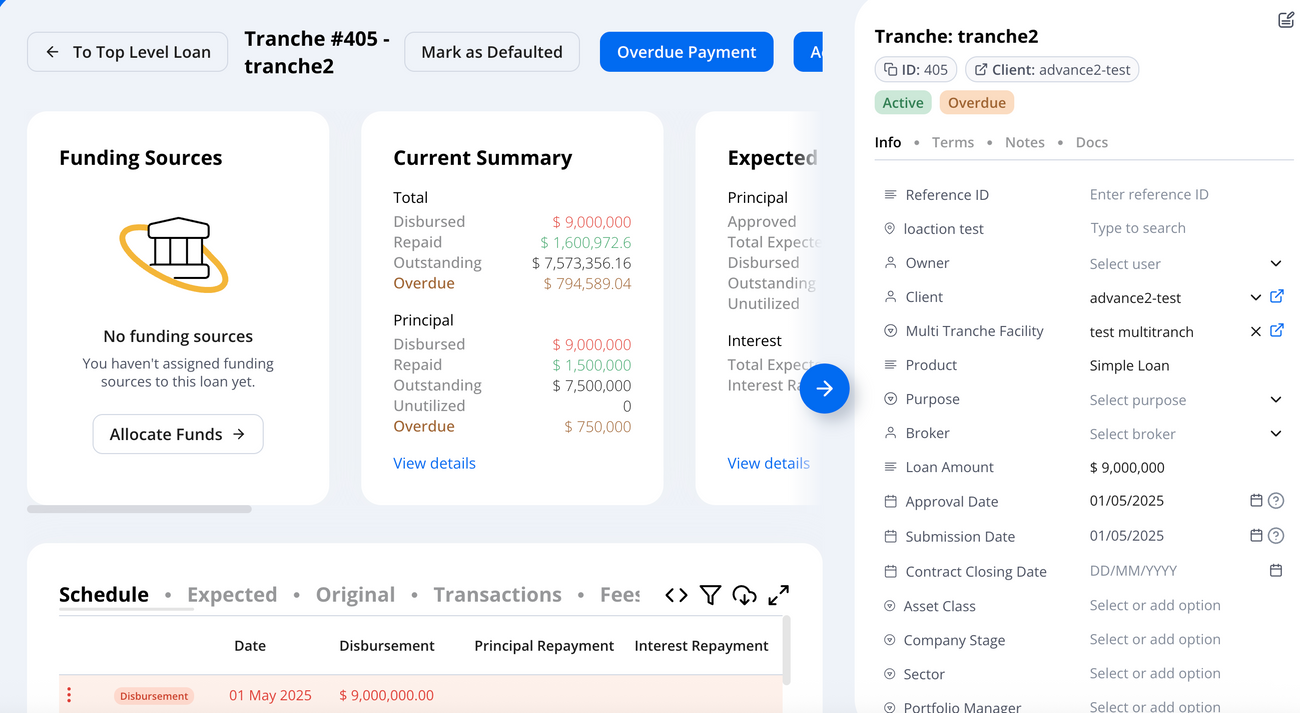

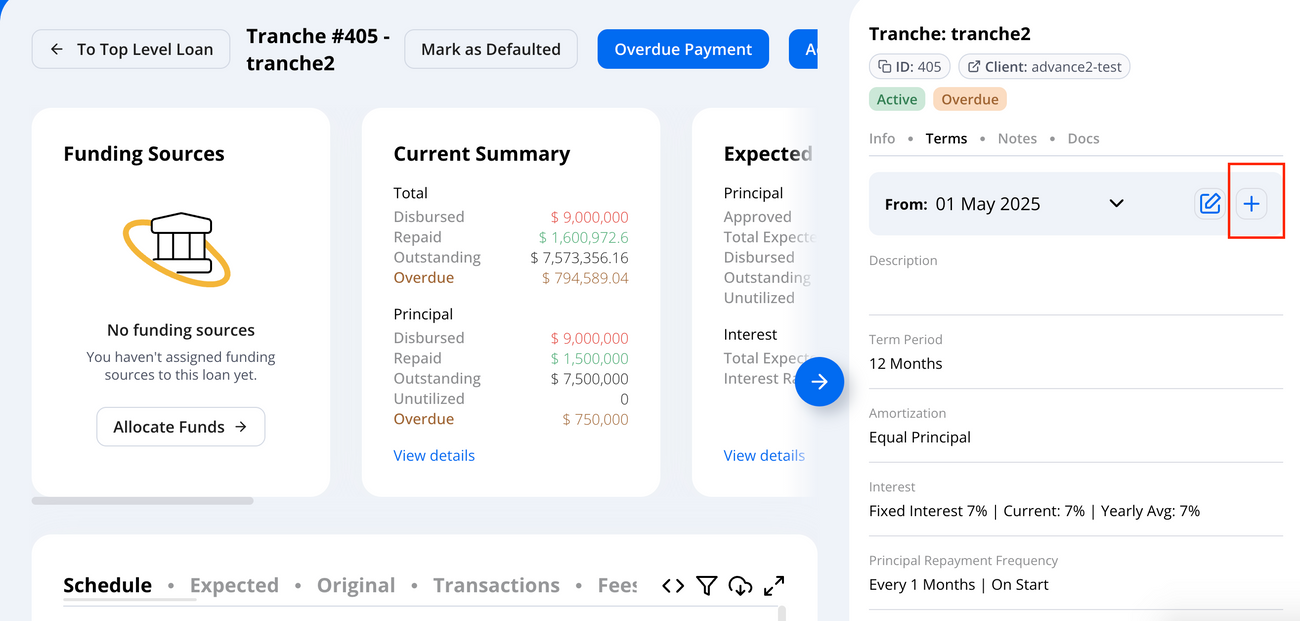

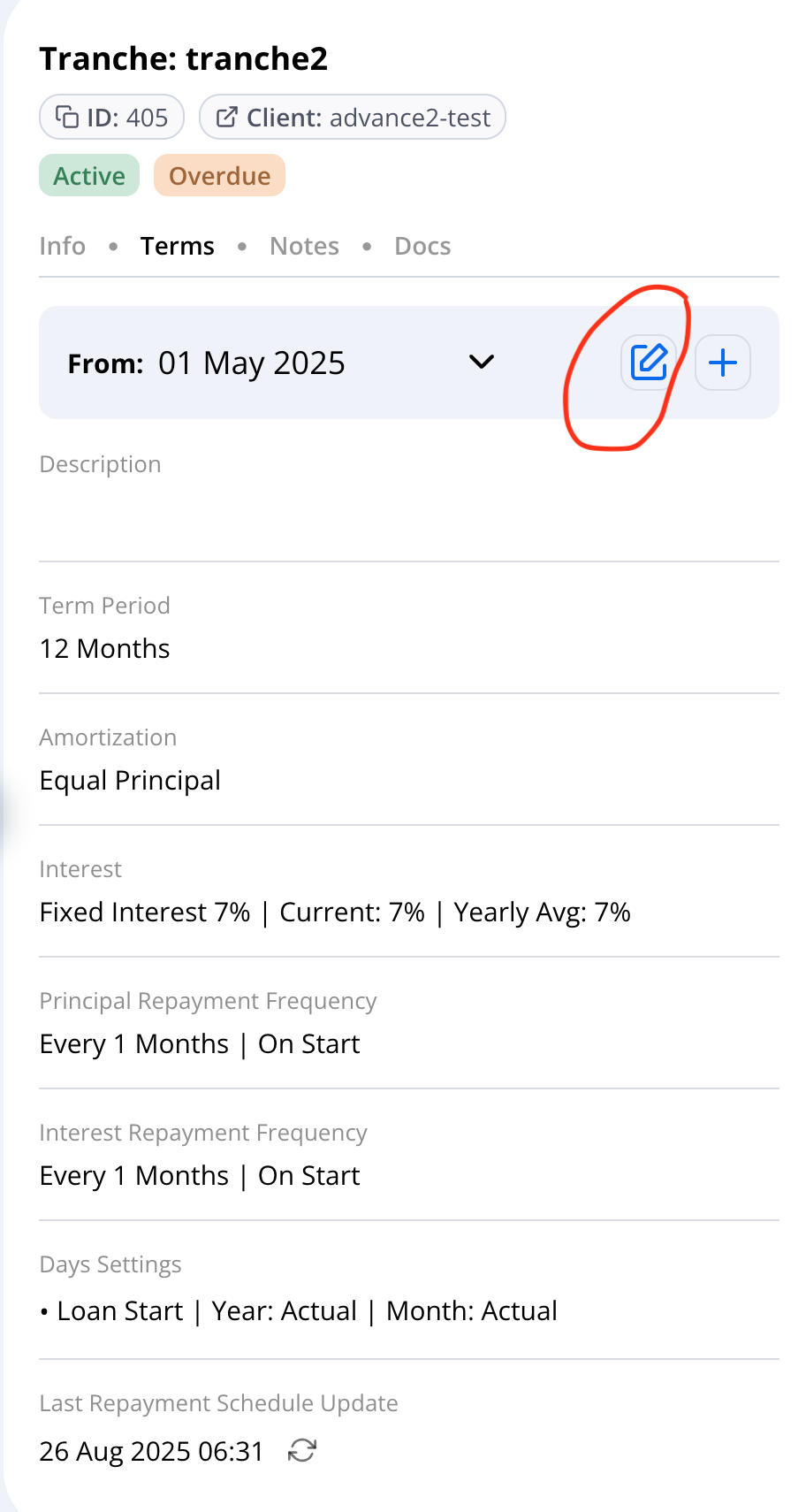

Loan amendments in Hypercore allow you to update an active loan’s terms after it has been approved and disbursed. This is handled through the Loan Sidebar → Terms Tab.

Amendments (update loan terms) ensure historical terms remain intact while new terms take effect from the specified effective date.

For pre-disbursement corrections or small administrative changes, you can also use Update Existing Terms, which directly edits the loan record without creating a formal amendment.

Creating New Terms Vs. Editing Existing Terms

Update Existing Terms (Direct Edit)

- What it does: Directly changes the loan record’s terms (e.g., update interest rate, maturity date, repayment frequency) without creating a formal amendment entry. When to use:

- Correcting data-entry mistakes (typos, wrong start date, wrong basis).

- Adjustments made before disbursement (loan not yet active)

- Administrative updates where audit history isn’t needed

- Impact:

- No amendment (loan terms) record is created.

- Audit trail shows “field updated” but not in an amendment workflow.

- The expected schedule is recalculated immediately.

Create a New Terms

- What it does: Opens a formal amendment workflow. Captures the old vs. new terms, with date-stamped history.

- When to use:

- Any negotiated change after disbursement (e.g., new interest rate, extended maturity, grace period added).

- Situations requiring auditability & lender/borrower visibility.

- Regulatory or investor reporting contexts where term history matters.

- Impact:

- A new Terms record is saved.

- Prior schedule remains preserved under “Original” or “Previous Amendment.”

- New terms apply prospectively from the amendment effective date.

Step by Step: Creating New Terms

- Navigate to the Loan

- Go to your Loan

- Select the loan you want to amend

- Create New Terms

- Under the loan details, you’ll see the current set of terms

- The original terms are saved when the loan was booked

- Click the ➕ (plus icon) to create an amendment.

