Funding Sources Module: Overview & Step-by-Step Guide

Last updated October 23, 2025

The Funding Sources Module in Hypercore allows you to model the capital structure behind your loans, tracking which funds or entities are providing capital, how they should be repaid, and what returns they are entitled to.

This guide walks you through:

- What a Funding Entity is and how to create one

- How to allocate that entity as a Funding Source on a loan

- How to define interest, fees, and terms

- Handling debt sales and internal expenses

- Common workflows and troubleshooting

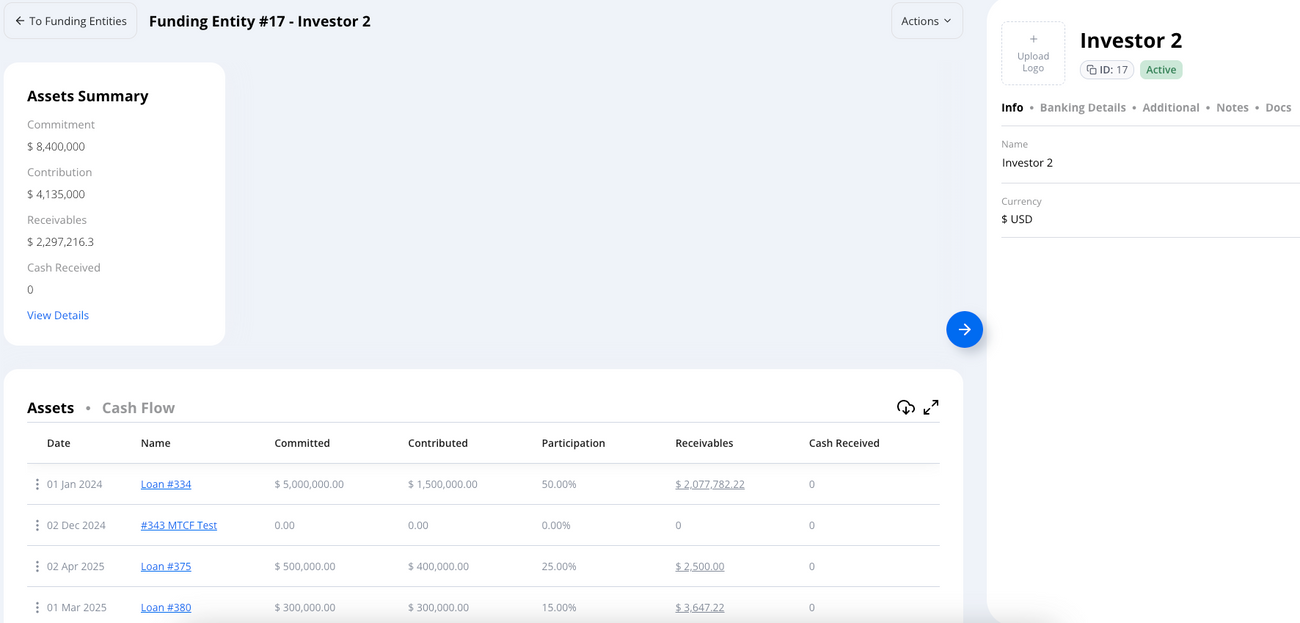

What Is a Funding Entity?

A Funding Entity represents the investor, lender, or capital pool that provides funding for a loan. You can think of this as the actual “funder”: whether it’s your firm, a syndicate partner, or a third-party fund.

Each entity contains:

- A profile (name, banking details, legal docs)

- A record of all loans they've funded

- Their terms, schedules, and accrued performance (when selecting the specific Funding Source)

➕ Creating a New Funding Entity

- Navigate to the Funding Entities section

- Click “New Entity”

- Enter a name and (optionally) attach:

- Legal documentation

- Bank info

- Additional notes or data tables

Once created, you can now use this entity to fund loans.