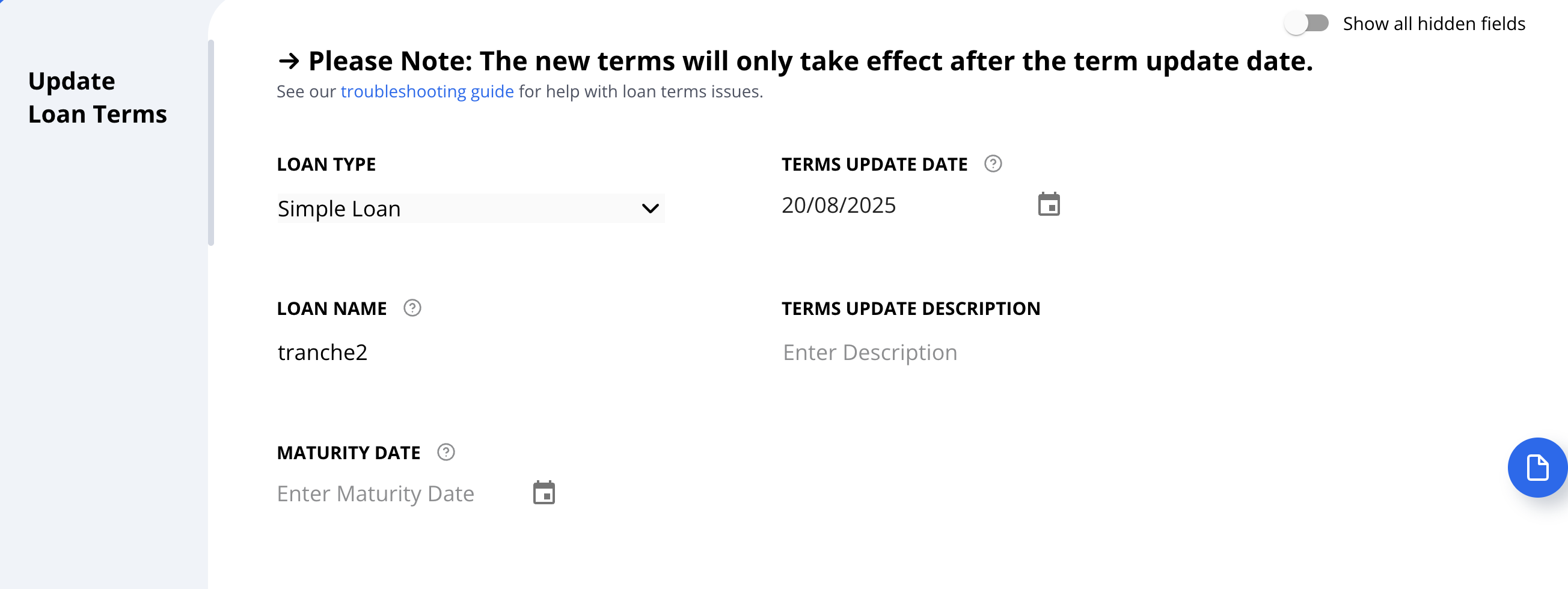

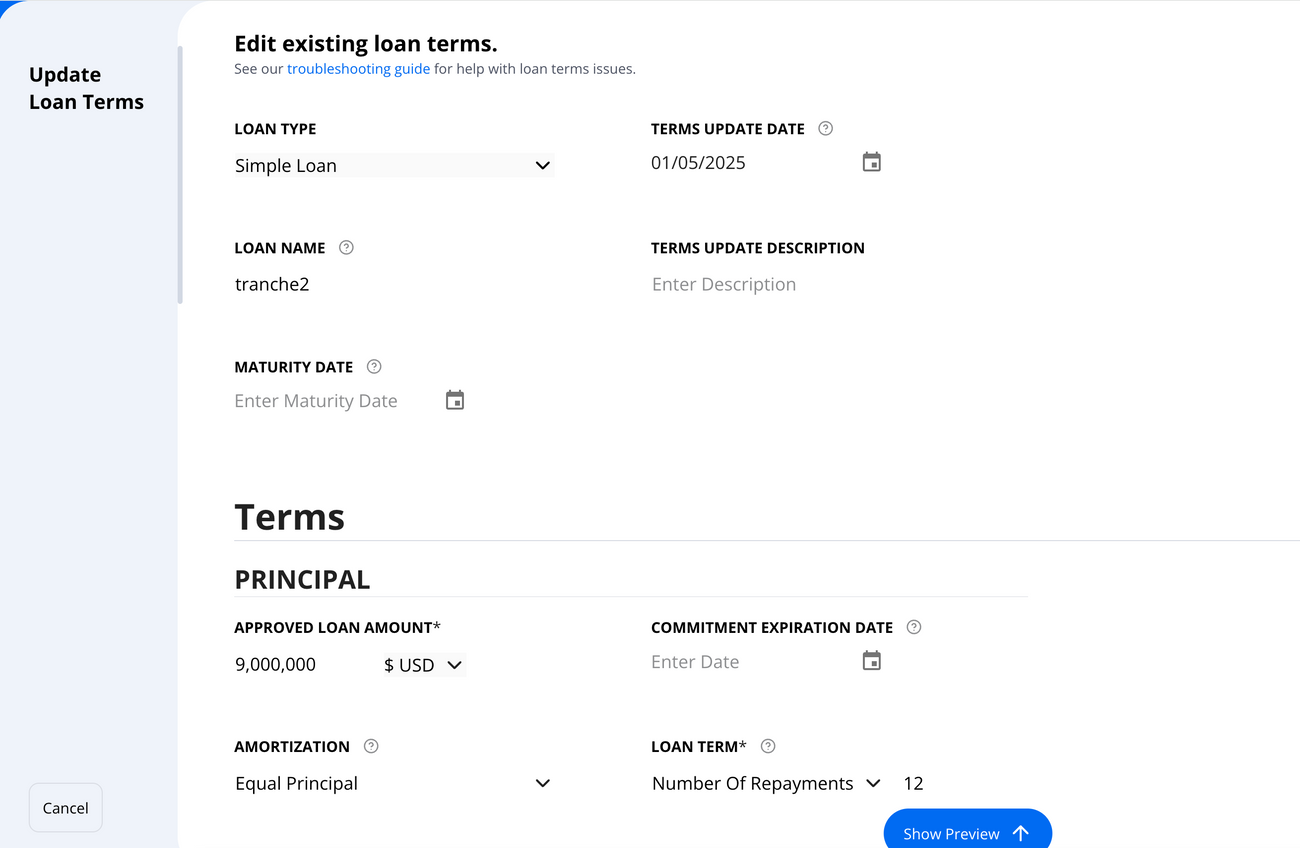

- Update the new terms details

- Enter the effective date of the amendment.

- The system will pre-fill the latest terms, so you don’t need to re-enter everything.

- Adjust only the specific field(s) that need to change (e.g., approved amount)

Add a description (best practice) for the reason of the amendment. This helps maintain a clear audit trail

- Review & Save

- Click Show Preview at the bottom of the screen to review the updated schedule.

- Verify that all changes are correct and match the effective date.

- Click Submit to apply the new terms from the selected date.

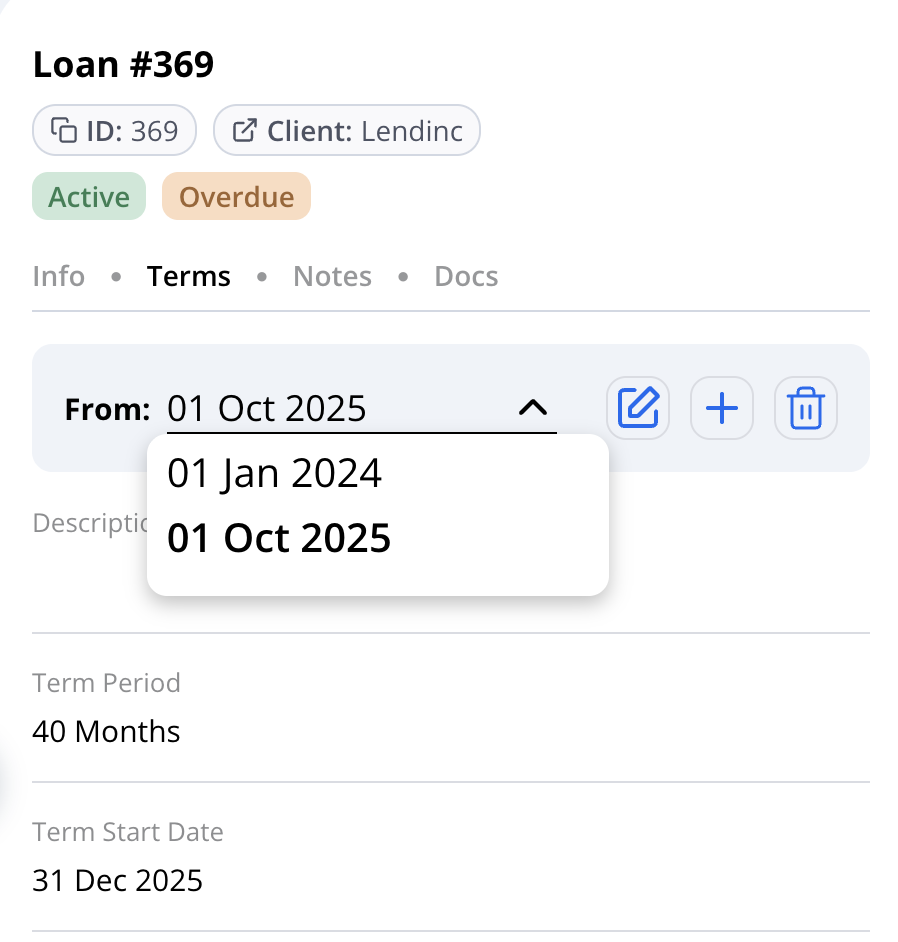

- View the updated terms

- In the terms tab, use the dropdown to view all saved terms.

Step by Step: Edit Existing Loan Terms

- Navigate to the Loan

- Go to your Loan

- Select the loan you want to amend

- Open edit existing loan terms

- In the Terms Tab, chose the terms you want to edit

- click the ✏️ Edit icon to update the terms

- Update loan terms

- Easily adjust loan terms from the familiar setup page you used when creating them.

- When done, click on update existing terms

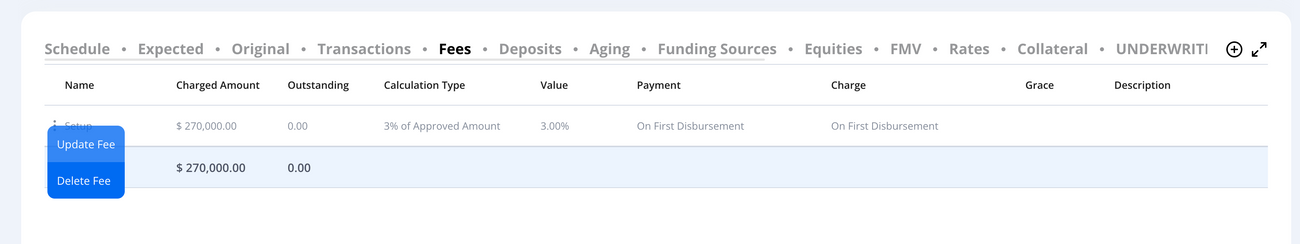

⚠️ Note on Fees:

Fee changes are managed in the Fees Tab of the Loan Page (not in Terms). Update a fee: Fees Tab -> ⋮ (3 dots) -> Update Fee Create a fee: Fees Tab -> ➕ (plus) For further guided detail please see here

Common Use Cases

1. Maturity Date Extension

Example: Extending a loan maturity from June 2025 → December 2025.

- Open the loan and navigate to the Terms tab.

- Select “Add Terms” .

- Navigate to the principal section -> Loan Term where you have two options:

- End Date ->Enter the new loan maturity date (e.g.

31-Dec-2025) - Number of Repayments -> extend the number of repayments so the schedule ends on

31-Dec-2025

- Confirm schedule recalculation → save the amendment

- Validate in the Schedule view:

- Expected repayment dates now extend through December 2025.

- Interest continues accruing to the new maturity.

2. Adding PIK / Compounding Interest

Example: Adding a Compounding Interest feature mid-loan.

- Open the loan record and go to the Terms tab.

- Select “Add Terms” → “Interest Terms”.

- Define the Terms Update Date (e.g.,

01-Oct-2025) when Compounding begins. - In the Interest Section:

- Enable Compounding.

- Select whether accrued compounding capitalizes on a monthly, quarterly, or annual basis.

- Set the compounding interest payment frequency.

- Save the terms.

- Validate in the Schedule view

- Rows from the terms' effective date show “Compounding Interest” columns.

3. Interest Rate Adjustment (Fixed ↔ Floating)

Example: Switching from a 6% fixed rate to Prime + 3%.

- Open the loan → Terms tab.