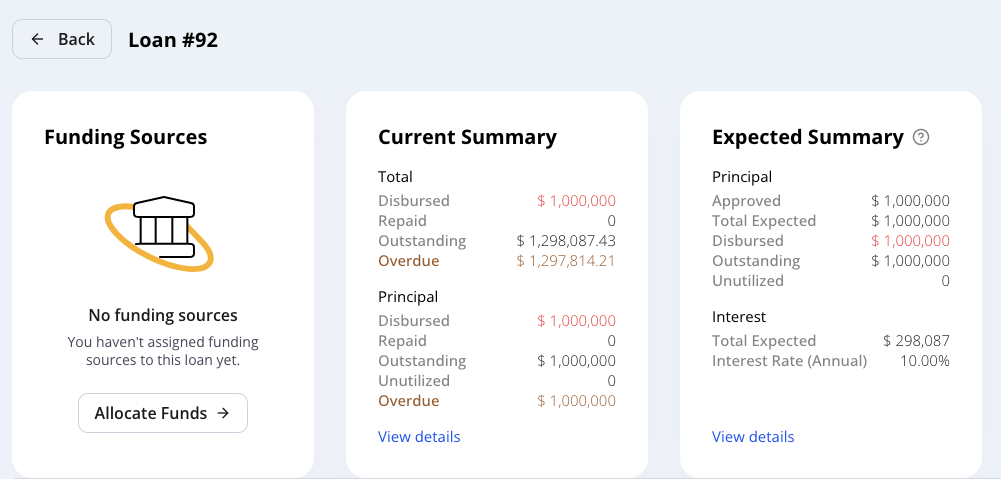

Allocating a Funding Source to a Loan

After your loan is set up and your funding entities are created, you’ll now assign how the loan is funded via Funding Sources.

Funding Source = Funding Entity + Loan + Allocation Terms

- From the loan view, click the Funding Sources card

- Select “Allocate Funds”

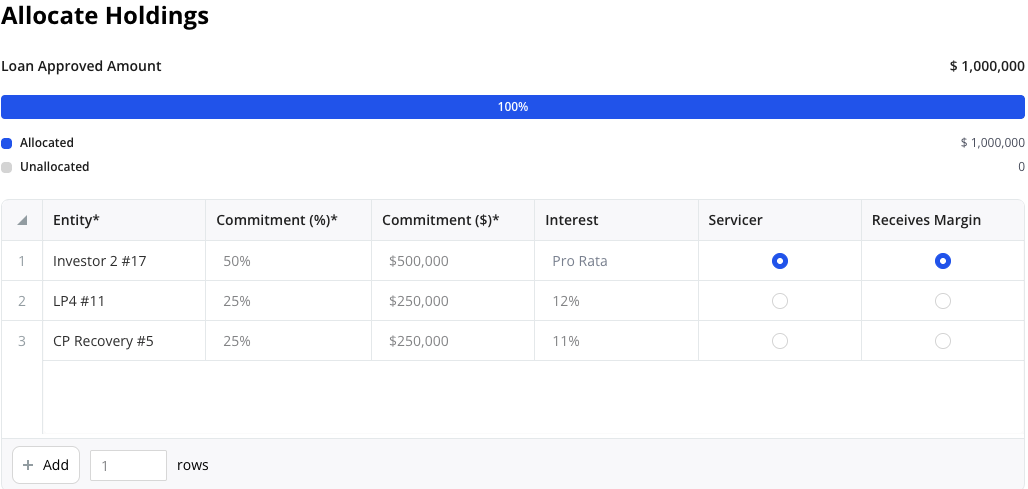

- Choose a funding entity and enter:

- Percentage or dollar amount (e.g., 50% or $5,000,000)

- The system will calculate the remaining unallocated amount

You can add as many funding entities as needed to cover the full loan.

Configuring Interest and Return Terms

For each funding source, define how returns will be shared:

Interest Options

- Pro-rata (default): Based on capital share or commitment share

- Fixed Interest Rate: Set a specific rate (e.g., 8%)

- Match Loan Terms: Accrue interest daily based on borrower terms (ideal for nuanced returns)

If you're using a fixed rate or non-prorata returns, Hypercore will automatically calculate the investor’s specific interest.