- Select + “Add Terms”

- Set the term update date (e.g.,

15-Sep-2025) for the new rate. - Update the Interest Rate Type:

- From: Fixed (6%).

- To: Floating (Prime + 3%).

- Save the terms.

- Validate in the Schedule view:

- Prior to effective date → Fixed 6% applies.

- From effective date onward → Floating Prime + 3% applies.

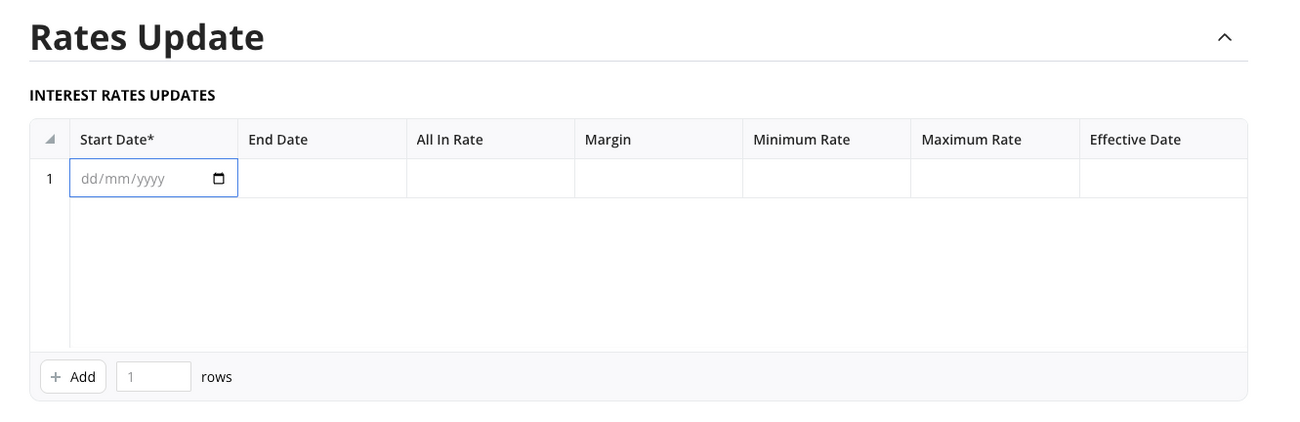

4. Periodic Interest Rate Adjustment

Example: Switch from a fixed 6% rate to 8% for the period Jan–Jun 2026, then revert to original rate.

- Navigate to the loan record → Terms Tab.

- Click ➕ Add Terms.

- Set Terms Update Date = 01-Jan-2025.

- Navigate to Rates Update

- Enter the Start date (01-Jan-2026)and the end date as (30-June-2026)

- Enter the new rates

- Save by updating existing terms

5. Grace Period/ Non accrual periods on Principal/ Interest

- Navigate to loan → Terms Tab → Add Terms.

- Set Terms Update Date

- Locate: Principal Grace Period → set number of periods/months.

- Locate: Interest Grace Period → set if borrower also pauses interest payments.

- Save by updating existing terms

6. Changes to amortization methods

- Navigate to loan → Terms Tab → Add Terms.

- Set Terms Update Date

- In the Principal section, change Amortization Type:

- Equal Principal (fixed principal, declining payments)

- Equal Installments (fixed total payment, shifting interest/principal split).