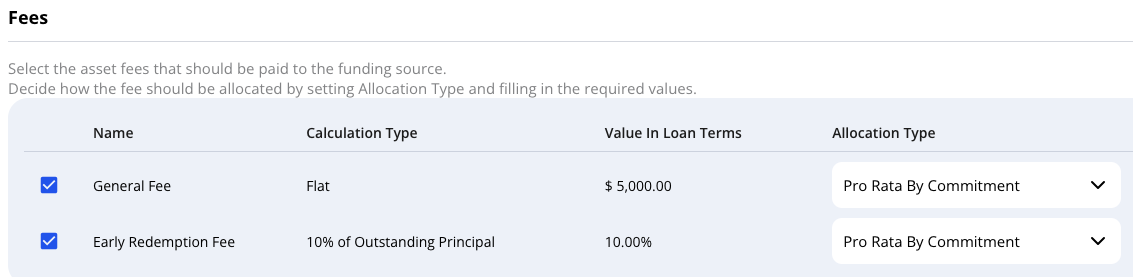

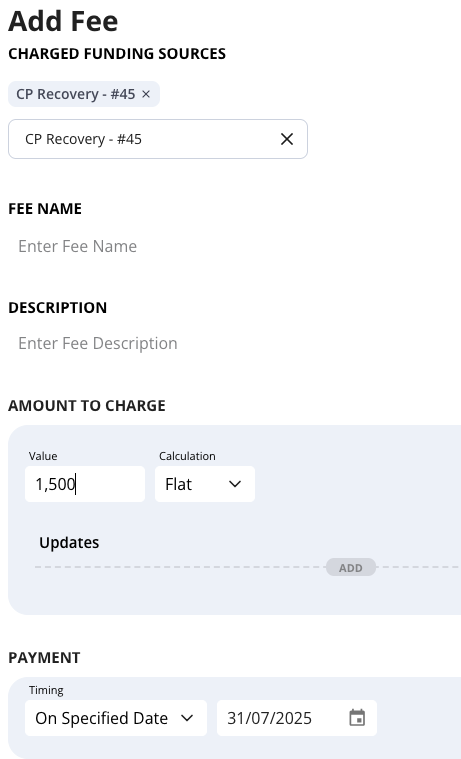

Borrower-Level Fee Allocation

When a borrower pays a fee, you can decide how it's split across funding sources:

- Toggle “Allocate to funding sources” ON

- Choose allocation logic:

- Pro-rata by commitment or principal

- Flat override amount

- Custom share (e.g. 50%)

- Send all to Servicer

Useful for origination, exit, or miscellaneous borrower-paid fees.

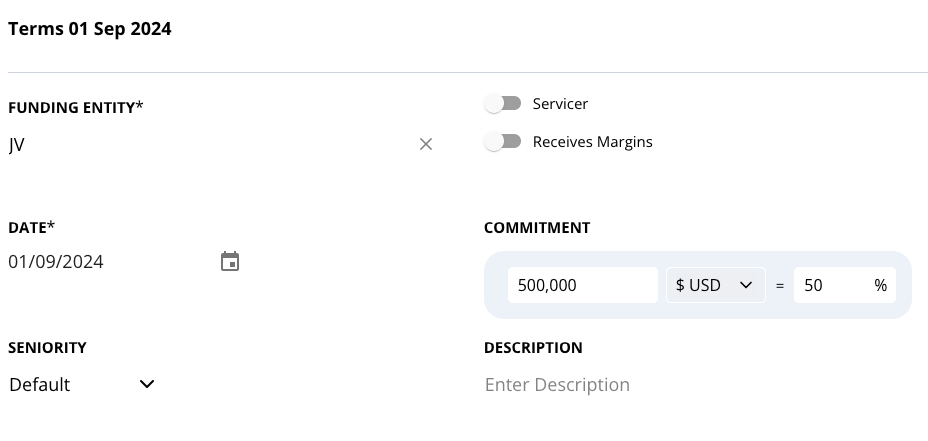

Assigning the Servicer (Margin Recipient)

A Servicer is the entity managing the loan servicing (usually yourself) and usually receives any remaining interest, fees, or margin not passed to other investors.