- Save by updating existing terms

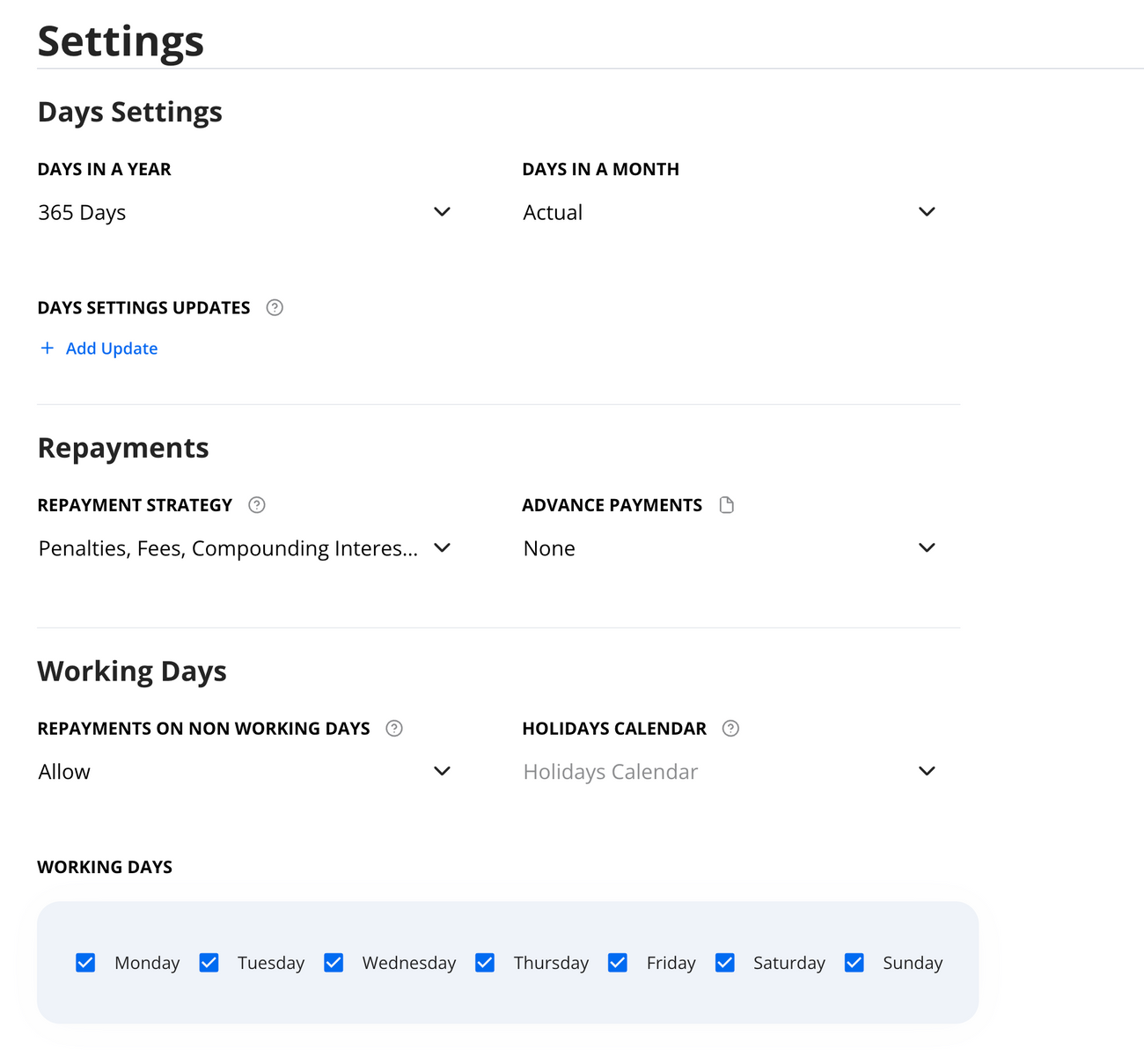

7. Changes in the days setting / non-working days or holidays

- Navigate to loan → Terms Tab → Add Terms.

- Set Terms Update Date

- Navigate to Settings / Days Settings:

- Select new Day Count Convention (e.g., Actual/360, Actual/365, 30/360).

- Set non-working days (e.g., weekends or jurisdiction-specific days) by unchecking the relevant options.

- Set the Holidays Calendar to treat holidays as non-working days.

- Save by updating existing terms

Best Practice (applies to all amendment types):

- Always set and confirm the Effective Date before saving.

- Add a note/comment for audit purposes by clicking the 📝 note icon next to each field.

- For multi-tranche facilities, confirm whether changes apply at the loan level or the facility (parent) level.

Key Notes

- Pre-filled Terms: The system automatically carries forward the most recent loan terms to save time.

- No Retroactive Impact: Amendments only affect the loan from the amendment date onward.

- Amortizing Loans: If the amendment occurs mid-schedule (e.g., extending a maturity date), payment amounts will adjust going forward.

Need Help?

For additional support, contact us at support@hypercore.ai .