To assign:

- Add your entity with an allocation (even if it is 0%)

- Toggle “Servicer” and “Receives Margins” (optional) on

- This entity will now capture the residuals automatically

This is useful if you're earning the spread between what the borrower pays and what the funders receive.

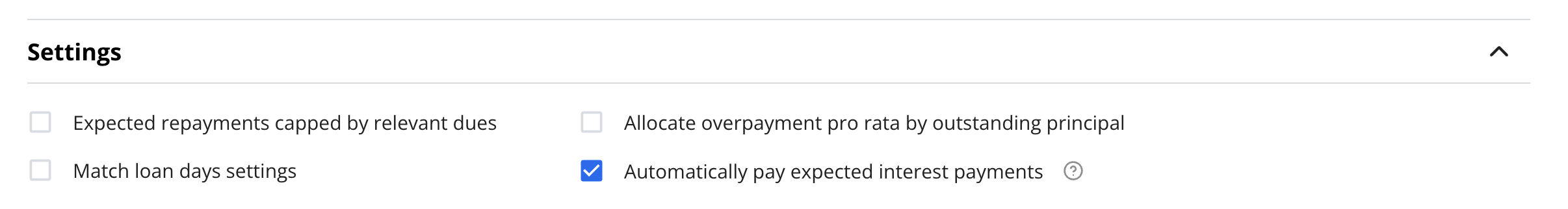

Automatically Pay Expected Interest Payments

When this setting is enabled, Hypercore will automatically mark expected interest payments as paid if no actual payment is recorded on the scheduled date.

How to Enable Automatic Interest Payments

- In the Terms view, scroll down to the Settings section.

- Check the box labeled Automatically pay expected interest payments.

How It Works On any day when an expected interest payment is due, but no actual payment has been recorded on the same day, Hypercore automatically generates the payment entry.

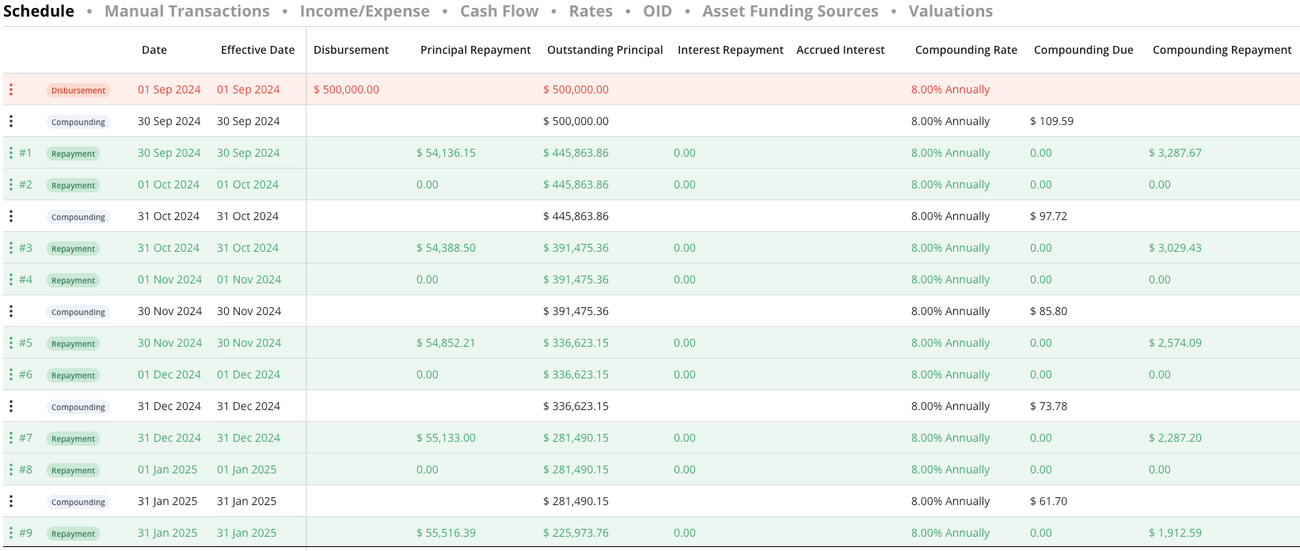

Viewing the Funding Source Schedule

Each funding source has a dedicated schedule, just like the borrower:

- Displays interest, principal, and fees from the perspective of the investor

- Automatically updates based on the loan’s performance and terms

- Supports manual adjustments, e.g. waivers or overrides

No need to manually record repayments, returns accrue automatically based on the terms set.

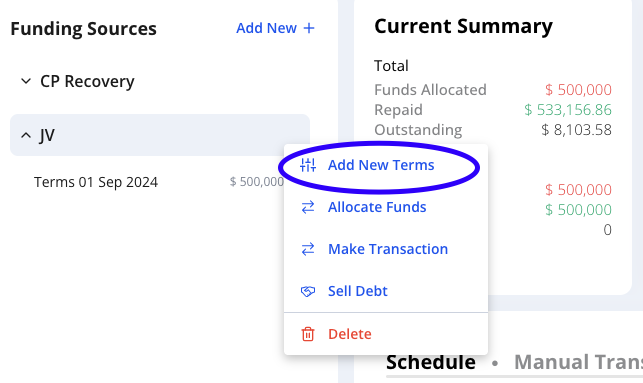

Updating Terms Over Time

To reflect a change (e.g., increased commitment or new rate):

- Open the funding source’s page

- Click “Add New Terms”

- Set a new effective date

- Edit fields like commitment, interest, toggles, etc.

Each new term set maintains historical integrity.

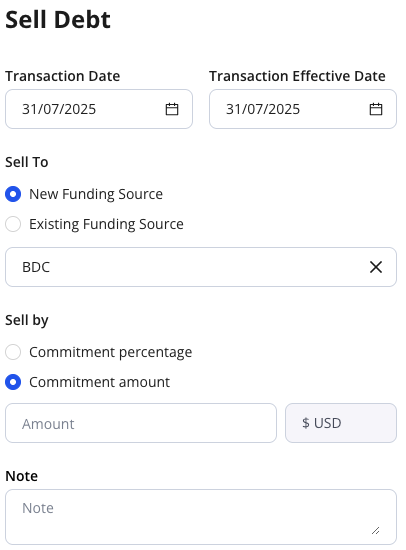

Selling/Transferring Debt

To transfer a portion of one entity’s investment to another:

- From the funding source, click “Sell Debt”

- Choose:

- Sale date

- Buyer entity

- % of principal or flat principal amount to transfer (e.g., 30%)

- System will:

- Recalculate pre-/post-sale values

- Auto-create new terms for buyer/seller

- Optionally, leave a comment for review before finalizing

- Click “Sell Debt” to complete

You may override interest/principal split manually if needed.

Cross-Fund Fees (Income & Expenses)

Set up internal fees between funding entities that are useful for:

- Admin fees

- Management fees

- Overrides

Note that these fees are to reflect any cash transactions solely between funding entities and/or servicer. These do not reflect on the borrower’s loan schedule in any way.

To add:

- Click “+ Income/Expense” on the funding entity that will receive the fee

- Select one or more paying entities

- Define the fee amount (e.g., $1,000 per repayment)

- You'll now see:

- Income row on the receiving entity

- Expense row (negative) on the paying entity

These appear on the funders’ schedules and affect net cash flow.

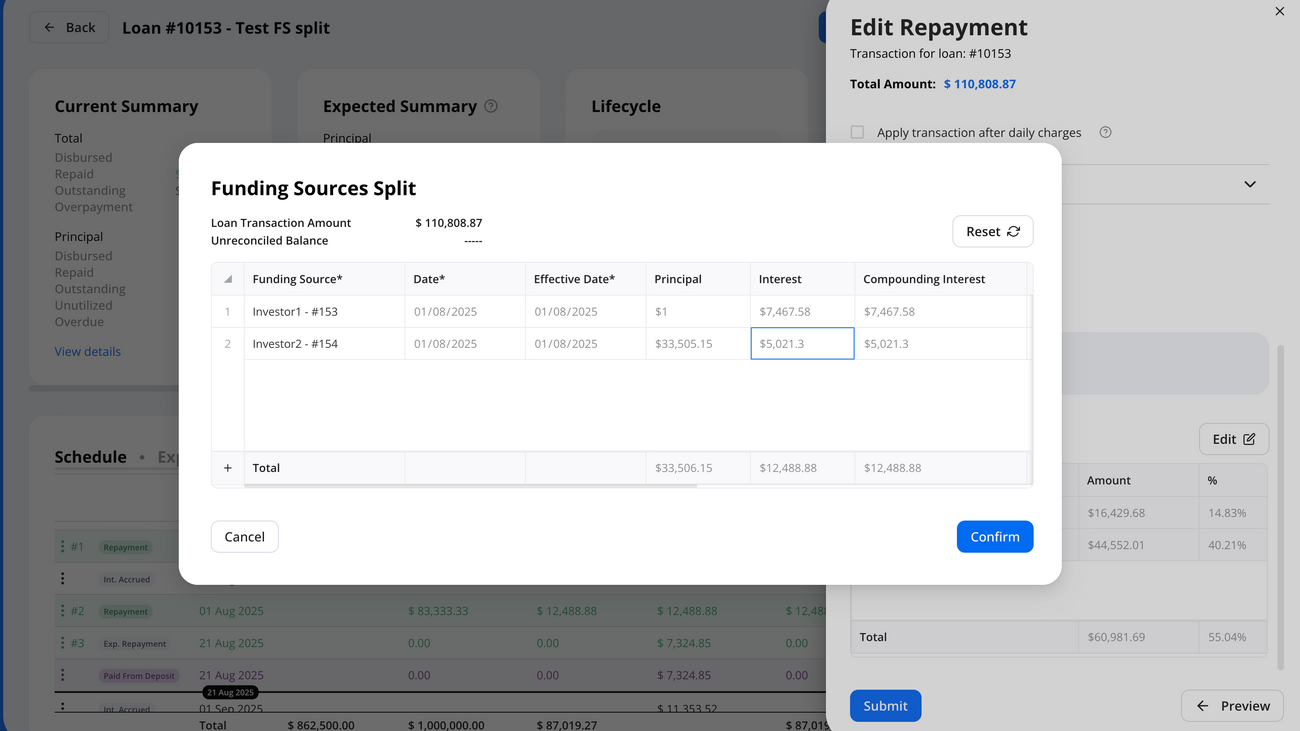

Manually Splitting Loan Transactions Across Funding Sources

You can manually define how a loan transaction (such as a disbursement or repayment) is split between multiple funding sources. This gives you precise control over allocation when a loan is financed by more than one entity.

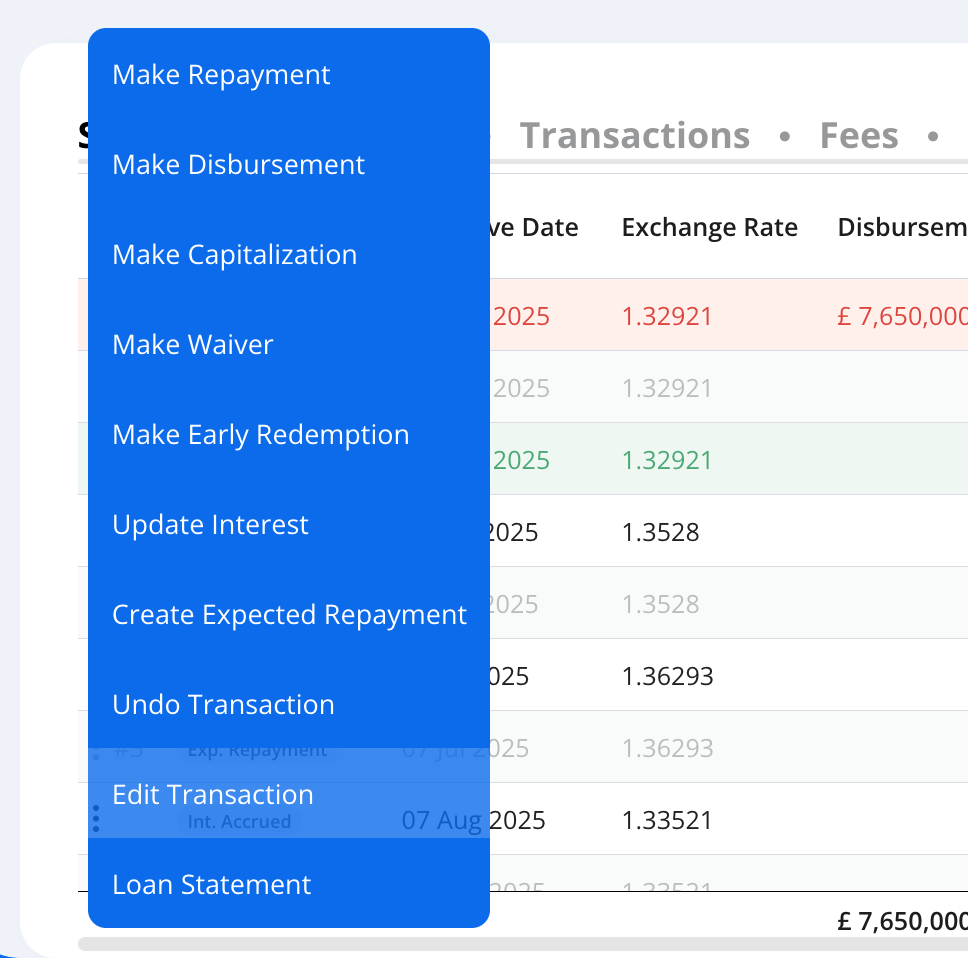

How to Manually Split a Transaction

- Open the Loan - Go to the loan you want to edit and open its Amortization Schedule.

- Locate the Relevant Transaction

- Find the row representing the disbursement or repayment you want to split.

- Edit the Transaction

- Click the ellipsis (⋮) at the end of the row -> Edit Transaction (or Edit Disbursement).

- Access the Funding Source Split

- In the Edit Repayment (or Edit Disbursement) window, scroll down to the section labeled Funding Sources Split.

- Click Edit to open the Funding Sources Split module.

- Edit the Split

- Here, you can enter or adjust the allocation amounts or percentages for each funding source.

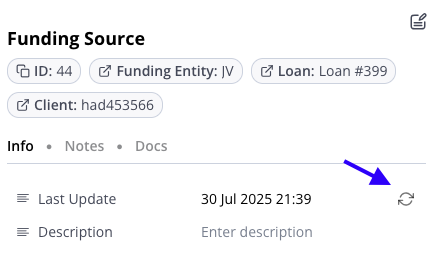

Refreshing Schedules & Troubleshooting

Funding source schedules recalculate:

- Automatically on major loan actions (repayments, early redemptions, fee events)

- Nightly in the background

If changes don’t reflect:

- Click the refresh icon on the funding source

- You can also see a pop-up indicator if the schedule is outdated

Managing Funding Entity Details

Each funding entity’s profile gives you full visibility:

- See all loans they fund

- Track historical terms & transactions

- Attach docs, bank info, and notes

- Use data for Investor Notices, fund performance summaries, and reporting

Best Practices

- Use servicer/margin toggles to capture margin and residuals

- Start simple (pro-rata) before modeling custom returns

- Comment and save debt sales for audit clarity

- Templates for recurring structures are coming soon!